Data Point

Wholesale Used-Vehicle Prices See Increase in First Half of March

Friday March 17, 2023

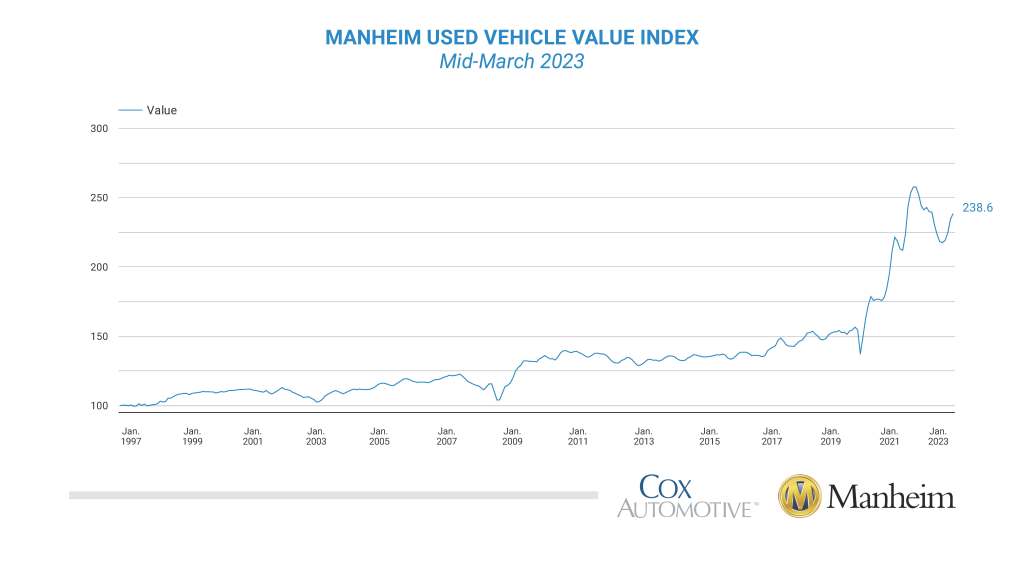

Wholesale used-vehicle prices (on a mix-, mileage-, and seasonally adjusted basis) increased 1.8% from February in the first 15 days of March. The midmonth Manheim Used Vehicle Value Index rose to 238.6, which was down 2.1% from the full month of March 2022. The seasonal adjustment minimized the gains. The non-adjusted price change in the first half of March was an increase of 3.8% compared to February, while the unadjusted price was down 2.6% year over year.

Over the last two weeks, Manheim Market Report (MMR) prices increased by an aggregate of 1.6%. Prices usually increase in the first two weeks of March, as the average price change for these weeks in the six years from 2014 through 2019 was an increase of 1.2%. Over the first 15 days of March, MMR Retention, the average difference in price relative to current MMR, averaged 100.5%, indicating that valuation models are below market prices. The average daily sales conversion rate of 68.3% in the first half of March increased relative to February’s daily average of 63.8% and was above the March 2019 daily average of 65.3%.

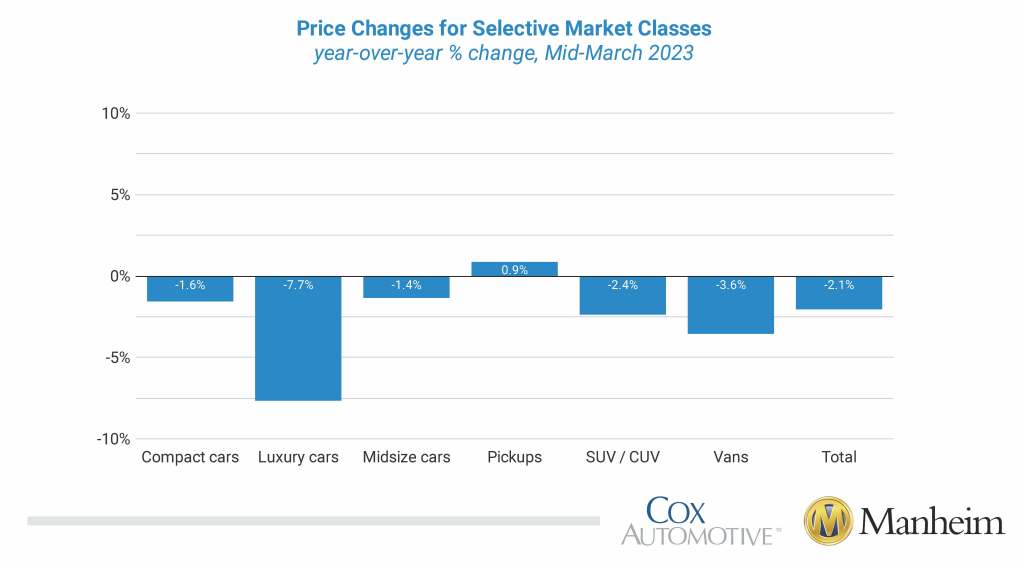

Seven of eight major market segments saw seasonally adjusted prices that were again lower year over year in the first half of March. Pickups had a 0.9% increase, while only midsize and compact cars lost less compared to the overall industry in seasonally adjusted year-over-year changes. The remaining segments lost between 2.4% and 7.7%, with luxury cars faring the worst. Seven of eight major segments saw price increases compared to February, with gains ranging from 0.1% to 2.4%. Sports cars were the lone exception, with a 2.4% decline from February.

Retail and Wholesale Days’ Supply Below Normal in Mid-March

Using estimates based on vAuto data as of March 13, used retail days’ supply was 38 days, which was down three days from the end of February. Days’ supply was down 11 days year over year and down four days compared with the same week in 2019. Leveraging Manheim sales and inventory data, we estimate that wholesale supply ended February at 24 days, down two days from the end of January and down four days year over year. As of March 15, wholesale supply was at 22 days, down one day from the end of February, down four days year over year, and four days lower than in 2019. Used supply measured in days’ supply and compared to 2019 suggests supply is below normal for this time of year, which indicates conditions that favor sellers.

Rental Risk Prices and Mileage Mixed in First Two Weeks of March

The average price for rental risk units sold at auction in the first 15 days of March was up 2.1% year over year. Rental risk prices were up 0.3% compared to the full month of February. Average mileage for rental risk units in the first half of March (at 65,100 miles) was up 3.4% compared to a year ago and up 7.2% month over month.

Tax Refund Dollars Down Compared to Last Year

The 2023 tax refund season is well ahead of last year in terms of the distribution of refunds, but the average refund is down. With statistics through the week ending March 3, more than $127 billion in refunds have been issued. While the number of refunds issued is 11% ahead of last year, 1.5% less has been disbursed than last year, and the average refund at $3,028 is down 11% year over year. The faster distribution of refunds caused this year’s tax refund season to start earlier, but the decline in dollars and in the average refund is likely to lead to less robust sales this spring.

The complete suite of monthly MUVVI data for March will be released on April 7, 2023, the fifth business day of the month, as regularly scheduled. To hear about the latest MUVVI and trends that shaped the quarter, register to attend the Q1 Manheim Used Vehicle Value Index Call on Friday, April 7, at 11 a.m. EDT. If you are observing Good Friday or Passover, a recording of the call will be available in the Newsroom on Monday, April 10.

For questions or to request data, please email manheim.data@coxautoinc.com. If you want updates about the Manheim Used Vehicle Value Index, as well as direct invitations to the quarterly call sent to you, please sign up for our Cox Automotive newsletter and select Manheim Used Vehicle Value Index quarterly calls.

Note: The Manheim Used Vehicle Value Index was adjusted to improve accuracy and consistency across the data set as of the January 2023 data release. The starting point for the MUVVI was adjusted from January 1995 to January 1997. The index was then recalculated with January 1997 = 100, whereas prior reports had 1995 as the baseline of 100. All monthly and yearly percent changes since January 2015 are identical. Learn more about the decision to rebase the index.