Data Point

CPO Sales Increase in July, Continue to Outpace Pre-Pandemic Level

Thursday August 12, 2021

Article Highlights

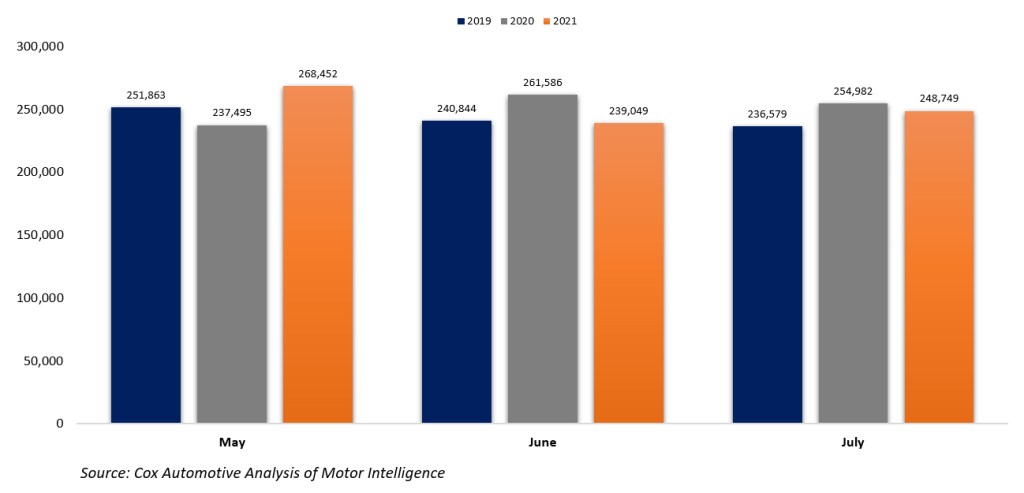

- In July, 248,749 CPO units were sold bringing June CPO sales down 2% year over year and up 4% month over month.

- Much more relevant is the July comparison to 2019, as CPO sales were up 5% compared to that more normal period.

- Through July, CPO sales are up 15% versus the same time in 2020 and are above the same period in 2019.

Certified pre-owned (CPO) sales reached 248,749 units in July, reflecting a 4% month-over-month increase and a 2% year-over-year decrease when relatively strong July 2020 CPO sales were part of the used-vehicle market recovery. A much more relevant comparison is to July 2019, and CPO sales were up 5% compared to that more normal period.

CPO Sales

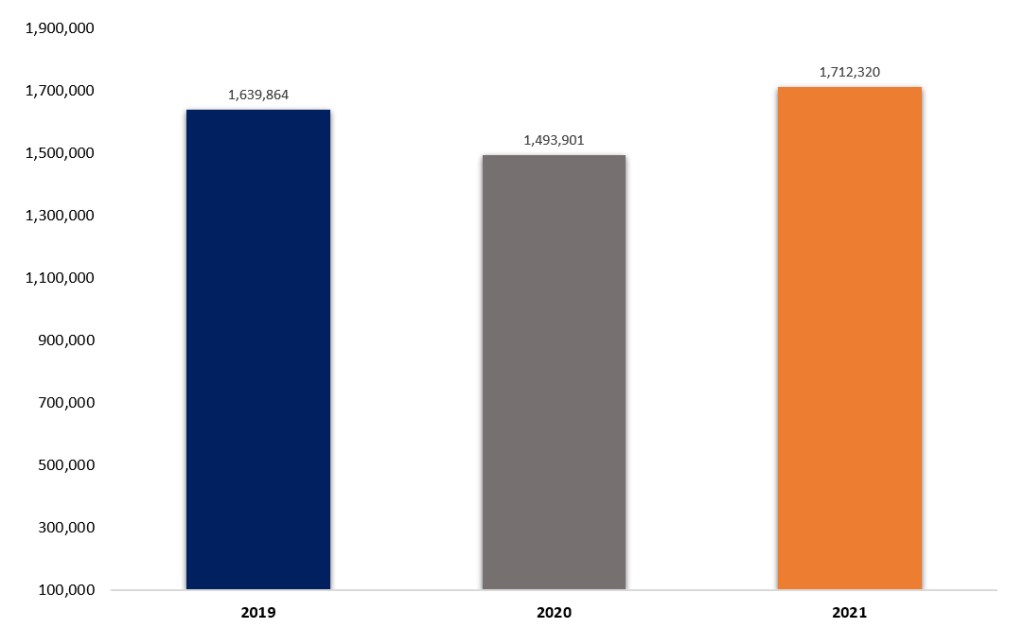

With 1,712,320 CPO units sold through July, CPO sales are up 15% versus the same time in 2020 and are above the same period in 2019 when 1,639,864 units were sold. 2019 set an all-time record for CPO sales at 2.80 million units. Moving into the second half of 2021, the CPO market is up more than 218,000 units above 2020 and 72,000 units above the 2019 level.

CYTD CPO SALES

When looking at the non-luxury brand performance last month within the CPO market, Kia had the largest year-over-year sales increase at 18% whereas big brands like Toyota and Volkswagen saw more than a 5% decrease in CPO sales compared to July 2020. Within the luxury segment, Alfa Romeo, who announced its revamped CPO website and sales program earlier this year, saw the largest gain compared to July last year at 43%.

According to Cox Automotive estimates, total used-vehicle sales were down 15% year over year in July. We estimate the July used SAAR to be 38.5 million, down from 44.8 million last July and down compared to June’s 39 million SAAR. The July used retail SAAR estimate is 21.5 million, down from 23.7 million last year and up month over month from June’s 21.3 retail SAAR.

Near-record low new-vehicle inventory and record-high prices will keep certified pre-owned units as very attractive alternatives. Credit conditions also remain favorable, as it remains easier to get a CPO loan than it was a year ago, and lower average interest rates on CPO loans help soften the impact of higher prices.