Data Point

Incentive Spending and Program Count Remains Low, Even as a Holiday Approaches

Wednesday June 30, 2021

Article Highlights

- According to an analysis of June program data by the Cox Automotive Rates & Incentives team, consumer cash has all but dried up.

- In general, each manufacturer is incentivizing with a great deal of selectivity.

- In May, the average incentive spend as a percent of the average transaction price dropped to a decade low of 7.4%.

With an Independence Day holiday fast approaching, industry observers might rightly expect a new round of special, can’t-pass-up Fourth of July incentives at dealerships across the U.S. But according to an analysis of June program data by the Cox Automotive Rates & Incentives team, consumer cash – the guaranteed cash-back money that any buyer qualifies for and is often the fodder of headline advertising – has all but dried up. Notably, there are few national Fourth of July-specific incentives to speak of; deals advertised as Holiday Specials have likely been in place since June 1. A holiday without incentives, an unheard-of situation according to our analysts.

“The supply-and-demand curve in the new car business has been completely flipped upside down,” notes Brian Finkelmeyer, senior director of new vehicle solutions at Cox Automotive. “Demand for new cars is significantly stronger than supply, and the need for traditional cash incentives to spur sales is all but gone.”

In general, each manufacturer is incentivizing with a great deal of selectivity when it comes to, as they say, “cash on the hood.” Very few 2021 models have guaranteed customer cash; there is some, but not much, cash available for the remaining 2020 models. In fact, incentive spending has been dropping throughout 2021. In May, the average incentive spend as a percent of average transaction price (ATP) dropped to a decade low of 7.4%.

Incentives as a Percent of Average Transaction Price

In the current market, a majority of the incentive programs in place are of two types, special financing deals offered by captive lenders and dealer cash. Dealer cash is money provided by the automakers directly to the dealers for added flexibility in deal-making. Dealer cash is not transparent to the customer, unlike guaranteed customer cash, and can be used by dealers to cover sales shortfalls (common right now), cover expenses, make payroll, etc.

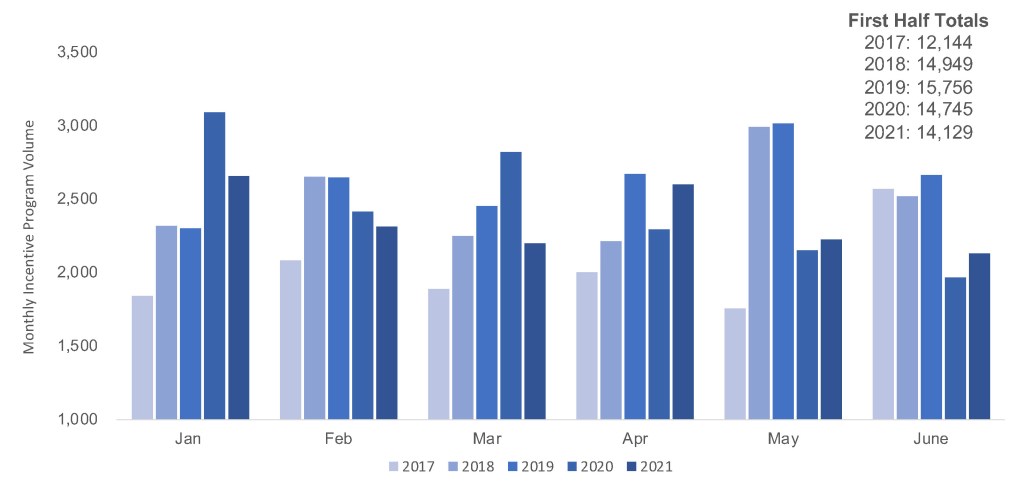

Monthly Incentive Program Volume (Industry): First Half 2017-2021

The number of incentive programs each month during the first half of 2021 has also been lower than in recent years. The volume of incentives – literally a count of the number of different incentive programs in the market in each month – during the first six months peaked in 2019, was lower in 2020, and lower still in 2021. Incentive activity – program count – is a measure of how proactive automakers feel they need to be to help stimulate sales.

Of late, and in a market with extremely low inventory, we’ve seen lower program activity along with lower spending. MSRP deals – deals at or above the manufacturers’ suggest retail price – are the new norm, for the first time in living memory, and big discounts are far and few between. Fortunately, most consumers are well aware.

The Cox Automotive Rates & Incentives (CAR&I) team has developed a methodology for measuring the accuracy of data used to calculate pricing and payment information presented through dealer service provider tools (e.g., dealer websites, inventory management, digital retailing & advertising, desking, equity, etc.). Approximately 17,500 individual dealerships – rooftops, in automotive parlance – in the U.S. rely on CAR&I incentive data for powering 5 different software applications through Cox Automotive native software/sites and our many industry partners. In all, an estimated 90,000 applications are relying on CAR&I data in a given month, providing valuable information to 40 million shoppers.