Data Point

Tight New-Vehicle Inventory in 2021 Drops Incentive Program Volume to Five-Year Low

Wednesday December 29, 2021

A general shortage of new-vehicle inventory has been the auto industry’s leading story of 2021. Tight inventory shifted the dynamics, turning the buyer’s market of 2019 into an unprecedented seller’s market in 2021.

Average transaction prices (ATPs) for new vehicles increased month after month in 2021, according to an analysis from our Kelley Blue Book team. November marked a fresh high-water mark for ATPs at $46,329. It was the eighth consecutive monthly record. A new record in December would not be surprising.

As ATPs climbed, new-vehicle sales incentives fell. In November, with inventory below 1 million units, incentives fell to 4.1% of ATP – less than $2,000. Two years ago, in November 2019, the average incentive package was well above $4,000, more than 10% of ATP.

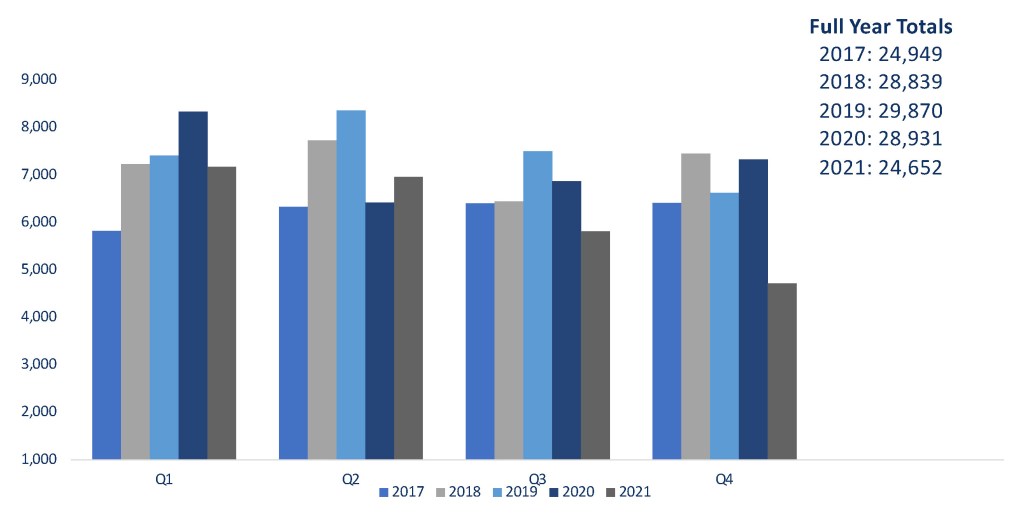

Incentive program volume fell dramatically throughout 2021 as well. Program volume – literally a count of the number of new-vehicle incentive programs offered by the automakers – reached an all-time high in 2019, when vehicle days’ supply was running well above 80 days. This year, with days’ supply at historic lows, incentive program volume peaked in Q1 and fell throughout the year. Total program volume in 2021 was down 17% from 2019 and down 15% compared to last year. Program volume in Q4, at 4,713, was the lowest in 5 years, down 36% from Q4 2020.

MONTHLY INCENTIVE PROGRAM VOLUME (INDUSTRY): QUARTERLY TOTALS 2017-2021

Thanks in part to tight inventory and relatively few incentives, the Cox Automotive Industry Insights team is forecasting December sales volume to come in near 1.10 million units, down more than 30% from December 2020. The incentive program count in December, at 1,456, is the lowest of 2021 and among the lowest count by the Cox Automotive Rates & Incentives team dating back to July 2017, when record keeping began. New-vehicle inventory levels are expected to remain tight through the first half of 2021. Shoppers can rightly expect incentive levels to remain low as well.

The Cox Automotive Rates & Incentives (CAR&I) team has developed a methodology for measuring the accuracy of data used to calculate pricing and payment information presented through dealer service provider tools (e.g., dealer websites, inventory management, digital retailing & advertising, desking, equity, etc.). Approximately 17,500 individual dealerships – rooftops, in automotive parlance – in the U.S. rely on CAR&I incentive data for powering 5 different software applications through Cox Automotive native software/sites and our many industry partners. In all, an estimated 90,000 applications are relying on CAR&I data in a given month, providing valuable information to 40 million shoppers.