Press Releases

Cox Automotive Forecast: April New-Vehicle Sales Pace Accelerates as Available Inventory and Higher Incentives Keep Market Rolling

Wednesday April 24, 2024

Article Highlights

- Annual new-vehicle sales pace in April is forecast to finish near 15.9 million, up 0.2 million from last April’s 15.7 million pace and an increase from March’s 15.5 million level.

- April’s sales volume is expected to fall to 1.34 million units, a 2.2% decrease from one year ago and a 6.8% decrease from March.

- Fewer selling days are driving adjustments to lift the sales pace, showing a healthy daily sales rate despite lower volumes.

Updated, May 2, 2024 – April new-vehicle sales pace finished below our forecast, despite strong sales performance by Toyota and Lexus. Other automakers, including Ford and Hyundai Motor Group, finished April about where expected, with sales slightly lower than year-ago levels. With fewer selling days this past April, volume was lower, as expected, at 1.31 million units, down 3.3% year over year and down 9.1% compared to March. The selling pace last month, estimated at 15.7 million, was up 0.4% year over year and up 1.1% month over month. Though lower than our 15.9 million forecast, the April SAAR was equal to the SAAR in April 2023 and an improvement from March. The 15.7 million pace, however, is noteworthy, as inventory in April was approximately 50% higher than one year ago, and sales incentives were far more generous. A stronger pace was expected. Still, heading into May, which is historically one of the strongest months of the year for new-vehicle sales, the market remains on track for its best year since 2019.

Importantly, while the new-vehicle market in the U.S. remains on track for a second straight year of gains, the market remains a long, long way from what might be considered pre-pandemic normal. In the five-year stretch prior to the pandemic, from 2015 to 2019, the new-vehicle sales in the U.S. averaged 17.3 million each year, peaking in 2016 at 17.5 million. From 2019 to 2023, the market averaged 15.2 million, lower by more than 12%. The reasons are clear and obvious: Notably, higher prices and higher loan rates have put a large number of shoppers on the sidelines, waiting for conditions to change. As Cox Automotive Chief Economist noted in a post Wednesday, “With the impact of tax refund season effectively over, the vehicle market is seeing declining sales momentum. The next few weeks and months could be challenging if consumers en masse believe that they are better off waiting.”

Earlier this year, our analyst called for “slow growth ahead.” As we close the books on April and head into May, that is exactly what the market is getting—slow growth and unremarkable sales. The new-vehicle market in 2024 is expected to beat 2023, but no one is expecting any home runs.

ATLANTA, April 24, 2024 – Cox Automotive forecasts a decline in April’s U.S. new-vehicle sales compared to last year; however, the market remains on the road to recovery, with vehicle sales at a healthy pace. Cox Automotive confirms its forecast that 2024 will be the best year for new-vehicle sales since 2019.

Sales volume this month is expected to fall 2.2% from April 2023 to 1.34 million units. The seasonally adjusted annual rate (SAAR), or selling pace, is expected to finish near 15.9 million, up 0.2 million over last year’s pace and up 0.4 million from March’s 15.5 million level. There are 25 selling days in April, one less than last year and two less than last month. Due to adjustments based on the number of selling days, the sales pace is forecast to increase even though sales volume will likely show a decline.

Healthy inventory levels and rising incentives continue to support new-vehicle sales. At the beginning of April, the total supply of available new vehicles was up 46% compared to last April, according to the latest vAuto Live Market View data.

Cox Automotive Senior Economist Charlie Chesbrough said: “Since April 2023, the new-vehicle SAAR has experienced some large swings, with an average sales pace in the mid-15 million level. This month, more volatility in the market is also expected, although the sales pace is anticipated to rise slightly. Despite high interest rates and elevated vehicle prices, consumers remain resilient. Sales growth may be sluggish, but growth continues. And we expect these conditions to persist throughout the year.”

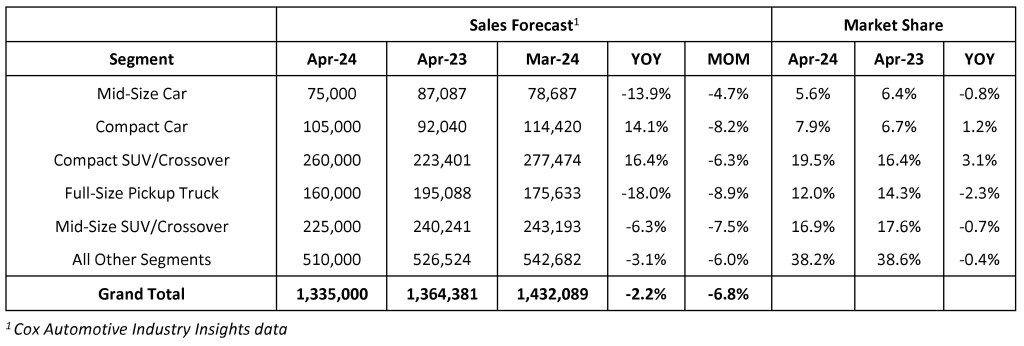

April 2024 New-Vehicle Sales Forecast

All percentages are based on raw volume, not daily selling rate.

About Cox Automotive

Cox Automotive is the world’s largest automotive services and technology provider. Fueled by the largest breadth of first-party data fed by 2.3 billion online interactions a year, Cox Automotive tailors leading solutions for car shoppers, auto manufacturers, dealers, lenders and fleets. The company has 29,000+ employees on five continents and a portfolio of industry-leading brands that include Autotrader®, Kelley Blue Book®, Manheim®, vAuto®, Dealertrack®, NextGear Capital™, CentralDispatch® and FleetNet America®. Cox Automotive is a subsidiary of Cox Enterprises Inc., a privately owned, Atlanta-based company with $22 billion in annual revenue. Visit coxautoinc.com or connect via @CoxAutomotive on X, CoxAutoInc on Facebook or Cox-Automotive-Inc on LinkedIn.

Media Contacts:

Mark Schirmer

734 883 6346

mark.schirmer@coxautoinc.com

Dara Hailes

470 658 0656

dara.hailes@coxautoinc.com