Press Releases

Cox Automotive Forecast: Improved Inventory Levels, Higher Fleet Sales Expected to Support Improving January U.S. Auto Sales

Wednesday January 25, 2023

Article Highlights

- Annual vehicle sales pace in January is expected to finish near 15.6 million, up from December’s 13.3 million pace and from last year’s 12.7 million level.

- Improved inventory and fleet activity are expected to contribute to a stronger sales pace.

- January sales volume is expected to rise 2.7% from one year ago and reach 1.03 million units; forecast calls for a 19.8% decrease from December, which had three more selling days.

Updated, Feb. 2, 2023 – While January sales reporting is not yet complete, and our team’s analysis of the results won’t be finished until early next week, the month did produce some solid sales reports and signs of market strength. Strong numbers from Hyundai and Kia were the headline, and Honda posted a much-needed year-over-year increase. Other makers reported respectable year-over-year gains, with only Toyota reporting a notable drop. January sales volumes are typically very low, and the volume a year ago, in January 2022, was particularly low – the lowest volume since April 2020. The headlines look good, but year-over-year sales gains were all but expected.

Our forecast called for a sales pace of 15.6 million, and indications are the market came in slightly higher, closer to 15.7 million. Either way, new-vehicle sales in January were solid and likely a sign that improved inventory levels are having the expected positive effect. We also believe that fleet sales increased significantly for the fourth straight month. With interest rates for auto loans elevated and heading higher and inflation pressures impacting many households, our team expects the major automakers to pivot to fleet sales to offset slowing retail demand.

For the past two years, fleet sales have been historically low. That will likely change in 2023. How high fleet sales can soar is yet to be seen, but as consumers pull back and inventory improves, fleet sales will be the critical tool for many automakers. Higher retail sales incentives will likely follow as well.

ATLANTA, Jan. 25, 2023 – New-vehicle sales in January are expected to show a surprising gain when announced next week, even though market conditions have not appreciably changed. The January 2023 auto sales pace, or seasonally adjusted annual rate (SAAR), is expected to finish near 15.6 million, a large increase from December’s 13.3 million pace, according to a forecast released today by Cox Automotive. However, some of the gain is due to statistical adjustments that correct for expected fewer sales in January and February.

With inventories improving daily, sales in January will benefit, increasing the sales pace. Sales volume for the month is expected to rise nearly 3% over January 2022’s inventory-constrained market but with the same number of selling days. January sales are expected to fall almost 20% month over month, largely due to three fewer selling days than December and the usual post-holiday drop in activity.

As we start 2023, high interest rates continue to hold back the new-vehicle market, while some concerns with inventory supply appear to be falling away. According to Charlie Chesbrough, Cox Automotive Senior Economist: “After a slow December, a return to ‘normal’ would be welcome. With inventories improving, and more fleet activity likely, we are expecting an increase in January new-vehicle sales activity. Though some dealer lots across the country have ample inventory, some Asian brands continue to have extremely limited availability. One of the key questions for the market this year is whether some brands – particularly American ones – will be forced to increase incentives to keep supply from getting too high.”

January 2023 Sales Forecast Highlights

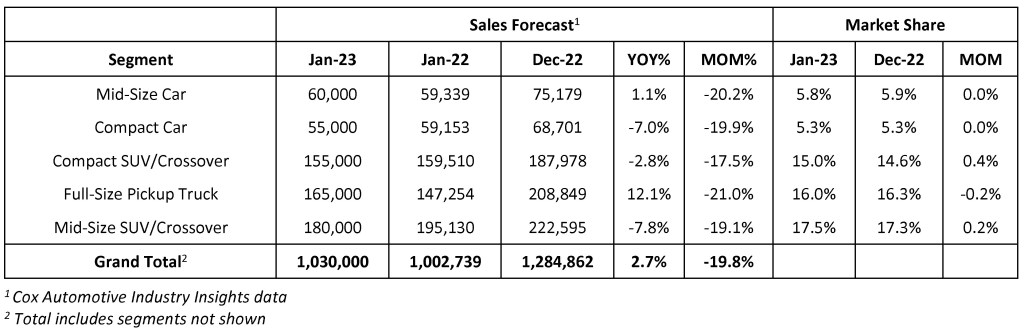

- Light new-vehicle sales are expected to rise 2.7% from January 2022 but fall 19.8% from last month.

- The SAAR in January 2023 is estimated to be 15.6 million, above last year’s 12.7 million level and up from December’s 13.3 million pace.

- January 2023 has 24 selling days, equal to 2022 but three fewer than December 2022.

January 2023 Sales Forecast

About Cox Automotive

Cox Automotive is the world’s largest automotive services and technology provider. Fueled by the largest breadth of first-party data fed by 2.3 billion online interactions a year, Cox Automotive tailors leading solutions for car shoppers, automakers, dealers, retailers, lenders and fleet owners. The company has 25,000+ employees on five continents and a family of trusted brands that includes Autotrader®, Dealertrack®, Kelley Blue Book®, Manheim®, NextGear Capital™ and vAuto®. Cox Automotive is a subsidiary of Cox Enterprises Inc., a privately-owned, Atlanta-based company with $21 billion in revenue. Visit coxautoinc.com or connect via @CoxAutomotive on Twitter, CoxAutoInc on Facebook or Cox-Automotive-Inc on LinkedIn.

Media Contacts:

Mark Schirmer

734 883 6346

mark.schirmer@coxautoinc.com

Dara Hailes

470 658 0656

dara.hailes@coxautoinc.com