Press Releases

Cox Automotive Forecast: October New-Vehicle Sales Steady, Volume Expected to Rise Despite Election Uncertainties and Weather Events

Thursday October 24, 2024

Article Highlights

- With more selling days month over month and year over year, October’s sales volume is forecast to be higher by 10% versus last month and up nearly 8% from one year ago.

- Election uncertainties and weather disruptions across the Southeast are expected to dampen sales volume in October.

- The new-vehicle sales pace in October is expected to finish near 15.8 million, equal to September’s pace and up from last October’s 15.3 million pace.

Updated, Nov. 4, 2024 – Supported by higher incentives, solid inventory levels, and generally improving consumer sentiment, new-vehicle sales in October likely came in slightly higher than the Cox Automotive forecast. Initial estimates put total new-vehicle sales at 1.33 million units last month, a gain of 11% from October 2023. Cox Automotive had forecast 1.31 million sales, an 8% year-over-year gain. Business disruptions following two major hurricanes in late September and early October likely deferred some new-vehicle sales, lowering the total volume.

The new-vehicle sales pace in October, now estimated at 16.0 million SAAR, is roughly on par with the sales pace the market has sustained for the past year and was just ahead of the Cox Automotive October forecast of 15.9 million. Higher vehicle prices, high auto loan rates and tight credit conditions continue to limit the market. As Senior Economist Charlie Chesbrough noted in the forecast published below, “The sales pace has been bouncing between 15-16 million for over 18 months, and [October] is expected to follow the same trend.” And follow it did.

Toyota sales were lower year over year, while the Hyundai, Kia and Genesis brands posted notably strong results. Initial estimates suggest Ford delivered a solid month. General Motors numbers were likely helped by higher fleet volume, and Stellantis leaned further into incentives to move older inventory. Mazda posted another strong month, with sales up more than 50% year over year. Mazda is a tier-two company when it comes to volume, but with two months to go in 2024, the Hiroshima-based company has already nearly surpassed total sales in calendar year 2023 thanks to strong new entries.

The U.S. national election will soon be in the rearview mirror, which will likely boost consumer confidence further – the uncertainty will end. With that and continued affordability improvements, Cox Automotive analysts continue to believe new-vehicle sales in 2024 will end the year on a positive note, likely landing at or above the Cox Automotive full-year forecast of 15.7 million.

ATLANTA, Oct. 24, 2024 – October new-vehicle sales are expected to remain steady at a seasonally adjusted annual rate (SAAR), or sales pace, of 15.8 million, unchanged from the sales pace in September. However, sales volume in October is anticipated to increase by 10% compared to last month and finish the month higher by 7.9% compared to last October, primarily due to the differences in the number of selling days.

According to Charlie Chesbrough, senior economist at Cox Automotive: “Neither tricks nor treats are expected from October new-vehicle sales. The sales pace has been bouncing between 15-16 million for over 18 months, and this month is expected to follow the same trend. This month has seen both headwinds and tailwinds. The recent extreme weather events in the Southeast have suppressed some business operations, which will cut into the sales total in October. On the other hand, recent interest rate cuts and stock market gains have likely provided some market support.”

The increased number of selling days is forecast to boost October’s new-vehicle sales figures. This month features 27 selling days, two more than last year and four more than last month, lifting the total sales volume.

Much like in September, robust new-vehicle inventory and heightened incentives are key factors helping maintain steady sales volume. Throughout 2024, incentives for new-vehicle sales have been steadily increasing, with September reaching the highest level since early 2021, according to Kelley Blue Book. However, new-vehicle listing prices have been gradually rising over the past few weeks, according to data from Cox Automotive’s vAuto Live Market View.

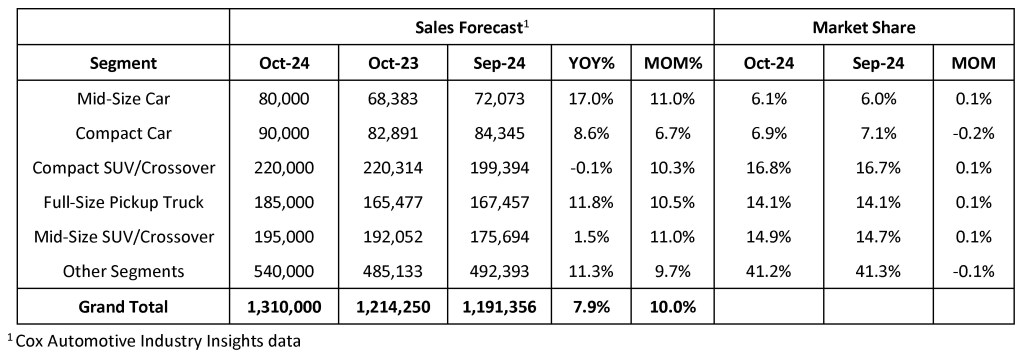

October 2024 U.S. New-Vehicle Sales Forecast

All percentages are based on raw volume, not daily selling rate.

About Cox Automotive

Cox Automotive is the world’s largest automotive services and technology provider. Fueled by the largest breadth of first-party data fed by 2.3 billion online interactions a year, Cox Automotive tailors leading solutions for car shoppers, auto manufacturers, dealers, lenders and fleets. The company has 29,000+ employees on five continents and a portfolio of industry-leading brands that include Autotrader®, Kelley Blue Book®, Manheim®, vAuto®, Dealertrack®, NextGear Capital™, CentralDispatch® and FleetNet America®. Cox Automotive is a subsidiary of Cox Enterprises Inc., a privately owned, Atlanta-based company with $22 billion in annual revenue. Visit coxautoinc.com or connect via @CoxAutomotive on X, CoxAutoInc on Facebook or Cox-Automotive-Inc on LinkedIn.

Media Contacts:

Mark Schirmer

734 883 6346

mark.schirmer@coxautoinc.com

Dara Hailes

470 658 0656

dara.hailes@coxautoinc.com