Evolution of Mobility

Consumer Attitudes Toward Car Ownership Are Changing

Tuesday May 28, 2019

Article Highlights

- Nearly everyone (83%) today is using a personally owned vehicle on a weekly basis, but alternative transportation options are starting to chip away at individual car ownership. Nearly 4 in 10 consumers agree that transportation is necessary but owning a vehicle is not.

- Unlike other mobility tech, which tends to attract more usage among Millennials and Gen Z, vehicle subscription has something for everyone. Younger generations are hooked by access to the best and newest vehicle technology, while older generations like easier maintenance and repair. The idea of variety and convenience appeals across the board.

- Dealers have the power to transform the automotive business themselves – before a third-party gains a toehold to marginalize them to the sidelines. The mainstreaming of new mobility services is an opportunity for dealers more than it is a threat.

Take a snapshot of the road today – before you know it, it will look completely different.

Today the traditional model of mobility (that is, individual car ownership, taxis and public transportation) reigns supreme. Most miles driven today are by owner-operated vehicles, and nearly everyone (83%) is using a personally owned vehicle on a weekly basis.1 But alternative transportation options are starting to chip away at this model.

Emotional benefits of car ownership like freedom, safety, and independence are as compelling as ever. But the practical benefits, e.g., cost of ownership and lack of flexibility, are influencing consumer attitudes in a way that could significantly impact individual car ownership. Half of consumers already think that owning a car is becoming too expensive and that cars are greatly under-used (especially when you consider the fact that they are only in use 4% of any given 24 hours).1

Awareness and usage of ride-hailing, car-sharing, and vehicle subscription services – not to mention self-driving cars – is growing and new transportation models will continue to emerge.1

How quickly the shift happens depends, in part, on infrastructure and technology, but a major factor is consumer acceptance. The Evolution of Mobility Study paints a rich story of the evolution of mobility and how consumers view a future with fewer cars in their garages but more options to help them get around.

Here are five realities that emerged from the study:

Reality #1: Ride-hailing has become mainstream

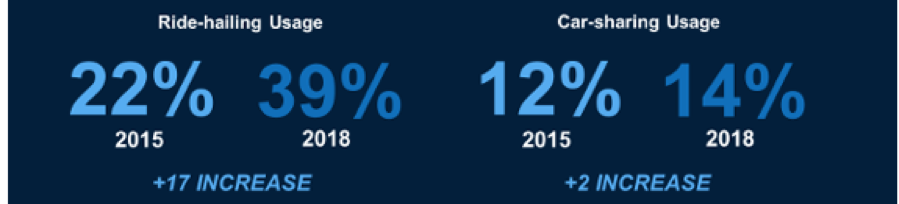

If you pick up a stranger’s phone and check out their apps, you’re likely to see Uber or Lyft among them. In fact, you’ve likely even used these services yourself. Nearly everyone has heard of ride-hailing, even if they don’t live in a big city where these services are most common. Nationwide, usage has jumped 17 points to 39% in the last three years.1 Ubiquitous as it may be, though, ride-hailing has not displaced car ownership.

Reality #2: Car-sharing offers big opportunities

Car-sharing (think Zipcar) has been around twice as long as ride-hailing, but only 54% of consumers are aware it exists (versus 9 out of 10 for ride-hailing).1 On top of that, penetration has remained fairly flat in the last 3 years – even in notorious mobility hubs like San Francisco, Austin, New York City, and Miami.

That said, car-sharing has a greater potential than ride-hailing to disrupt individual car ownership. For now, though, challenges such as availability or accessibility are barriers to consumer adoption. No player currently operating in this space is able to meet the majority of consumers’ needs for transportation through the car-sharing model.

Reality #3: Subscription services are gaining traction

While consumers cite accessibility, convenience and cost as barriers to using car-sharing services, one aspect of car-sharing does have broad appeal: flexibility.1 One car simply does not fit all.

Subscription services, where a monthly fee allows consumers to swap vehicles more frequently than a traditional lease and covers everything but the gas, are on the rise. Subscription services are the newest mobility player – so new, in fact, that its impact wasn’t even being measured three years ago. Today, 1 in 4 consumers know about it – that’s a much steeper incline of awareness than ride-hailing or car-sharing that have been around for a decade or two.1

Clutch Technologies is helping lead the way with this alternative transportation model by enabling car dealers and OEMs to provide vehicle subscription services directly to consumers while at the same time creating a new profit center for their businesses.

Reality #4: Subscription is growing quickly

There is a fair amount of appeal for the subscription model and it’s gaining popularity fast. One in 10 consumers said they would opt for subscription over buying a vehicle the next time they’re in market.1 If that doesn’t sound so impressive, consider again that this alternative transportation model has only been around a short time with the introduction of OEM programs, like Porsche Passport. Compared to the more languid beginnings of other mobility models, this is a huge leap.

Consumers already using subscription services say they love the freedom from responsibility of car ownership as well as the convenience and choice to get the exact car they need for every occasion.

Unlike other mobility tech, which tends to attract more usage among Millennials and Gen Z, subscription has something for everyone. Younger generations are hooked by access to the best and newest vehicle technology, while older generations like easier maintenance and repair.1 The idea of variety and convenience appeals across the board.

Reality #5: Subscription is anyone’s game

So while there’s appetite for subscription services, the study shows that there’s no clear preference for who offers them.1

That’s good news for dealers and OEMs. History has proven if a better system comes along and it’s viable, people will use it. It’s entirely plausible that taxicab companies considered that there could be a better way to dispatch their vehicles. But their missed opportunity opened the door for a third-party (Uber) to revolutionize the ride-hailing industry.

With the growing need for integrated transportation providers, dealers can transform the automotive business themselves – before a third-party gains a toehold to marginalize them to the sidelines. The mainstreaming of new mobility services is an opportunity for dealers more than it is a threat.

The Final Word

One thing the Evolution of Mobility Study makes clear: we are witnessing the early stages of a shift in how consumers view transportation. The evolution is already underway—with nearly 4 in 10 consumers agreeing that transportation is necessary but owning a vehicle is not.1 A significant opportunity exists for dealerships to ride this wave of mobility and diversify their revenue streams with new transportation offerings.

Tags

Sources:

1) Cox Automotive Evolution of Mobility Study