Data Point

CPO Sales Waver in April

Tuesday May 16, 2023

Article Highlights

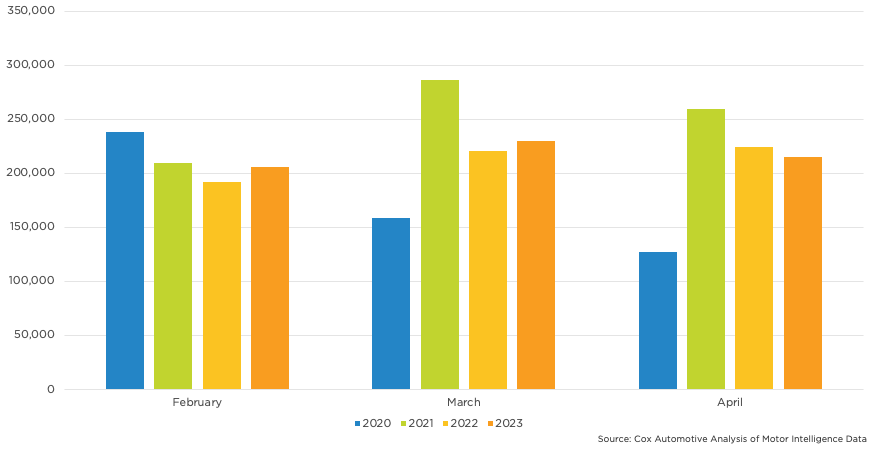

- Certified pre-owned (CPO) sales in April fell 4.2%, over 9,000 units, from last April to finish at 214,684.

- This total is down nearly 15,000 units, or over 6%, from March’s number.

- Among the large manufacturers, Toyota had the highest CPO sales volume in April.

Certified pre-owned (CPO) sales in April fell more year over year than the overall used retail market. CPO sales decreased 4.2%, or over 9,000 units, from April 2022 to finish at 214,684. This total is down nearly 15,000 units, a 6% drop from March’s number. Year-to-date CPO sales remain up 6% compared to 2022.

“April CPO sales took it on the chin compared to March, but the pace was healthier than either January or February,” said Chris Frey, senior manager of Economic and Industry Insights at Cox Automotive. “The current year-to-date sales pace of 213,000 is about 7,500 better than last year, but it’s also down by 21,000 from the pre-pandemic monthly average.”

April CPO Sales

Retail used-vehicle sales — the volume of vehicles sold via a dealership, thus removing private party sales — are estimated to be 1.6 million, down 1.2% from April 2022. An early read of same-store Dealertrack data shows that used retail sales were weaker than this initial report shows and decreased by 7% year over year. The Cox Automotive team acknowledges that the Dealertrack estimates could be understating sales due to a rise in cash buying, a trend for the last 10 months as interest rates have risen to 20-year highs. The used retail sales pace ticked higher to 18.3 million in April from March’s downwardly revised 18.1 million level.

“Higher interest rates and the looming concerns of a recession likely contributed to the CPO sales decline, with buyers pulling back from last month,” said Frey. “We still think the strategy shift mentioned last month will pay off, with older units entering the mix, but after April’s sales decline from March, it looks to be a bit longer before we see sustained sales improvement from the larger pool of CPO-eligible units.”

Toyota had the highest CPO sales volume in April among the large manufacturers. Hyundai had the largest year-over-year percentage gain in CPO sales, while Chevrolet had the largest decline.