Data Point

Wholesale Used-Vehicle Prices See Increase in First Half of December

Monday December 19, 2022

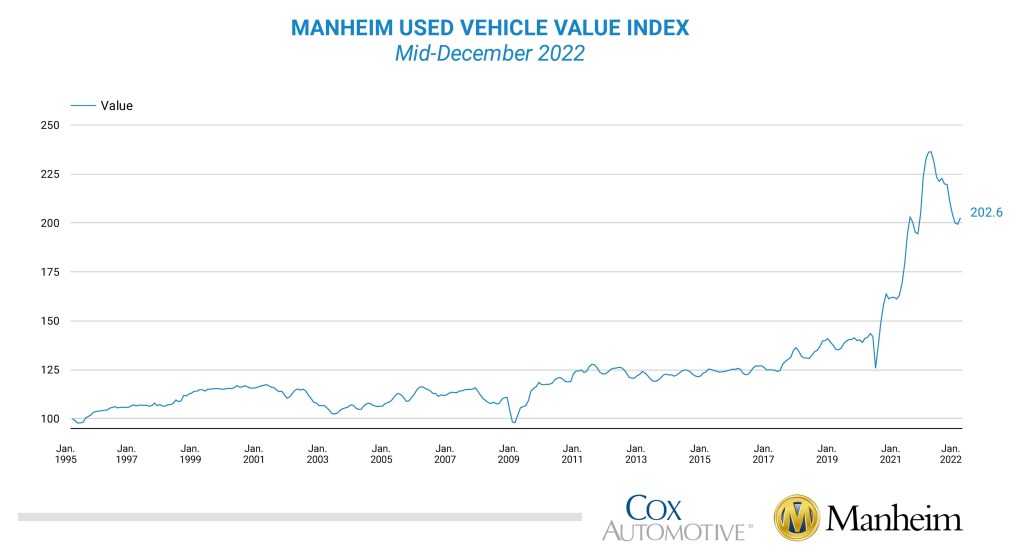

Wholesale used-vehicle prices (on a mix-, mileage-, and seasonally adjusted basis) increased 1.6% from November in the first 15 days of December. The mid-month Manheim Used Vehicle Value Index rose to 202.6, down 14.2% from the full month of December 2021. The non-adjusted price change in the first half of December was a decline of 1.0% compared to November, moving the unadjusted average price down 12.3% year over year.

Over the last two weeks, Manheim Market Report (MMR) prices saw higher than normal declines for the time of year, resulting in a 1.2% cumulative decline in the Three-Year-Old MMR Index, which represents the largest model-year cohort at auction. Over the first 15 days of December, MMR Retention, which is the average difference in price relative to current MMR, averaged 98.7%, which indicates that valuation models are ahead of market prices. The average daily sales conversion rate of 53.8% in the first half of December increased relative to November’s daily average of 49.4% and was higher than the December 2019 daily average of 52.2%. The latest trends in key indicators suggest wholesale used-vehicle values should see modest declines in the second half of December.

Continuing the trend that started in October, all eight major market segments saw seasonally adjusted prices that were lower year over year in the first half of December. Sports cars fell 10.7%, the smallest decrease, while vans, pickups, compact, and luxury cars lost less compared to the overall industry seasonally adjusted year-over-year decline of 14.2%. All eight major segments saw price increases compared to November, with full-size, luxury and sports cars higher by 3.3% or more. The remaining segments saw increases of between 0.5% and 1.6%.

Retail and Wholesale Days’ Supply Below Normal in Mid-December

Using estimates based on vAuto data as of Dec. 12, used retail days’ supply was 49 days, which was down three days from the end of November. Days’ supply was up two days year over year but down three days compared with the same week in 2019. Leveraging Manheim sales and inventory data, we estimate that wholesale supply ended November at 29 days, unchanged from the end of October but up five days year over year. As of Dec. 15, wholesale supply was at 28 days, down one day from the end of November but up four days year over year and two days lower than in 2019. Used supply measured in days’ supply and compared to 2019 suggests supply is below normal for this time of year, which indicates that price pressure should be lower than normal.

Rental Risk Prices and Mileage Down in First Two Weeks of December

The average price for rental risk units sold at auction in the first 15 days of December was down 4.8% year over year. Rental risk prices were down 2.8% compared to the full month of November. Average mileage for rental risk units in the first half of December (at 53,000 miles) was down 22.7% compared to a year ago and down 1.9% month over month.

Consumer Sentiment Measures Up to Start December

The initial December reading on Consumer Sentiment from the University of Michigan increased 4% to 59.1 as views of both current conditions and future expectations both increased. Median expected inflation rates declined one year out and were steady over the next five years. Consumers’ views of buying conditions for vehicles improved and was the second-best reading since March. June was the all-time low in the reading. The improvement in the Michigan index is consistent with an improvement in the daily index of consumer sentiment from Morning Consult. That index was up 2.3% through Dec. 15. Sentiment has been improving this fall as gas prices have been steadily declining. According to AAA, the average price for unleaded gasoline was $3.18 per gallon, down 4% year over year as of Dec. 15.

The complete suite of monthly MUVVI data for December will be released on Jan. 9, 2023, the fifth business day of the month, as regularly scheduled. Register to attend the next quarterly call on Monday, Jan. 9, 2023, at 11 a.m. EST.

If you have any questions regarding the Index or would like to sign up for updates, please contact the Cox Automotive Industry Insights team at Manheim.Data@coxautoinc.com.