Press Releases

Cox Automotive Forecast: New-Vehicle Sales Pick Up in February After Slow Start to 2024

Friday February 23, 2024

Article Highlights

- The seasonally adjusted annual sales rate (SAAR) for new vehicles in February is forecast to increase from January and finish near 15.4 million.

- The sales pace in February expected to be higher by 0.5 million from last February’s 14.9 million pace and up from January’s 15.0 million level.

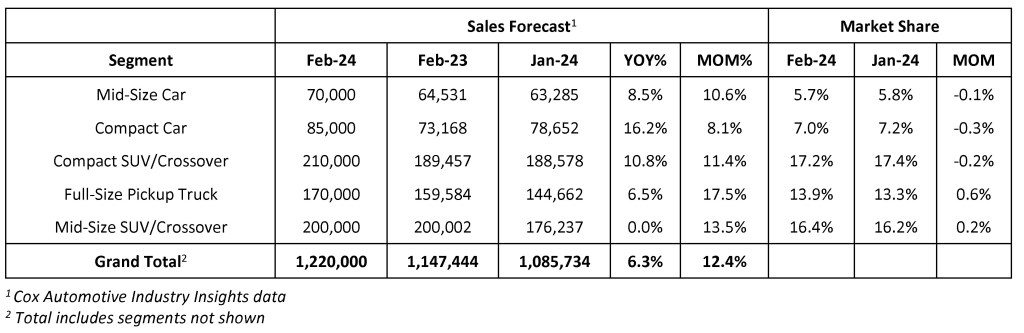

- February’s new-vehicle sales volume is forecast to rise 6.3% year over year and reach 1.22 million units.

Updated, March 4, 2024 – As forecast by the Cox Automotive team, new-vehicle sales in the U.S. picked up in February, as warmer weather and increasing consumer sentiment as measured by Morning Consult combined to help sales improve notably from the January slowdown. Total new-vehicle sales in February are now estimated at 1.25 million, above our forecast of 1.22 million units and up 9.6% year over year.

The seasonally adjusted annual rate (SAAR), or selling pace, came in near 15.8 million last month, above forecast, and up significantly from January’s 15.0 million level and the 14.9 million pace recorded in February 2023. The strong 15.8 million sales pace was higher than the average pace over the past six months.

The market turnaround was led in part by strong results from Toyota and Honda, two companies that are enjoying higher inventory than one year ago. Overall, industry-wide new-vehicle inventory levels started February at 2.61 million units and higher by 50% from year-ago levels. Days’ supply of new vehicles at the start of the month was considered high – at 80 days – by historic norms, and the higher inventory levels are leading to increasing incentives and discounts, helping bring buyers back into the market and putting 2024 on pace for the best year of new-vehicle sales since 2019.

ATLANTA, Feb. 23, 2024 – February new-vehicle sales, when announced next week, are expected to show gains over last year and improvement from January, which came in slower than expected. Sales volume this month is expected to reach 1.22 million units, an increase of 6.3% over February 2023, when the market was still recovering from severe product shortages.

The seasonally adjusted annual rate (SAAR), or selling pace, is expected to finish near 15.4 million, up 0.5 million over last year’s pace and an improvement over January’s surprisingly low 15.0 million level. The SAAR has averaged 15.5 million over the last six months, and the expectation is that sales this month will return closer to that trend after falling off in January. There are also 25 selling days this February, one more than last year, which will also lift February’s sales totals.

According to Charlie Chesbrough, Senior Economist at Cox Automotive: “January and February are slow months for vehicle sales, but the new-vehicle sales pace this past January saw a surprising decline from December. Bad weather was a likely contributor and kept shoppers away from dealership lots. However, the weather this February was particularly mild across much of the country, so a bit of a rebound is expected this month. We are also seeing solid inventory levels and growing incentives and discounts, which should help sales volume.”

February 2024 New-Vehicle Sales Forecast

All percentages are based on raw volume, not daily selling rate.

About Cox Automotive

Cox Automotive is the world’s largest automotive services and technology provider. Fueled by the largest breadth of first-party data fed by 2.3 billion online interactions a year, Cox Automotive tailors leading solutions for car shoppers, auto manufacturers, dealers, lenders and fleets. The company has 29,000+ employees on five continents and a portfolio of industry-leading brands that include Autotrader®, Kelley Blue Book®, Manheim®, vAuto®, Dealertrack®, NextGear Capital™, CentralDispatch® and FleetNet America®. Cox Automotive is a subsidiary of Cox Enterprises Inc., a privately owned, Atlanta-based company with $22 billion in annual revenue. Visit coxautoinc.com or connect via @CoxAutomotive on X, CoxAutoInc on Facebook or Cox-Automotive-Inc on LinkedIn.

Media Contacts:

Mark Schirmer

734 883 6346

mark.schirmer@coxautoinc.com

Dara Hailes

470 658 0656

dara.hailes@coxautoinc.com