Driving greater efficiencies

Evolution of Automotive Retail

Monday October 23, 2017

Article Highlights

- The biggest opportunity in automotive retail is improving the car-buying experience: less than 1% of consumers like the car shopping and buying process, as it exists today.

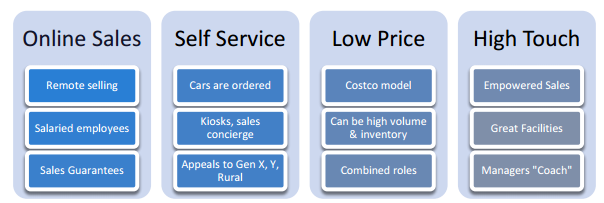

- As the retail business continues to evolve to meet consumers’ needs, Cox Automotive has identified four different types of sales models that are likely to emerge in the next 10 years: Online, Self-Service, Low Price and High Touch.

- Regardless of the model, future success will be based on specific operational practices. Our research revealed that there are several best practices that should universally apply to any new or emerging retail model around: Sales, Appraisals, F&I and Operations.

The biggest opportunity in automotive retail is improving the car-buying experience: less than 1% of consumers like the car shopping and buying process, as it exists today.1

Consumer data overwhelmingly supports that consumers value a car-buying experience that is transparent, predictable, streamlined, efficient, personalized with no pressure and enjoyable, and independent dealers are uniquely positioned to respond more readily to consumer demands for a better car-buying experience. The biggest opportunity for Independent Dealers is to leverage their agility to align to consumers’ needs.

New Sales Models Emerge

As the retail business continues to evolve to meet consumers’ needs, Cox Automotive has identified four different types of sales models that are likely to emerge in the next 10 years:

In the case of car dealerships today, many are in the “mushy middle,” providing consumers very little differentiation in the sales process or experience. This limits the dealership’s ability to optimize its operations. A clear sales model allows alignment between Marketing, Sales Processes, Compensation plans, and sets a clear expectation with the customer.

1. Online – The entire or majority of the transaction is done remotely and salaried salespeople act more like call center agents. Trade-in valuation tools and online negotiation platforms will be very important to the process. Peace-of-mind items like money-back guarantees will be in force to build trust and confidence. Videos on how to use the Service department will be used along with service apps.

The Online process flow transacts primarily online, or dealers have a team that transacts with buyers primarily online. This sales model is about getting base information in and providing a quote back. The final step is offering at-home delivery. Dealerships that follow this model are clearly volume-based and pass on scale efficiencies to extend lower cost to the consumer.

“I’d like to do everything remotely, like I do for Amazon. Even haggle via chat room. I don’t want to go to a dealership unless the exact car I want is there.”

2. High Touch – Dealership facilities look more like a nice hotel lobby with amenities such as coffee shops, boutique stores, and a concierge assigning one person to escort the customer through the entire process. Car servicing is door-to-door pickup and delivery. This premium approach costs more and often takes more time. Salespeople will be empowered to make autonomous decisions with managers providing coaching.

The High Touch model uses heavy involvement of sales consultants and manager/concierges to deliver a superior consumer experience. The sales process centers on consumer engagement and satisfaction with profitability as a natural by-product. Home delivery and pickup are optional.

“I’m going premium. I find the Dollar Store or Wal-Mart infuriating. I particularly don’t like to wait. I’d like it to be like the Apple Store Genius Bar, where I make an appointment with a specific person who’s waiting for me.”

3. Self-Service – Consumers use tools at the dealership or from home to buy a car on their own: They perform the majority of the work as they interact with kiosks, tablets, computers, beacons, a smartphone app and other systems. Sales guides are available to aid buyers in the process. This model type appeals to Gen X, Y and Rural audiences. It’s an attractive option for dealers in rural areas as it lets them offer a large virtual inventory to buyers without the cost of floor planning as many vehicles.

“You know it would be nice to have an interactive device next to each model that could supply information about the model without a need for a salesperson.”

4. Low Price – This self-directed experience allows the consumer to start pick out their car from large inventories, complete the paperwork and drive off. There are a minimum number of people working at the dealership, but the prices are low and the process is fast. Think of it as a Costco model based on high volume and inventory with few employees performing multiple roles. Employees are highly trained to respond to consumers’ needs and most are salaried.

“I’d prefer the economical option, if there’s not a lot of haggling, and its lower cost. If I have to just deal with one person, I’d prefer that. If there was a digital queue, and I’m alerted when it’s my turn, I’m okay with that.”

Regardless of Model, Future Success Will Be Based on Specific Operational Practices

Despite the challenges to current retailing models, results from extensive Cox Automotive research reveal that that are several best practices that should universally apply to any new or emerging retail model:

Sales

- Paperless credit applications

- Ability to input customer information digitally through apps and tablets

- Less negotiation

- A defined dealership culture

- Sales rep initiates negotiations with customer

Appraisals

- Full transparency of trade-in value determination with consumer participation

- Valuation occurs mostly concurrent with sales process

F&I

- Entire process conducted on the sales floor not in the back office

- Digital aftermarket presentation that occurs earlier in the process (online before consumer arrives at dealership, during “wait times” of sales process, etc.)

Operations

- Minimal handoffs

- Process standardization regardless of whether the customer is in-store, online or self-serve

- Allowing the majority of activities to occur offsite

- Potential process-ending decision points at the start of the process (e.g., credit checks)

- A system that dictates the process for a consistent customer experience

- An integrated end-to-end system that ensures maximum efficiency

- Maximize customer satisfaction by reducing cycle time

Tags

- Source: 2015 Car Buyer of the Future Study, Autotrader