Data Point

Despite Slow January, 2021 CPO Sales Expected to Rebound to Pre-Pandemic Level

Friday February 12, 2021

Article Highlights

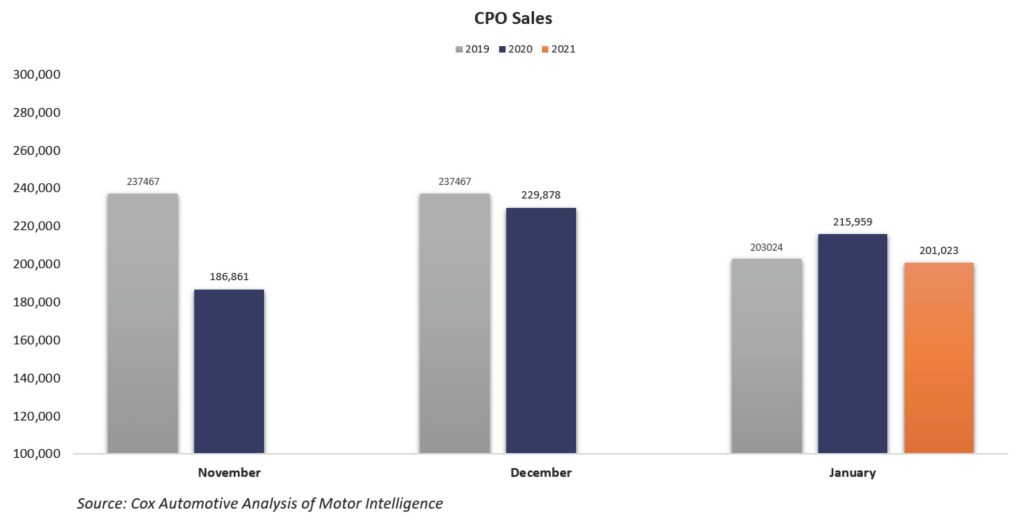

- Sales of certified pre-owned (CPO) vehicles declined 7% year over year in January, down from last year's level which was the highest January CPO sales in a decade.

- For January, 201,023 CPO units were sold, down 13% month over month compared to seasonally strong CPO sales in December.

- In January, Toyota, Honda and Chevrolet continued to be the biggest players in the CPO market, collectively representing 32% of all CPO sales.

Sales of certified pre-owned (CPO) vehicles declined 7% year over year in January, down from last year’s level which was the highest January CPO sales in a decade. For January, 201,023 CPO units were sold, down 13% month over month compared to the seasonally strong CPO sales in December.

The CPO market has been one of the strongest performing segments within the auto retail market despite the ongoing pandemic. Going into 2021, we expect the market to continue its consistent performance for year-over-year gains. The 2021 Cox Automotive CPO sales forecast, which is subject to change, is 2.8 million units, up from 2.6 million sold in 2020 and on par with 2019.

In January, Toyota, Honda and Chevrolet continued to be the biggest players in the CPO market, collectively representing 32% of all CPO sales. Those three plus Ford and Nissan accounted for 45% of CPO sales this past month. CPO sales in 2020 continued to be led by the big volume players Toyota, Honda and Chevrolet which represented 30% of total CPO sales.

According to Cox Automotive estimates, used-vehicle sales were down 5% year over year in January. The January used SAAR was 38.1 million, down from 40.1 last January but essentially unchanged from December’s 38. The January used retail SAAR estimate was 20.8 million, down from 21.2 last year but up slightly month over month from December’s 20.2 million.