Press Releases

Cox Automotive Forecast: July U.S. Auto Sales Drop as Recovery Headwinds Grow

Wednesday July 27, 2022

Article Highlights

- U.S. new-vehicle sales in July are forecast to finish down year over year as supply remains low.

- Annual new-vehicle sales pace in July is forecast to finish near 13.2 million, up from last month’s 13.0 million seasonally adjusted pace but 10% lower than last year’s 14.7 million level.

- July sales volume is expected to fall to 1.12 million units, down 13% from one year ago and down 2% from last month.

UPDATED, Aug. 3, 2022 – The Cox Automotive Industry Insights team was forecasting new-vehicle sales in July to trend closely to the results seen in June, as new-vehicle inventory levels are holding steady at approximately 1.1 million units, a days’ supply in the mid-30s. As noted in the forecast release below, “Auto sales are expected to show very little change from June’s results, as a lack of supply continues to batter the new-vehicle market.”

A battered market is exactly what we got in July, with sales volume off by approximately 12% year over year, with big declines at Honda and Toyota, two automakers with particularly low new-vehicle inventory. The new-vehicle SAAR in July is estimated at 13.3 million, slightly better than the Cox Automotive forecast of 13.2.

Honda sales in July were remarkably low. In fact, of Honda’s five lowest-volume sales months in the past decade, four have been posted in 2022 – January, May, June, July. Honda dealers started the month with a 21 days’ supply, among the lowest in the industry and better than only Toyota and Kia, brands that also posted big year-over-year drops in sales last month.

A bright spot: Ford Motor Company. Both of its brands have above-average inventory right now—Ford brand is at 45 days—and sales last month showed a jump of more than 36% year over year. The comparison was easy, though: Ford’s new-vehicle sales last year, when inventory was much thinner, were dismal, among the lowest in a decade. The lesson: In today’s market, if you have them, you can sell them.

Reflecting on sales last month, Senior Economist Charlie Chesbrough notes, “July results will likely be yet another reminder of how the U.S. auto market has been transformed from just a few years ago, before the pandemic. Today’s auto market, running on a consistent 35 days’ supply, simply can’t support the volume so many of us took for granted. The old market, with 70-plus days’ supply, is a fading memory, and returning to near 17 million annual sales will likely take years. This new U.S. auto market is a lean operation, where monthly retail sales of approximately 1 million units is the norm. The challenge now? How to operate profitably in this new environment and be ready to move if and when the market grows.”

ATLANTA, July 27, 2022 – July U.S. auto sales are expected to show very little change from June’s results as a lack of supply continues to batter the new-vehicle market. According to the Cox Automotive forecast released today, the seasonally adjusted rate (SAAR) of new-vehicle sales in July is expected to rise slightly to 13.2 million, up from last month’s 13.0 million pace but fall well below last year’s 14.7 million level.

The sales volume in July is forecast to finish near 1.12 million units, down 13% from last year’s volume of 1.29 million and lower by 2% from June. With 26 selling days in July, the same as last month and one less than last year, the volume decline is mainly attributed to the continued lack of available product.

“As we move into the second half of 2022, there are plenty of headwinds pushing against a notable recovery in sales volumes,” said Cox Automotive Senior Economist Charlie Chesbrough. “Rising interest rates and low consumer sentiment are keeping many potential buyers out of the market. At the same time, higher prices for both gasoline and vehicles are making affordability an even greater challenge. Tight supply, however, continues to be the biggest obstacle over the near term, and there is little evidence of supply returning to normal.”

Most industry forecasters, including Cox Automotive, expect the chip shortage and other supply chain problems to improve throughout the second half of this year. Still, the pace of that recovery will be varied and volatile. Notes Chesbrough, “Industry observers are likely going to have to wait until the fall for any of these issues to show improvement.”

July 2022 Sales Forecast Highlights

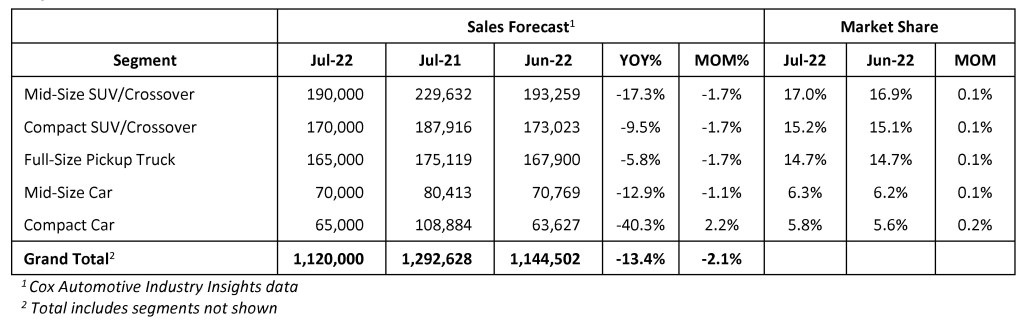

- In July, light new-vehicle sales are expected to fall 13.4% from July 2021 and fall 2.1% from last month.

- The SAAR in July 2022 is estimated to be 13.2 million, below last year’s 14.7 million level but up from June’s 13.0 million pace.

- Only one segment – Compact Car – is forecast to see a month-over-month sales increase.

- There are 26 selling days in July 2022, one less than July 2021 but the same as June 2022.

JULY 2022 NEW-VEHICLE SALES FORECAST

All percentages are based on raw volume, not daily selling rate.

About Cox Automotive

Cox Automotive Inc. makes buying, selling, owning and using vehicles easier for everyone. The global company’s more than 27,000 team members and family of brands, including Autotrader®, Dealer.com®, Dealertrack®, Kelley Blue Book®, Manheim®, NextGear Capital®, VinSolutions®, vAuto® and Xtime®, are passionate about helping millions of car shoppers, 40,000 auto dealer clients across five continents and many others throughout the automotive industry thrive for generations to come. Cox Automotive is a subsidiary of Cox Enterprises Inc., a privately-owned, Atlanta-based company with annual revenues of nearly $20 billion. www.coxautoinc.com

Media Contacts:

Mark Schirmer

734 883 6346

mark.schirmer@coxautoinc.com

Dara Hailes

470 658 0656

dara.hailes@coxautoinc.com