Commentary & Voices

Q3 2022 Kelley Blue Book Brand Watch Non-Luxury report: Supply Constrained Toyota Widens its Lead; Car Shopping Rebounds

Monday November 7, 2022

Article Highlights

- Toyota widened its lead over Ford and Chevrolet despite low supply.

- Shopping for traditional cars returned to pre-pandemic levels on high gas prices.

- Ram claims top honors in seven of the 12 most important factors to buyers.

Toyota, with one of the lowest inventory levels in the U.S. industry, widened its lead in shopping consideration over Ford and Chevrolet in the third quarter, according to the most recent Kelley Blue Book Brand Watch™ report on non-luxury shopping. Due in part to high gas prices, shopping for traditional cars, of which Toyota has some of the most popular, rebounded to pre-pandemic levels.

The Kelley Blue Book Brand Watch report is a consumer perception survey that also weaves in shopping behavior to determine how a brand or model stacks up with its segment competitors on a dozen factors key to a consumer’s buying decision. Kelley Blue Book produces quarterly Brand Watch reports for non-luxury and luxury brands and assesses shopping for electrified vehicles. Beginning in Q1 2022, the methodology includes surveying both mobile and desktop users instead of only desktop users.

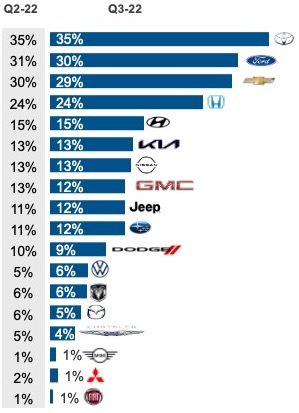

Toyota’s U.S. sales rose in September from a year ago but were down for the quarter due to low inventory. Still, the automaker has held the top shopping spot for three consecutive quarters after briefly losing it to Ford in Q4 2021. Of all non-luxury shoppers, 35% considered Toyota in the third quarter, the same percentage as the previous quarter. No. 2 Ford and No. 3 Chevrolet each dropped by a percentage point to 30% and 29%, respectively.

Quarterly Brand Consideration

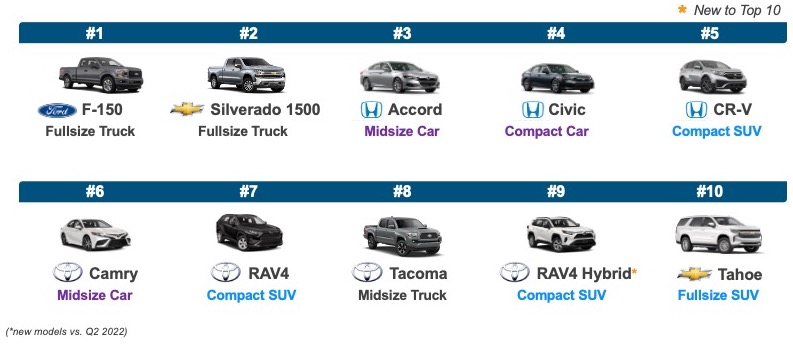

Toyota had strong shopping consideration for a variety of its models. Quarterly consideration growth for the RAV4 Hybrid soared by 21%, at least partly due to high gas prices. It is consistently the most-shopped electrified vehicle and returned to the Top 10 most-shopped of all non-luxury vehicles in the quarter after dropping off at the end of last year. In addition, the Camry, the regular RAV4 and the Tacoma ranked in the Top 10.

Top 10 Models Considered

Subaru, Volkswagen and Jeep each gained a percentage point of shopping consideration in Q3. Of all non-luxury shoppers, 12% shopped for Subaru, and 12% considered Jeep. Volkswagen had 6% consideration. Subaru got a lift from increased shopping for the freshened BRZ sports car and the new Solterra, Subaru’s first electric vehicle. Jeep freshened its Grand Cherokee and introduced the upscale Wagoneer and Grand Wagoneer. Volkswagen rose on the strength of shopping for the fuel-sipping Golf and Jetta cars as well as Tiguan and Toureg SUVs.

GMC, Dodge, Mazda, Chrysler and Mitsubishi dipped by a percentage point. All others held steady from the previous quarter.

Car Shopping Rebounds on Higher Gas Prices

Shopping consideration for cars has now rebounded to pre-pandemic levels. Of all non-luxury shoppers, 40% considered a car. A year ago, less than a third considered a car. The Top 5 most shopped cars were mostly the usual: Honda Accord and Civic, Toyota Camry and Corolla, as well as the Dodge Charger, heading into its final year before Dodge muscle cars go electric.

Quarterly Segment Consideration

Still, SUVs remained the most popular vehicle style. Of all non-luxury shoppers, two-thirds consider an SUV, a level that has held steady for some time. Higher gas prices have shoppers looking at smaller, more fuel-efficient SUVs dominated by Honda and Toyota. Honda CR-V, Toyota RAV4 and RAV4 Hybrid were the most-shopped SUVs, in that order. The larger Chevrolet Tahoe and Dodge Durango followed them.

About a third of shoppers considered a pickup truck. The Ford F-150 returned to its position as the most-shopped pickup truck, overtaking Chevrolet Silverado. Toyota Tacoma, Ram 1500 and Ford’s large F-Series Super Duty models rounded out the list of Top 5 most-shopped trucks.

Shopping for minivans, which are in short supply, held at 5% of all non-luxury shoppers. The hybrid-only Toyota Sienna, Honda Odyssey, Chrysler Pacifica and Pacifica Hybrid and Kia Carnival, in that order, were the most-shopped minivans.

Affordability, Fuel Efficiency Gain Importance to Shoppers

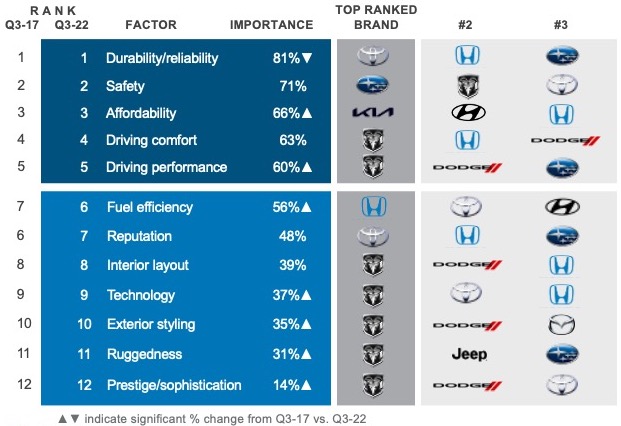

The rank order of the dozen factors that are most important to non-luxury shoppers when selecting a vehicle has remained largely unchanged over the past five years. However, some factors have gained in importance, while others have slipped.

Reliability/Durability remains No. 1 by a wide margin. Still, it is less important than it was, likely because reliability and durability have improved significantly over the years across the board and are assumed to be there by consumers.

Factors that have become more important to consumers in this inflationary period of record car prices and high gas prices are affordability, fuel efficiency and driving performance.

Factors Driving Non-Luxury Consideration

Stellantis’ Ram brand took the most top honors, scoring first in seven of the dozen most important factors – Driving Comfort, Performance, Interior Layout, Technology, Exterior Styling, Ruggedness and Prestige/Sophistication. That compares with leading in two categories in the previous quarter.

Dodge lost the No. 1 spots it held in the previous quarter for Driving Comfort, Driving Performance, Interior Layout, Exterior Styling and Prestige/Sophistication. But it lost those spots to its sibling brand Ram. Dodge still ranked No. 2 or No. 3 across those five factors.

Kia, Hyundai and Honda took the top three spots in the all-important affordability category. Honda rated No. 1 in fuel efficiency, followed by Toyota and Hyundai.

Subaru is back in the game, retaking its No. 1 spot in Safety and nabbing four third-place spots for Durability/Reliability, Driving Performance, Reputation and Ruggedness.

Michelle Krebs is executive analyst at Cox Automotive.