Press Releases

Cox Automotive Forecast: January U.S. Auto Sales Expected to Gain More Than 5% Year over Year Despite Harsh Winter Weather

Monday January 27, 2025

Article Highlights

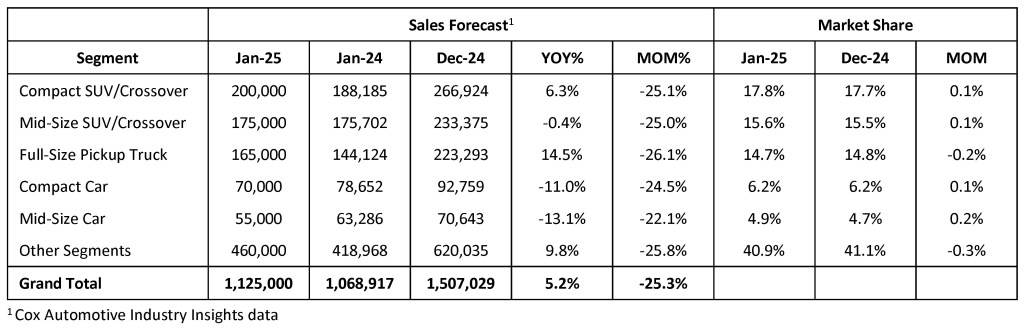

- Sales volume in January is forecast to reach 1.125 million, reflecting a 5.2% increase from last year’s total but a 25.3% decrease from December.

- January’s new-vehicle sales pace is expected to reach approximately 15.8 million, representing an increase of 0.8 million compared to last January’s pace of 15.0 million but is a decline from December’s 16.8 million level.

- New-vehicle sales in January are expected to stay positive year over year for the fourth consecutive month, although they will follow the seasonal trend of being significantly lower month over month.

Updated, Feb. 4, 2025 – New-vehicle sales in January increased compared to year-ago levels, as our team had expected, but initial results indicate that market volume likely came in slightly below our forecast. The Cox Automotive forecast called for year-over-year growth of 5.2%, but early estimates suggest the increase was closer to 4%, as some automakers posted record January volume and others saw declines from January 2024 levels. Our market continues to be one of diverging stories. As Chief Economist Jonathan Smoke notes, while the macro view is one of growth, “actual experience may vary.”

January is typically a low-volume sales month, and there were no shortages of sales challenges last month — from extreme cold over much of the market to major fire disruptions in Southern California. Consumer confidence also declined more than expected in January and was lower than in January 2024, the first yearly decline since September. All factors considered, the positive sales performance in January was a good sign for the market.

January marked the fourth consecutive month with higher year-over-year sales, an indication of momentum in the new-vehicle market. December was particularly strong, and the January sales pace of near 15.6 million, slightly below the forecast of 15.8 million, was the strongest since 2021. How long will the current momentum hold? Cox Automotive is optimistic in the near term. New-vehicle inventory is relatively healthy, and major automakers have turned up the sales incentives. More importantly, shoppers are likely being influenced by a real concern that prices in the future will be higher, not lower — red lights are flashing with all the talk of higher tariffs, the slashing of government-backed EV incentives, and the potential return of inflation. For in-market buyers, there is little incentive to wait and find out. Cox Automotive is forecasting total new-vehicle sales in 2025 to reach 16.3 million, up from 16 million in 2024. Another year of slow growth despite an uncertain road ahead.

ATLANTA, Jan. 27, 2025 – While the new-vehicle market finished 2024 on a high note, the pace of new-vehicle sales in January is expected to slow month over month, due in part to harsh winter weather nationwide and normal seasonal patterns. Historically, January has been a low-volume month. According to the Cox Automotive forecast released today, sales volume in January is projected to reach 1.125 million, a 25.3% drop from December but a 5.2% increase compared to January 2024.

Cox Automotive forecasts January’s seasonally adjusted annual rate (SAAR), or sales pace, to be 15.8 million, an increase from 15.0 million last year, though a decrease from December’s surprisingly strong 16.8 million. At 15.8 million, this would represent the highest January SAAR in three years.

According to Senior Economist Charlie Chesbrough at Cox Automotive: “New-vehicle sales have been strong since the election, but they are expected to moderate slightly this month. Sales pace in November and December were at the highest levels we’ve seen since the spring of 2021, but a dip this month is likely.”

“January is generally one of the slowest months of the year for vehicle sales,” Chesbrough added, “so a large decline from December is normal. However, severe weather across the country, along with the fires out west, will negatively affect consumer activity, though the extent is uncertain.”

New-Vehicle Inventory and Incentives Remain Robust, Above Year-Ago Level

According to an analysis of vAuto Live Market View data, the total U.S. supply of available unsold new vehicles at the start of January stood at 2.88 million units, marking the first time it registered below 3 million since the end of October. This decline in inventory levels indicates a tightening supply situation in the market. However, inventory and incentives remain higher than they were a year ago, suggesting that dealers still have sufficient inventory and are offering deals to entice buyers.

January 2025 New-Vehicle Sales Forecast

January has 25 selling days this month, one less than last month but the same as last year.

2025 New-Vehicle Sales Forecast

After finishing 2024 at just over 16.0 million units, according to the Kelley Blue Book estimates, Cox Automotive is forecasting new light vehicle sales to continue to improve modestly in 2025, reaching 16.3 million by year’s end. Positive economic growth coupled with improved buying conditions should lead to a 2%-3% gain. However, policy changes regarding tariffs and electric vehicle tax credits from the Trump administration could have negative effects on the outlook, particularly in the second half of the year.

About Cox Automotive

Cox Automotive is the world’s largest automotive services and technology provider. Fueled by the largest breadth of first-party data fed by 2.3 billion online interactions a year, Cox Automotive tailors leading solutions for car shoppers, auto manufacturers, dealers, lenders and fleets. The company has 29,000+ employees on five continents and a portfolio of industry-leading brands that include Autotrader®, Kelley Blue Book®, Manheim®, vAuto®, Dealertrack®, NextGear Capital™, CentralDispatch® and FleetNet America®. Cox Automotive is a subsidiary of Cox Enterprises Inc., a privately owned, Atlanta-based company with $22 billion in annual revenue. Visit coxautoinc.com or connect via @CoxAutomotive on X, CoxAutoInc on Facebook or Cox-Automotive-Inc on LinkedIn.

Media Contacts:

Mark Schirmer

734 883 6346

mark.schirmer@coxautoinc.com

Dara Hailes

470 658 0656

dara.hailes@coxautoinc.com