Press Releases

Cox Automotive Forecast: Tight Supply Puts Brakes on New-Vehicle Sales

Tuesday July 27, 2021

Article Highlights

- Annual new-vehicle sales pace in July is forecast to finish near 15.2 million, the slowest pace of 2021.

- July sales volume is expected to rise nearly 7.8% from one year ago and finish near 1.33 million units.

- The current low-supply, high-demand situation means finding and buying a new vehicle may be a challenge for consumers.

UPDATED August 4, 2021 – The automotive sales pace in July slowed substantially, as tight vehicle supply severely limited sales at some automakers. The Cox Automotive Industry Insight team had forecasted slowing sales, as available inventory at the start of July was at the lowest point in memory. Days of supply had dropped to 29, according to an analysis of vAuto Available Inventory data. Inventory levels have generally declined since February, and the short supply is now impacting the industry’s sales pace.

Sales results for July indicate that sales slowed even more than our team had forecast, with the seasonally adjusted annual rate (SAAR) of sales coming in at 14.8 million, below our July forecast of 15.2 million. Volume of 1.29 million was lower than our forecast of 1.33 million. The sales pace of 14.8 million was the lowest level since July 2020 and down 13.4% from July 2019.

The Cox Automotive full-year forecast for automobile sales is 16.5 million, with sales in the second half of the year expected to be slightly below the 8.3 million sold in the first half.

ATLANTA, July 27, 2021 – July U.S. auto sales are expected to reveal a new-vehicle market that has a large problem – too few products to sell. The sales pace, which had been averaging nearly 17.0 million a month through May, is expected to show another decline as falling inventories are halting sales activity around the country. Cox Automotive forecasts the July sales pace to fall to 15.2 million, down from June’s 15.4 million level. This would be the third consecutive monthly pace decline after hitting a post-COVID-19 peak in April. Sales volume is expected to rise nearly 7.8% over last July, but with 27 selling days this year, one more than last year, that is a minimal gain.

“Sales pace has really been falling throughout the month – and quickly,” said Charlie Chesbrough, senior economist, Cox Automotive. “The estimated sales pace of 15.2 million in July is the slowest pace since last August’s 15.1 million, and if inventory levels do not improve, we could see the pace drop even more.”

Inventory levels were tight to start the year after factory closures during the virus outbreak in 2020, but the global chip shortage has significantly impacted vehicle production this year causing available supply to be at a critically low level. To start July, new-vehicle inventory was at a record low 25 days’ supply. A certain amount of supply is necessary for buyers to find the exact vehicle – type, color, trim – they want. Through the spring, inventory levels were extremely low, yet sales were able to maintain a strong pace. However, over the last two months, the sales pace has declined substantially, and the lack of products is to blame. It is expected that sales will continue to be constrained by a lack of inventory through August and September but should improve in Q4 as chip orders from manufacturers see more fulfillment.

Demand remains strong in the marketplace supported by improved consumer confidence, a strong stock market, and ongoing economic recovery. For consumers, this low-supply, high-demand situation means finding and buying their next vehicle may be a challenge. Vehicle shoppers may have a hard time finding the exact vehicle they want, in the specific color and trim package desired. And, if they can find a vehicle they want to buy, they may find that the price is non-negotiable as the average transaction price for a new vehicle in June was nearly equal to the manufacturer’s suggested retail price. This combination of hard-to-find vehicles and higher prices is slowing the auto market, and there is little change expected over the next few months.

July 2021 New-Vehicle Sales Forecast Highlights

- In July, new light-vehicle sales are forecast to reach 1.33 million units, or nearly 7.8% higher compared to July 2020. When compared to last month, sales are expected to rise over 35,000 units or 2.8%.

- The seasonally adjusted annual rate (SAAR) in July 2021 is estimated to be 15.2 million, above last year’s COVID-19-impacted 14.6 million level but a slight decrease from June’s inventory- constrained 15.4 million pace, and the slowest pace yet in 2021.

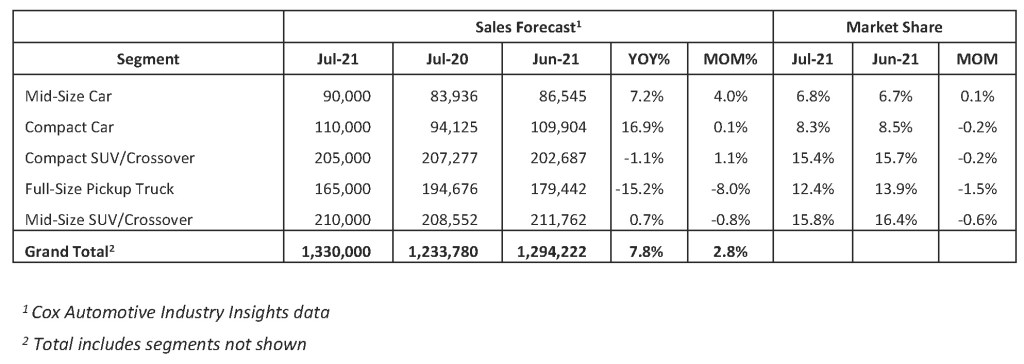

July 2021 New-Vehicle Sales Forecast

All percentages are based on raw volume, not daily selling rate.

About Cox Automotive

Cox Automotive Inc. makes buying, selling, owning and using vehicles easier for everyone. The global company’s more than 27,000 team members and family of brands, including Autotrader®, Dealer.com®, Dealertrack®, Dickinson Fleet Services, Kelley Blue Book®, Manheim®, NextGear Capital®, VinSolutions®, vAuto® and Xtime®, are passionate about helping millions of car shoppers, 40,000 auto dealer clients across five continents and many others throughout the automotive industry thrive for generations to come. Cox Automotive is a subsidiary of Cox Enterprises Inc., a privately-owned, Atlanta-based company with annual revenues of nearly $20 billion. www.coxautoinc.com

Media Contacts:

Mark Schirmer

734 883 6346

mark.schirmer@coxautoinc.com

Dara Hailes

470 658 0656

dara.hailes@coxautoinc.com