Consumers are following several trends/current events that negatively impact their purchasing power, including rising gas prices, rising interest rates, and new proposed tariffs on imported vehicles and parts. Of those three, gas prices garner the most attention (87 percent), interest rates second (81 percent), but auto tariffs register a strong 71 percent.

Consumers aren’t just following the news about these topics. They are concerned about them. Seventy-five percent of vehicle owners are concerned about the new tariffs.

Younger people are most affected by the news.

Extrapolating impact on summer buying or near-term plans is difficult given the challenge of reaching someone who has purchased since the new auto tariffs were proposed at the end of May. But judging from survey data on recent purchasers and their own decisions, the most extreme impact is expected to be on imported and new vehicles.

So far at least, 42 percent of recent purchasers say the new tariffs did not impact their decision in buying an import or domestic vehicle. Thirty-five percent say that it did not impact their choice of new or used. Those pivoting slightly favored buying new over buying used (which makes since given tariffs haven’t actually been implemented).

Likewise, 46 percent said the news has not impacted their method of purchase, be it leasing or financing. Those pivoting favored financing over leasing.

A whopping 84 percent of recent owners expect some impact to new prices. Seventy-six percent expect an impact on domestic vehicle prices, and nearly two-thirds expect at least some impact on used prices.

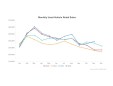

When you combine import-related-fear of higher prices with expectation of higher interest rates as well, consumers with a sensitivity to potential payment inflation are likely thinking twice about delaying any auto purchase plans. Auto prices do not suggest that buyers are getting bargains or special deals in either the new or used market, but today’s prices and payments may look fantastic compared to what’s coming.

Note: Survey of consumers was conducted August 9 through August 18 and included 1,005 total respondents.