Commentary & Voices

Incentives Are Helping Keep CPO Strong

Friday February 28, 2020

Article Highlights

- With tax return season on the horizon, CPO/loaner/used-vehicle sales will likely be strong for the foreseeable future.

- What many consumers don’t know about CPO vehicles is that many come with good, factory-backed incentives to help sweeten the deal.

- Cox Automotive Rates & Incentives is helping dealers and consumers receive transparent, accurate incentive data for all vehicles – new, CPO and used.

Thanks in part to a strong supply of off-lease vehicles returning to the market, certified pre-owned (CPO) sales continue to be a bright spot for the auto industry. CPO sales in January were healthy, and there’s nothing that makes us believe anything will be different in February. In fact, with tax return season on the horizon, CPO/loaner/used-vehicle sales will likely be strong for the foreseeable future. Cox Automotive is forecasting that CPO sales alone in 2020 will reach nearly 3 million units.

Most consumers inherently understand the value of nearly-new, certified vehicles – vehicles in good condition, priced well below new. CPOs are backed with factory warranties, include roadside assistance, and have a vehicle history report to show past maintenance. Yes, CPO vehicles typically cost more than a similar used car, but that’s the price you pay for peace of mind.

What many consumers don’t know about CPO vehicles, however, is that many come with good, factory-backed incentives to help sweeten the deal. In fact, this past month, 20 different automotive brands offered special APRs for CPO vehicles, some as low as 0.99% to make them more attractive.

An APR incentive can make a big difference in the monthly payment, so it’s critical that dealers have a full understanding of all available CPO incentives, just as it is critical with new. According to the most recent Cox Automotive Car Buyer Journey study, used-vehicle buyers spend more than 10 hours online before they buy, searching inventory, comparing prices, considering vehicles. As most deals now begin online, it’s critical to have the right information available.

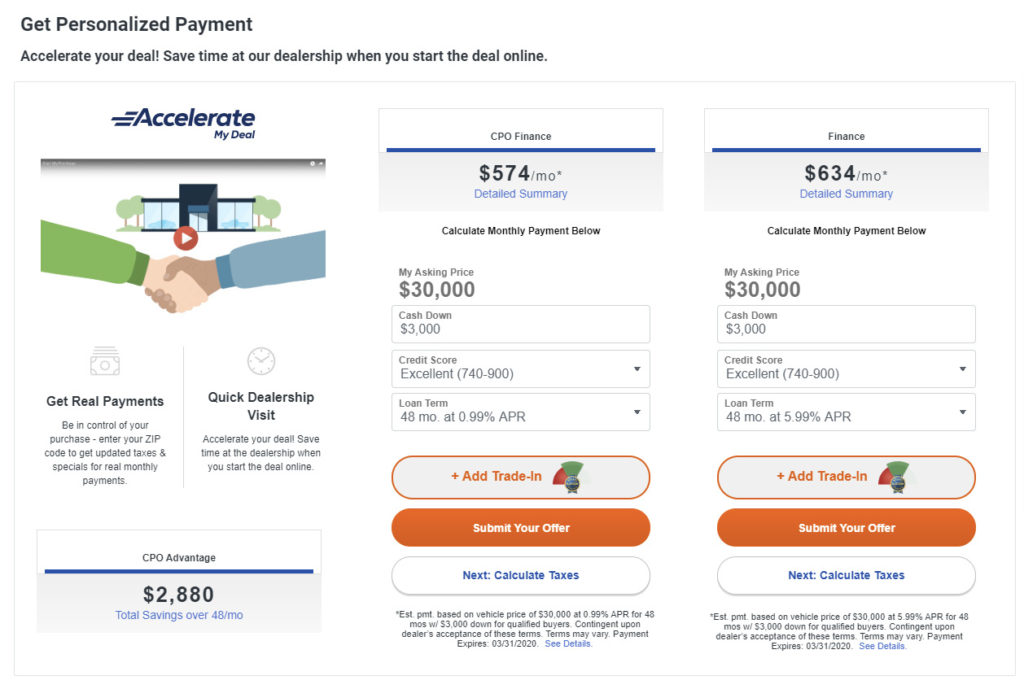

Monthly payments matter. And getting the details right matters too, especially when consumers begin to pencil deals online. Each day in our business approximately 435,000 shoppers have the opportunity to begin a deal using Cox Automotive Digital Retailing listings – including vehicles listed on Autotrader, KBB.com, Dealer.com-managed sites and other dealer sites. If the numbers are not correct, countless deals can be lost before they even begin.

As seen in the example below, with all other factors being equal, this consumer can benefit from a $2,880 savings over the term with CPO financing.

Cox Automotive Rates & Incentives is helping dealers and consumers receive transparent, accurate incentive data for all vehicles – new, CPO and used. We recently launched a new data set for CPO APR and used-vehicle retail financing. This new capability can help dealers accurately present the best available price and payment details for CPO vehicles, with the most up-to-date, relevant incentive data included.

Cox Automotive is forecasting CPO sales in 2020 to maintain a healthy pace, and special factory-supported APR incentives can help support this momentum. Getting that incentive information correct counts, which is why the team at Cox Automotive Rates & Incentives is sharply focused on CPO rates and finance payments.

Brad Korner is general manager of Cox Automotive Rates & Incentives. The Cox Automotive Rates & Incentives (CAR&I) team has developed a methodology for measuring the accuracy of data used to calculate pricing and payment information presented through dealer service provider tools (e.g., dealer websites, inventory management, digital retailing & advertising, desking, equity, etc.). Approximately 17,500 individual dealerships – rooftops, in automotive parlance – in the U.S. rely on CAR&I incentive data for powering 5 different software applications through Cox Automotive native software/sites and our many industry partners. In all, an estimated 90,000 applications are relying on CAR&I data in a given month, providing valuable information to 40 million shoppers.