Data Point

New-Vehicle Average Transaction Prices Retreat for Second Straight Month, According to Latest Kelley Blue Book Estimates

Monday March 11, 2024

Article Highlights

- New-vehicle average transaction prices (ATP) in February 2024 declined from January and were lower year over year by 2.2%; new-vehicle ATPs are now down 5.4% from the December 2022 peak.

- February electric vehicle (EV) prices were lower by nearly 13% year over year, led by strong incentive packages; volume leader Tesla posted higher prices after hitting bottom in January.

- Affordability continues to fade: Nine new vehicles transacted for under $25,000 in February, down from 29 in February 2021.

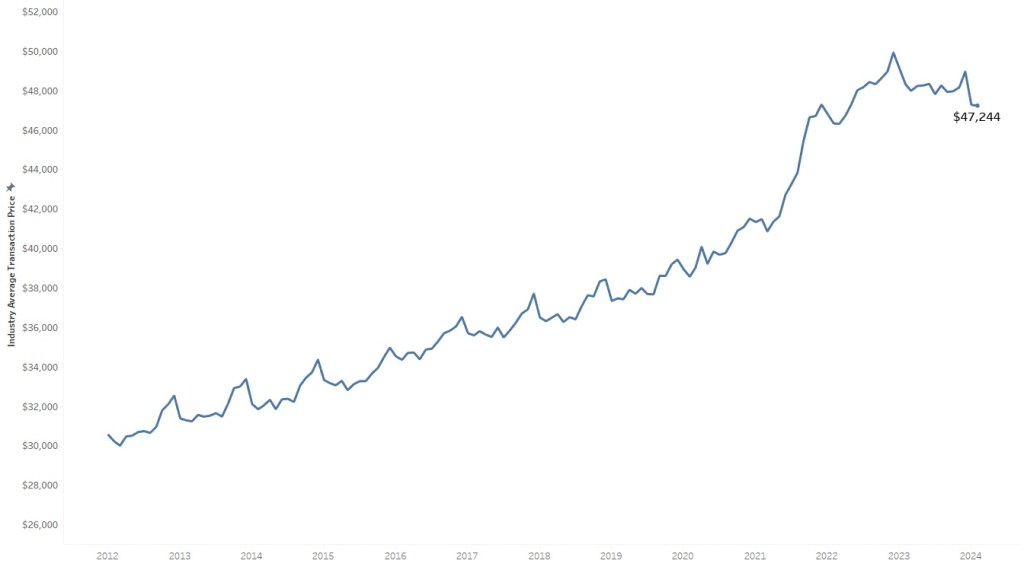

ATLANTA, March 11, 2024 – New-vehicle transaction prices (ATP) in February 2024 held mostly steady, according to an analysis by Kelley Blue Book, falling less than one-tenth of 1% from the revised January ATP. The average transaction price of a new vehicle in the U.S. last month was $47,244, down 2.2% from February 2023 and down 5.4% from the market peak in December 2022. Still, new-vehicle prices in the U.S. remain elevated, higher by nearly 14% compared to February 2021.

NEW-VEHICLE AVERAGE TRANSACTION PRICE

With new-vehicle inventory continuing to rise in the U.S., downward price pressure and higher incentives appear to be key drivers of the market’s current momentum. At the start of February, new-vehicle inventory in the U.S. stood near 2.61 million units, a 50% increase from one year earlier. Sales last month picked up from January and, with a seasonally adjusted annual rate (SAAR) of sales of 15.8 million, kept 2024 on track for the best new-vehicle sales year since 2019.

“While everyone may applaud that prices are coming down, even marginally for the moment, affordability is still challenging the market,” said Erin Keating, executive analyst for Cox Automotive. “Most shoppers have not seen their incomes increase as quickly as vehicle prices, so affording a new vehicle remains difficult. We should also note that despite rising inventory, which is good for consumers, the levels are muted, not alarming.”

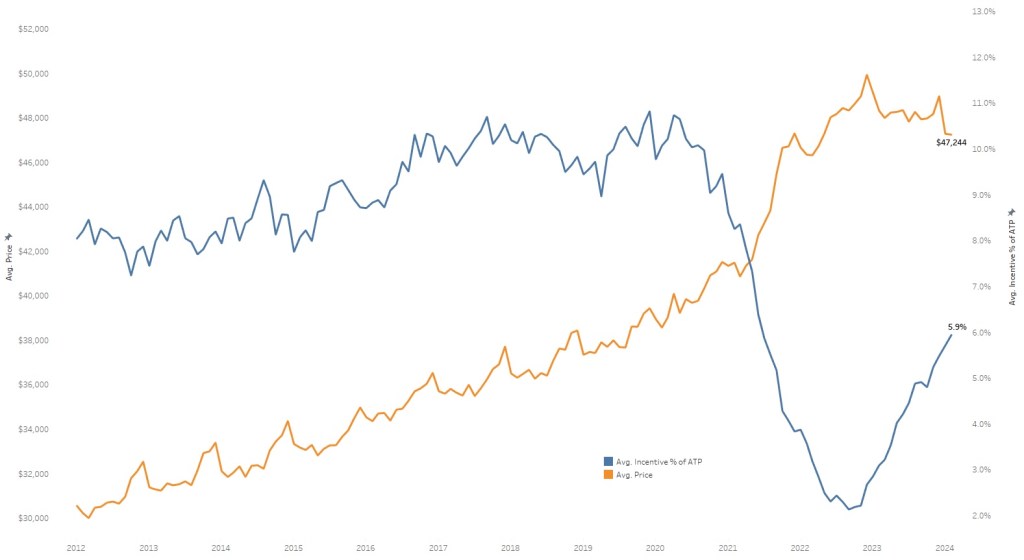

Higher Incentives Help Keep New-Vehicle Prices in Check

New-vehicle incentives in February averaged 5.9% of transaction price, up from 5.7% in January and significantly higher than the average of 3.1% recorded in February one year ago. Incentives hit bottom in the fall of 2022 – 2.1% of ATP in September of that year – and, along with inventory, have increased steadily since.

INDUSTRY AVERAGE TRANSACTION PRICE VERSUS INDUSTRY AVERAGE INCENTIVE SPEND AS % OF ATP

Luxury vehicle incentives continue to be more generous than non-luxury. In February, incentives in the luxury market averaged 6.1% of ATP, down from January but nearly twice the level seen one year ago. The luxury ATP in February was $61,424, an increase from January. Non-luxury vehicle incentives averaged 5.9% in February, an increase from 5.5% in January. Non-luxury vehicle ATPs last month were $44,052, generally unchanged from January, when prices were estimated at $44,062.

Incentive packages continue to be highest with Infiniti, Audi, Mini, and Polestar, all over 10% of average transaction price, according to Kelley Blue Book estimates. On the other end of the scale, Lexus, Toyota, Porsche, and Land Rover had some of the lowest incentives last month, all 3.0% or lower. Incentives at Land Rover averaged only 2.0% of ATP, according to the Kelley Blue Book estimates. Still, the average price paid for a new Land Rover last month was over $102,000.

Affordability Continues To Fade

In February, of the roughly 275 different models available in the U.S. market, only nine had transaction prices below $25,000 and only two transacted for less than $20,000. The Kia Rio and Mitsubishi Mirage were the two most affordable vehicles in the U.S. last month, and both are being dropped from the market. While vehicle price increases have slowed in the past year, the industry’s vehicle mix and shift toward luxury has tilted the U.S. auto market away from affordability. In February 2021 – three years ago – there were 29 vehicles with transaction prices routinely below $25,000, including eight different models transacting below $20,000.

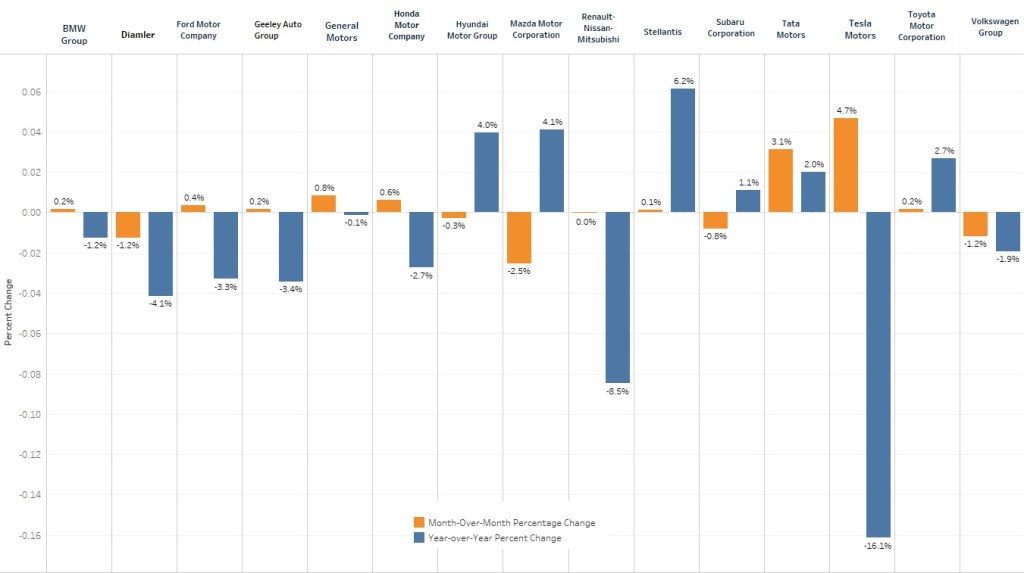

PRICE CHANGE PERCENTAGE BY AUTOMAKER

The market is in a new place now. Last month, the top of the market was more crowded than ever: Among mainstream brands, 30 different vehicles posted average transaction prices over $100,000, with the Mercedes G-Class on top with an ATP of $203,154. In fact, the February Kelley Blue Book report shows that significantly more vehicles in the U.S. transact at prices above $75,000 (sales of more than 81,000) than below $25,000 (nearly 52,000). According to the latest Cox Automotive/Moody Analytics Vehicle Affordability Index, new-vehicle affordability has improved in recent months but remains far worse today than it was in 2019. (Note: Kelley Blue Book estimates exclude exotics from brands including Ferrari, Lamborghini, and Rolls Royce.)

Tesla Prices Rise, But EV Prices Continue To Decline

According to newly revised electric vehicle (EV) transaction price data, the average price paid for an electric vehicle in February was $52,314, down from a revised $54,863 in January, according to Cox Automotive and Kelley Blue Book estimates. EV transaction prices in February were lower year over year by 12.8%, an accelerating decline compared to January when prices were lower year over year by 11.6%.

“Our research continues to show that price remains a significant barrier for consumer adoption,” said Stephanie Valdez Streaty, director of Industry Insights at Cox Automotive. “While the higher inventory levels and increased competition continue to drive down the price premium of EVs, it’s important to acknowledge that EVs remain priced above mainstream non-luxury vehicles by nearly 19%.”

The market’s general EV price decline has been led in part by the two most popular EVs in the U.S. – the Tesla Model 3 and Model Y. Transaction prices for the Model Y last month, estimated at $49,363, were the lowest on record and were lower versus February 2023 by 16.2%. Model 3 transaction prices last month, at $43,614, were lower year over year by 12% and near the lowest level on record. High incentives and discounts on most models also continue to play a major role in lower EV prices.