Data Point

With Inventory Down, Cash Incentives Follow. Except With Full-Size Pickups.

Wednesday September 2, 2020

Article Highlights

- The story in August, as it has been all summer, is about low inventory levels holding back a more robust sales recovery.

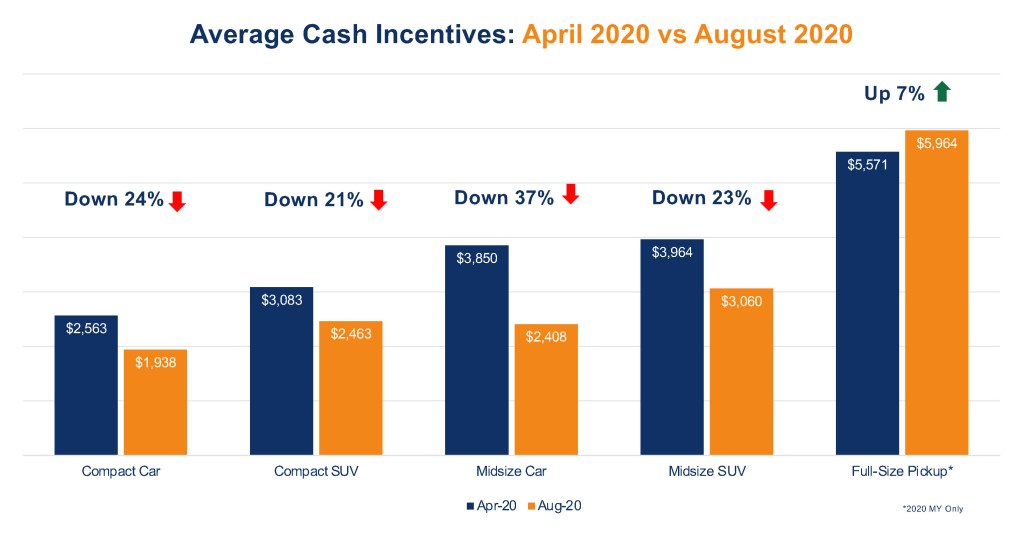

- Our Cox Automotive Rates & Incentives team analyzed combined dealer and customer cash incentive offers in the chart below for August and compared those to the offers earlier this year in April.

- Looking at the Big 5 segments, which account for 65% of total new auto sales in the U.S., there’s significantly less cash in four of the five.

Cox Automotive is forecasting August sales will beat July, marking a fourth consecutive month of rising sales. In a bit of good news, many new-vehicle dealers in mid-August were indicating sales and service levels approaching something close to normal.

The story in August, as it has been all summer, was about low inventory levels holding back a more robust sales recovery. The month began with 26% less new-vehicle inventory on the ground versus last year: 2.33 million vehicles in dealer stock versus 3.12 million in early August 2019. With demand remaining relatively strong and inventories low, many automakers have been throttling back incentives to improve their margins. With lower cash incentives available, many would-be buyers are dropping out of the market, not able to find the product or the deal they’re looking for.

Our Cox Automotive Rates & Incentives team analyzed combined dealer and customer cash incentive offers in the chart below for August and compared those to the offers in April. Looking at the Big 5 segments, which account for 65% of total new auto sales in the U.S., there’s significantly less cash in four of the five segments. Typically, in August, cash incentives would be rising to clear out aging stock.

In each segment, there are interesting trends emerging and some OEMs are making noticeable adjustments to their incentive strategies.

For example: In the compact SUV segment, total incentives on average are down 21% from a $3,083 average in April to $2,463 in August. Hyundai and Nissan have made some big reductions in spending; Honda and Subaru had no national cash incentives on the CR-V and Forester, respectively, in August.

Despite the segment pulling back on offers, Jeep continues its aggressive push to move the metal on the Cherokee. Their total incentive offer of $5,500 is more than two times higher than the compact SUV average. They are clearly not happy being a lower-tier player in terms of sales volume in the segment.

The full-size truck segment is the one segment where cash offers are improving, as less emphasis is being placed on 0% financing. Looking at cash incentives on MY2020 full-size pickups, the segment average cash offer in April of $5,571 increased 7% to $5,929 in August. The increase, however, was almost driven entirely by higher cash incentives being offered on the F-150, which was segment-leading at $8,250 in August, up from $6,000 in April. Inventory levels on the F-150 continue to hover well above the industry average. Chevrolet, GMC and Toyota all had equal or lower cash incentives in August versus April. Ram and Nissan were up slightly.

New-vehicle inventory levels are expected to remain tight for the foreseeable future as production volumes slowly return to normal. Continued OEM discipline with incentive spending is also likely to be the norm until inventory pressure forces brands to get back to their more aggressive ways.

Brian Finkelmeyer is senior director of new car solutions at Cox Automotive. The Cox Automotive Rates & Incentives (CAR&I) team has developed a methodology for measuring the accuracy of data used to calculate pricing and payment information presented through dealer service provider tools (e.g., dealer websites, inventory management, digital retailing & advertising, desking, equity, etc.). Approximately 17,500 individual dealerships – rooftops, in automotive parlance – in the U.S. rely on CAR&I incentive data for powering 5 different software applications through Cox Automotive native software/sites and our many industry partners. In all, an estimated 90,000 applications are relying on CAR&I data in a given month, providing valuable information to 40 million shoppers.