Press Releases

Cox Automotive Forecast: New-Vehicle Sales Accelerate in July

Wednesday July 26, 2023

Article Highlights

- With supply holding at healthy levels, U.S. new-vehicle market is expected to spur a notable year-over-year sales improvement in July.

- The annual new-vehicle sales pace in July is expected to finish near 15.9 million, up 2.6 million from last July’s 13.3 million pace and up from June’s 15.7 million level.

- July’s sales volume is expected to rise 15.3% from one year ago and reach 1.32 million units. This is a 4.8% decrease from June, which had one more selling day than July’s 25 days.

Update, Aug. 2, 2023 – New-vehicle sales in July likely came in near 1.30 million, an increase of more than 15% over year-ago levels and very close to the Cox Automotive forecast (below) published last week. (Hat tip to our senior economist.) Vastly increased inventory levels and a general improvement in consumer sentiment are helping fuel stronger sales in the U.S. Recovering fleet business – notably with rental and government buyers – was also a key driver of volume this month, as it has been through the first half of 2023.

Early in July, new-vehicle inventory levels were roughly 75% higher than they were a year ago, according to estimates from our vAuto Available Inventory database, and higher supply levels have helped keep a lid on transaction prices. New-vehicle sales incentives have been increasing through the spring, along with inventory levels, and the Industry Insights team is expecting to report higher new-vehicle sales incentives in July as well.

A year ago, with tight inventory and wallet-breaking inflation, the July seasonally adjusted annual rate of sales (SAAR) was an anemic 13.3 million units. This year, the July sales pace was at a far healthier level, closer to 15.7 million, according to early estimates. Companies like Honda and Subaru have seemingly recovered from dismal results a year ago when both had run out of vehicles to sell, and the brands from Korea – Hyundai, Kia and Genesis – continue to grow sales at a relentless pace and gobble up market share. Our estimation is that the big domestic brands, Ford and General Motors, posted sales gains but underperformed the wider industry. Stellantis likely continued on the path it’s been following all year, accepting lower volume and higher transaction prices, a strategy that could shift as market share tumbles.

The Cox Automotive Industry Insights team will have a full accounting by the end of the week, but this we already know: Improving consumer sentiment, higher inventory levels, and growing fleet deliveries continue to drive new-vehicle sales higher year over year in the U.S.

ATLANTA, July 26, 2023 – New-vehicle sales, when announced next week by automakers, are expected to show big gains over last year and a slight improvement over last month. The key reason for these gains continues to be the market’s healthy recovery from being supply-chain constrained over the previous two years. The July seasonally adjusted sales rate, or SAAR, is expected to finish near 15.9 million. This is an increase from June’s 15.7 million level and May’s 15.1 million level. Sales have been showing surprising strength this year in spite of large interest rate increases, and July is expected to continue that trend.

July’s sales volume is expected to show a 15.3% gain over last year’s supply-limited market. However, U.S. auto sales volume is expected to decline modestly from last month, mainly due to one less selling day in July versus June.

According to Charlie Chesbrough, senior economist at Cox Automotive: “The return of supply – which is nearly 80% higher than one year ago – has been the key driver of sales this year. However, it isn’t consumers buying all these cars and trucks; rather, it is being fueled at least in part by rental and commercial fleets. When COVID disrupted supply chains and vehicle production, OEMs focused on keeping retail channels as stocked as possible, leaving fleet demand unfulfilled. However, now that production is returning to normal, fleet sales have rebounded, and these sales are significantly lifting industry volume.”

Last month, sales into large commercial, government and rental fleets, not including sales into dealer and manufacturer fleets, increased nearly 45% year over year to 217,572 units, according to an estimate from Cox Automotive. Through the first half of 2023, total new-vehicle sales in the U.S. were up more than 12%, with retail sales increasing by approximately 9% and total fleets sales jumping by more than 34%.

July 2023 Sales Forecast Highlights

- The annual sales pace in July is forecast to finish near 15.9 million, up 2.6 million from last July’s pace and up from June’s 15.7 million level.

- July’s sales volume is expected to rise 15.3% from one year ago and reach 1.32 million units.

- There are 25 selling days in July 2023, one less day than last month and a year ago.

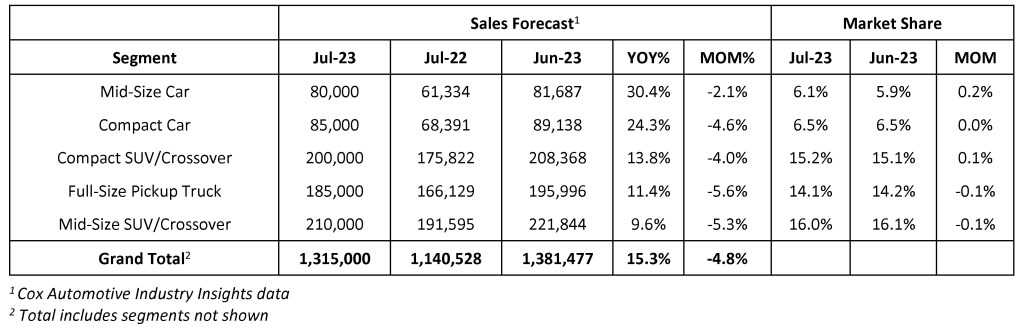

July 2023 U.S New-Vehicle Sales Forecast

All percentages are based on raw volume, not daily selling rate.

Slowdown in New-Vehicle Sales Expected in Coming Months

Although sales have shown strength thus far in 2023, some slowdown in the second half of this year is expected. Economic headwinds from high prices and tighter credit will likely slow the new-vehicle sales recovery. In addition, some of the pent-up demand has likely now been fulfilled. However, more incentives and more fleet will continue to provide support.

About Cox Automotive

Cox Automotive is the world’s largest automotive services and technology provider. Fueled by the largest breadth of first-party data fed by 2.3 billion online interactions a year, Cox Automotive tailors leading solutions for car shoppers, automakers, dealers, retailers, lenders and fleet owners. The company has 25,000+ employees on five continents and a family of trusted brands that includes Autotrader®, Dealertrack®, Kelley Blue Book®, Manheim®, NextGear Capital™ and vAuto®. Cox Automotive is a subsidiary of Cox Enterprises Inc., a privately-owned, Atlanta-based company with $22 billion in annual revenue. Visit coxautoinc.com or connect via @CoxAutomotive on Twitter, CoxAutoInc on Facebook or Cox-Automotive-Inc on LinkedIn.

Media Contacts:

Mark Schirmer

734 883 6346

mark.schirmer@coxautoinc.com

Dara Hailes

470 658 0656

dara.hailes@coxautoinc.com