Press Releases

Cox Automotive Forecast: U.S. Auto Sales Begin to Rebound in May as Markets Reopen

Thursday May 28, 2020

Article Highlights

- Annual vehicle sales pace in May is expected to finish near 11.4 million, down significantly from last year’s 17.4 million, but an improvement from April’s 8.6 million level.

- May sales volume is forecast to fall 33% from May 2019 and finish near 1,050,000 units.

- Use of digital and virtual shopping and buying tools is increasing sharply, but multiple headwinds could impede sales recovery.

ATLANTA, May 28, 2020 – COVID-19 continues to plague the light vehicle market, but May’s sales pace is still expected to be a giant step forward on the path to recovery. According to a forecast released by Cox Automotive, new light-vehicle sales volume in May is expected to finish near 1,050,000 units, down 33% compared to last May but up 49% from last month.

After incorporating seasonal adjustments, the annual vehicle sales pace is expected to finish near 11.4 million, up from last month’s historically low 8.6 million pace but still far below May 2019’s robust 17.4 million level.

May is normally a critical month for the industry as it kicks off the summer sales season. When sales are reported next week, analysts will be searching the results for signs of an industry in recovery. According to Charlie Chesbrough, senior economist at Cox Automotive: “Recent trends suggest daily sales are showing significant gains over March and April’s collapse. Data reveals the market hit a bottom around the first of April, and since then has been making a slow but steady recovery. The opening of dealerships, and whole states, over the last few weeks is greatly contributing to the upward sales trend. The key question for the market going forward is whether these modest but steady sales gains will continue into June or does the sales recovery stagnate.”

Multiple Headwinds Could Impede Sales Recovery

As the industry drives into the summer selling season, a full sales recovery faces multiple headwinds. This crisis is unique because the industry is facing a negative demand shock and a negative supply shock simultaneously. Vehicle factories have been mostly closed since late March and are only beginning to restart. That means new-vehicle inventory is at the lowest volume in more than a year. Low inventory means less choice for consumers, particularly with popular vehicles like pickup trucks and SUVs. As sales begin to recover, inventory levels will be drawn down even further, quickly causing some brands to face serious shortages. At a minimum, selection may become more limited as the desired model may be in stock but not in the consumer’s preferred color or trim, potentially resulting in the consumer delaying purchase, switching brands, or moving into the used-vehicle market.

In the COVID-19 Digital Shopping Study 2.0 released today, Cox Automotive assesses how the global pandemic has impacted vehicle shopping habits; how vehicle consideration has changed; and how luxury and non-luxury shoppers’ purchase decisions differ. The study found that once consumers feel safety measures are in place and business are open, nearly half of in-market shoppers expect to transact in 30 days or less.

With the economy in recession and unemployment elevated, the study found that consumers are interested in the “right deal.” Price incentives and low-to-no APR are sill the leading offers that can trigger a shopper to move forward who may have been delaying their purchase. The study also finds that nearly half of consumers in market have reconsidered their price point for a new vehicle, and consumers are also looking to lower their down payments on a new-vehicle purchase. Even before COVID-19 hit, the auto industry was wrestling with a new-vehicle affordability issue. In the aftermath, the problem will likely be accentuated.

Use of Digital and Virtual Tools Increases Sharply

Both consumer demand for and dealership use of digital and virtual tools has increased during the global pandemic, according to Cox Automotive data. Online shopping sites, Autotrader.com and KBB.com, have seen record-breaking traffic on weekends, likely as shoppers spend time online instead of on dealership lots. Vehicle description page views are up relative to overall traffic, and the volume of online chats and text messages sent to dealerships via the shopping websites has increased 150%. On Autotrader.com, the volume of digital retailing “deal sends” – when a customer makes an offer online – is up more than three-fold year over year. The Cox Automotive COVID-19 Digital Shopping Study found that consumers want to do more online, with 2-in-3 now more likely to purchase a vehicle completely online.

May 2020 Sales Forecast Highlights

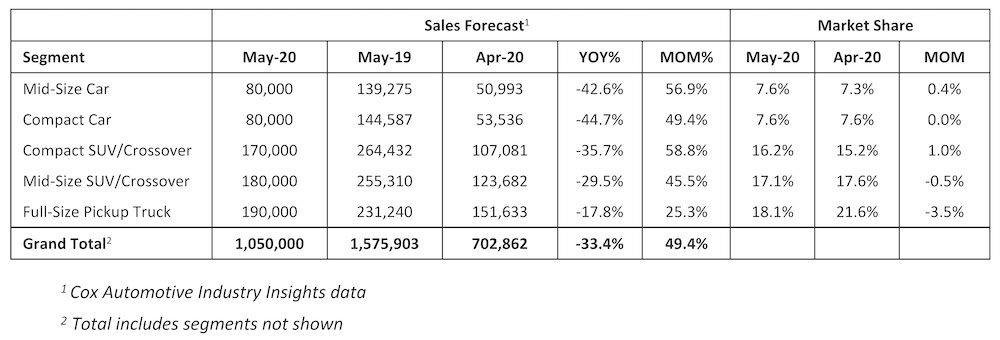

- In May, new light-vehicle sales, including fleet, are forecast to fall to 1,050,000 units, down nearly 33% compared to May 2019. When compared to last month, sales are expected to rise by roughly 347,000 units, an increase of 49%.

- The SAAR in May 2020 is estimated to be 11.4 million, far below last year’s 17.4 million level but a big improvement from last month’s 8.6 million pace.

May 2020 Forecast

All percentages are based on raw volume, not daily selling rate.

About Cox Automotive

Cox Automotive Inc. makes buying, selling, owning and using cars easier for everyone. The global company’s 34,000-plus team members and family of brands, including Autotrader®, Clutch Technologies, Dealer.com®, Dealertrack®, Kelley Blue Book®, Manheim®, NextGear Capital®, VinSolutions®, vAuto® and Xtime®,are passionate about helping millions of car shoppers, 40,000 auto dealer clients across five countries and many others throughout the automotive industry thrive for generations to come. Cox Automotive is a subsidiary of Cox Enterprises Inc., a privately-owned, Atlanta-based company with revenues of $21 billion. www.coxautoinc.com

Media Contacts:

Mark Schirmer

734 883 6346

mark.schirmer@coxautoinc.com

Dara Hailes

470 658 0656

dara.hailes@coxautoinc.com