Press Releases

Cox Automotive Forecast: Driven by a Strong Q4 and a Post-Election Boost, U.S. Auto Sales Beat Expectations in 2024, Expected to Finish Above 15.8 Million, Best Result Since 2019

Tuesday December 17, 2024

Article Highlights

- Cox Automotive forecasts full-year 2024 U.S. new-vehicle sales to finish near 15.85 million units, up from 15.50 in 2023 and the highest point since 2019.

- Momentum continues: New-vehicle sales pace in December is expected to finish near 16.5 million, up 0.6 million from last December’s 15.9 million pace and equal to November’s 16.5 million level.

- Electric vehicle sales in the U.S. are forecast to set another record, with a total sales volume near 1.3 million. Tesla sales are forecast to decline year over year for the first time since 2014.

Updated, Jan. 6, 2025 – New-vehicle sales in 2024 finished near 16.0 million, according to estimates from Cox Automotive’s Kelley Blue Book, an increase of just over 2% from 2023 and the best year for volume since the pandemic. Total new-vehicle sales ended the year strong, just above the Cox Automotive new-vehicle sales forecast. Nearly every automaker posted higher sales year over year in 2024, with Stellantis and Tesla notable exceptions. General Motors was the top-selling automaker in 2024, while Honda and Mazda delivered strong growth. Retail sales were particularly strong at year-end.

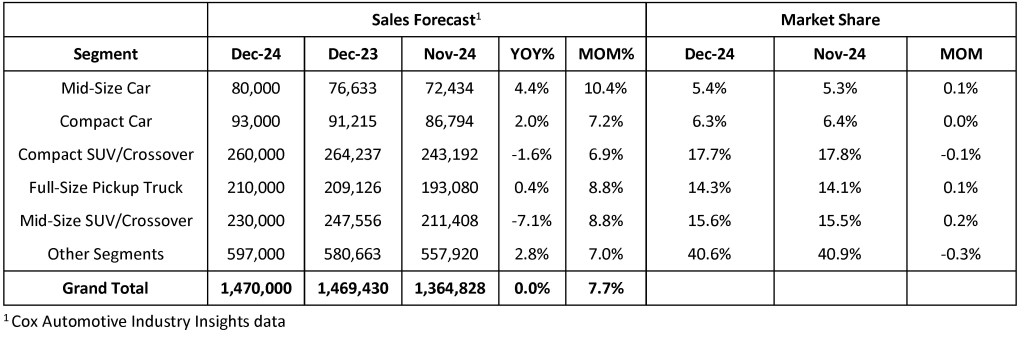

ATLANTA, Dec. 17, 2024 – December new-vehicle sales, to be confirmed in early January, are expected to show steady growth over last year’s market. According to the Cox Automotive forecast released today, December’s seasonally adjusted annual rate (SAAR), or sales pace, is expected to finish at 16.5 million. This SAAR is up from last year’s 15.9 million level and equal to November’s 16.5 million. Sales volume in December is expected to reach 1.47 million, a 7.7% increase from last month but flat compared to one year ago.

According to Charlie Chesbrough, senior economist at Cox Automotive: “With the U.S. election season now in the rearview mirror, we are seeing a bit of a bump up in sales. Both October and November saw a shift to a higher sales pace, and a similar outcome is forecast this month. Many buyers who thought it best to wait to get the best deal are realizing that now is the time to buy before new administration policy changes are implemented. Some vehicle buyers are taking advantage of EV discounts that could be dialed back by the new administration, and others may be concerned potential tariffs may hit prices. So, the market has strong tailwinds as the year comes to a close.”

December 2024 New-Vehicle Sales Forecast

Robust Q4 Performance Drives 2024 Auto Sales Above Forecasts

New-vehicle sales remained steady through the first three quarters of 2024, supported by improved inventory and higher incentives. However, since October, the sales pace has shifted to a higher gear, with the fourth quarter expected to finish with a SAAR of 16.4 million.

Considering the strong Q4, full-year 2024 U.S. auto sales, as estimated by Kelley Blue Book, are expected to reach approximately 15.85 million units, reflecting a 2.3% increase from 15.55 million in 2023 and slightly above Cox Automotive’s forecast of 15.7 million shared at the beginning of the year. Improving consumer confidence, lower interest rates and less uncertainty are lifting Q4 sales, and that trend is expected to continue into next year. Cox Automotive expects new-vehicle sales to improve further in 2025, reaching 16.3 million units.

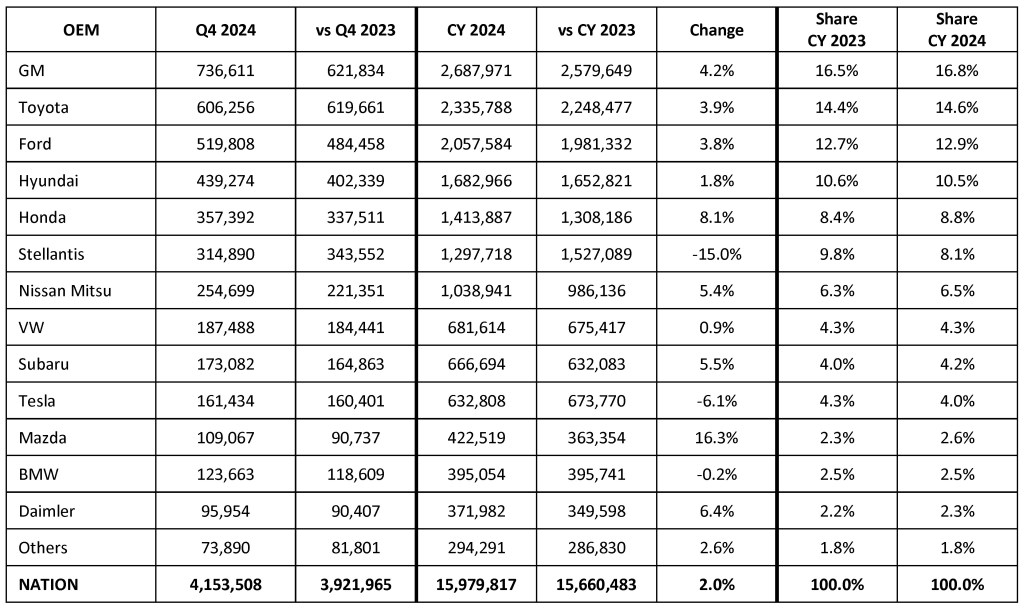

General Motors Retains Sales Crown in 2024, Honda Gains Most Share

Year-over-year sales gains were delivered in 2024 by every major manufacturer except Stellantis and Tesla, while BMW’s sales were flat. The 2024 sales crown will go to General Motors, with sales forecast to finish near 2.7 million units, up over 4.2% from last year.

If success is measured by higher market share, however, Honda will be the big winner in 2024, gaining half a point in share thanks to a more-than-20% sales increases from the HR-V and Civic, the two lowest-priced vehicles in its portfolio. In 2024, Honda Motor sales in the U.S. – combined Honda and Acura volume – outpaced Stellantis, jumping the storied Japanese brand into fifth place on the sales chart.

Full-Year 2024 New-Vehicle Sales Forecast

All percentages are based on raw volume, not daily selling rate. There are 25 selling days this month, one less than November 2024 and one less than December 2023.

Forecast: 2025

As the auto market heads into 2025, the Cox Automotive Economic and Industry Insights team anticipates the new-vehicle market to grow by approximately 3%. Overall, the team expects 2025 to be another positive year for car buying. Earlier today, Cox Automotive Chief Economist Jonathan Smoke shared his team’s expectations for the U.S. automotive market in the year ahead. Forecast: 2025 outlines five themes expected to shape the automotive industry in the coming year.

About Cox Automotive

Cox Automotive is the world’s largest automotive services and technology provider. Fueled by the largest breadth of first-party data fed by 2.3 billion online interactions a year, Cox Automotive tailors leading solutions for car shoppers, auto manufacturers, dealers, lenders and fleets. The company has 29,000+ employees on five continents and a portfolio of industry-leading brands that include Autotrader®, Kelley Blue Book®, Manheim®, vAuto®, Dealertrack®, NextGear Capital™, CentralDispatch® and FleetNet America®. Cox Automotive is a subsidiary of Cox Enterprises Inc., a privately owned, Atlanta-based company with $22 billion in annual revenue. Visit coxautoinc.com or connect via @CoxAutomotive on X, CoxAutoInc on Facebook or Cox-Automotive-Inc on LinkedIn.

Media Contacts:

Mark Schirmer

734 883 6346

mark.schirmer@coxautoinc.com

Dara Hailes

470 658 0656

dara.hailes@coxautoinc.com