Press Releases

Cox Automotive Forecast: New-Vehicle Sales to Increase More Than 11% Year Over Year Through the First Half of 2023

Tuesday June 27, 2023

Article Highlights

- New-vehicle inventory levels significantly improved from last year, helping stimulate sales despite elevated prices and high auto loan rates.

- Fleet sales pushed industry volume higher as retail sales improved modestly.

- Cox Automotive increases full-year, new-vehicle sales forecast to 15.0 million in 2023 after a surprisingly strong first half.

Updated, July 6, 2023 – In the first half of 2023, the U.S. new-vehicle market has been surprisingly strong, with sales volume increasing more quickly than forecast as the industry’s inventory issues faded. Sales in June, as we’ve seen in many months prior this year, surprised to the upside, with volume beating the Cox Automotive forecast. The June sales pace has been initially estimated at 15.7 million, higher than the Cox Automotive forecast of 15.2 million. Through the first six months, according to industry sources, the market likely delivered sales of 7.69 million units, just above our forecast of 7.65 million and up 12.3% versus the same period in 2022.

Overall, new-vehicle sales have been more robust than expected due to a heavy push of fleet sales and a U.S. car buyer who has stayed resilient in the face of high prices and record auto loan rates. As our Chief Economist Jonathan Smoke noted on the Mid-Year Review call last week, “Consumers always find a way to buy new wheels despite the circumstances. Americans are not only car-dependent but have a love for cars. This is exactly what makes the automotive business so wonderful. People often make what economists would consider irrational decisions when it comes to cars. They overspend, they break budgets, they forgo other expenses in order to get the ride they want. They write songs about cars, and they give names to cars. That’s what makes the auto industry the best industry in the world.”

Heading into the second half of the year, however, the market will likely see fewer upside surprises. As Smoke added, “I do not believe we are on the cusp of exciting growth ahead. The market will still be limited by total available supply, but demand will also be limited by the level of prices and rates, which are not likely to come down enough to stimulate more demand than the market can bear.”

Limited new-vehicle inventory over the past two years has indeed been more than the market could bear, and that has been a key driver of tremendous new vehicle price inflation. But the industry is now likely at a turning point, where it finds more balance between supply and demand. And that balanced market is expected to deliver small but more predictable changes in sales and fewer headlines about big price changes.

Last week, Cox Automotive updated its full-year forecast to 15.0 million units, up from 13.9 million in 2022, according to estimates from our Kelley Blue Book data sets. For a full review of the market’s performance in the first half, a replay of the 2023 Cox Automotive Mid-Year Review has been posted in the Newsroom.

ATLANTA, June 27, 2023 – Cox Automotive, the world’s largest automotive services and technology provider, forecasts U.S. new-vehicle sales volume will reach 7.65 million units in the first half of 2023, an increase of 11.6% year over year. After a stronger-than-expected first half, punctuated by a notable improvement in fleet sales, Cox Automotive has increased its full-year sales forecast to 15.0 million.

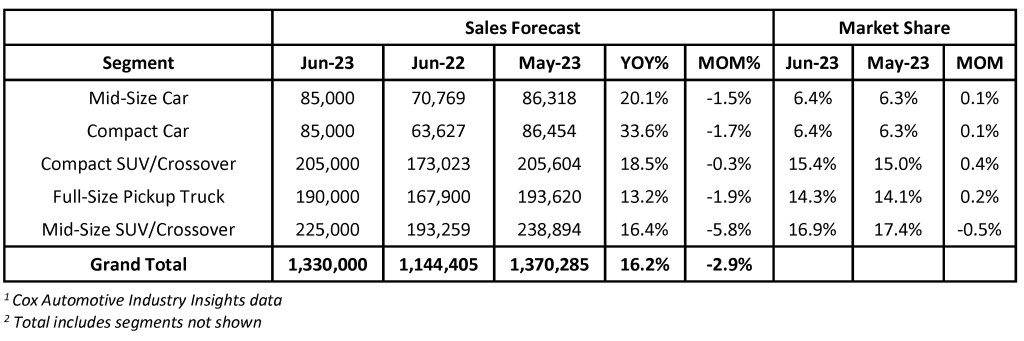

Sales volume in June is expected to reach 1.3 million units, up from 1.1 million a year ago. The June seasonally adjusted annual rate (SAAR) is forecast at 15.2 million, an increase of more than 16% compared to June 2022, when new-vehicle inventory was less than half the current levels.

“We came into 2023 concerned about affordability, supply constraints, and a fragile economy,” noted Cox Automotive Chief Economist Jonathan Smoke. “But the jobs market has remained healthy, and consumers have found a way to buy new wheels. As we close the first half, the market is showing signs of being more balanced, with smaller, more predictable changes in sales and less news about big price changes. A year from now, we might look back at this point as the beginning of a return to normal.”

A key driver of the new-vehicle market in 2023 has been the vastly improved new-vehicle inventory levels, which are up more than 70% year over year in June. Days of supply has also increased notably, holding near or above 50 days through much of the first half. In the first half of 2022, days of supply averaged closer to 35 days. Fleet sales have also underpinned the market improvement through the first half. Initial forecasts suggest fleet sales could increase by more than 40% year over year through the end of June, as retail sales are likely to show gains of about 3%.

With a “Surprising” First Half Closing, Cox Automotive Ups Full-Year Outlook

According to Kelley Blue Book estimates, new-vehicle sales through the first half of 2023 are forecast to increase by nearly 800,000 units over the first half of 2022. The sales pace through the first half has been 15.4 million, up from 13.7 million in the first half of 2022.

With expectations of some minor slowing in the second half of 2023, Cox Automotive is increasing its full-year new-vehicle sales forecast to 15.0 million, a gain of nearly 8% from 2022, when sales finished at 13.9 million. Fleet sales are now forecast to finish the year at 2.6 million, up from 1.8 million in 2022. Full-year retail sales are forecast to increase from 11.7 million in 2022 to 12.4 million in 2023.

“The resilience of vehicle buyers in the face of historic increases in interest rates has been surprising,” said Cox Automotive Senior Economist Charlie Chesbrough. “However, maybe less surprising, but more than we expected, has been the industry’s return to old habits to move the metal. We expect that headwinds will grow in the second half of this year as credit availability and unfulfilled demand become scarcer.”

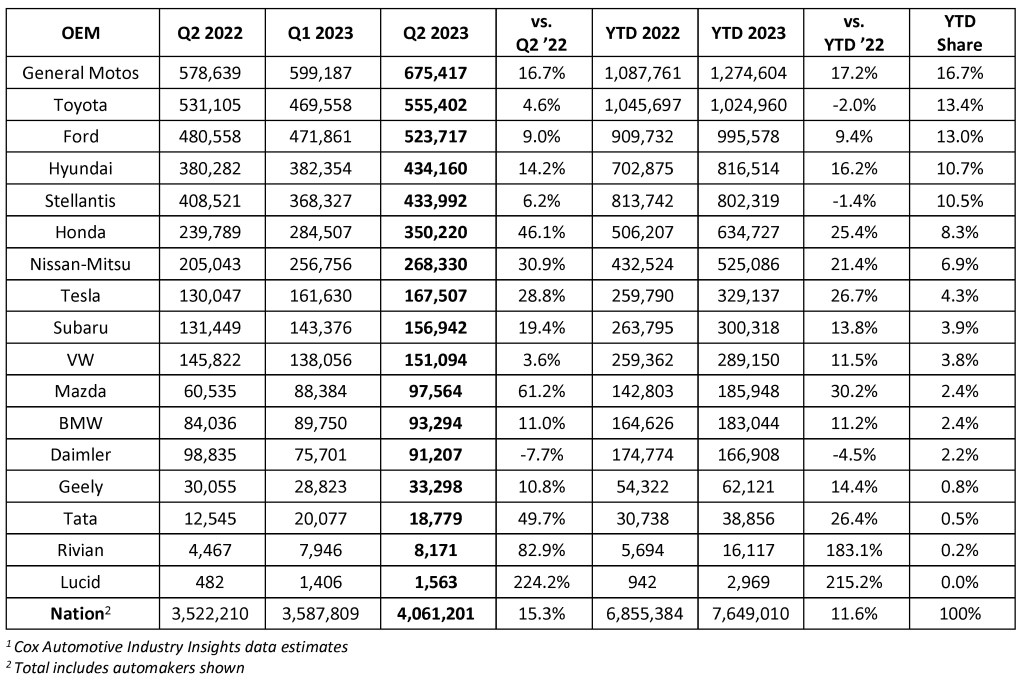

GM Remains On Top; Toyota Volume Falls

General Motors will remain the top automaker in new-vehicle sales through the first half of 2023. GM sales are forecast to increase by more than 17% year over year in the first half. Toyota, which continues to operate with among the leanest new-vehicle supply in the industry, will remain No. 2 and slightly ahead of Ford. A standout in the market has been the Hyundai Motor Company, with its Hyundai, Kia and Genesis brands. Hyundai sales through the first half are forecast to increase by more than 16% year over year. In terms of total sales, Hyundai has passed Stellantis to become the 4th largest automaker by sales in the U.S.

Most companies increased sales in the first half, with strong increases from Honda, Mazda, Nissan and Tesla. In all cases, improved inventory levels have helped drive higher sales volumes. Higher incentives and – in the case of Tesla, specifically – aggressive price cutting has helped drive further growth.

EV Sales Continue to Climb, Inventory Builds

Cox Automotive is forecasting U.S. EV sales to surpass 1 million units for the first time in 2023, and through the first half, EV sales are very much on course. Sales of pure battery electric vehicles are forecast to reach nearly 500,000 units in the first half, up from 355,000 a year earlier. EV share is approaching 7% of the total U.S. auto market.

EV availability has increased substantially in the first half of 2023. As the second quarter of 2023 draws to a close, EV inventory across the U.S. is estimated to be above 90,000 units for the first time. A year ago, when inventory everywhere was scarce, EV supply was closer to 21,000 units. The EV sales pace has increased but not as quickly as inventory. In June, based on data from the vAuto Available Inventory Database, Cox Automotive is estimating that days of supply for EVs is at 92 days, up from 36 days a year ago and well above the industry-wide average of 51.

June 2023 Sales Forecast Highlights

- The annual sales pace in June is forecast to finish near 15.2 million, up 2.2 million from last June’s pace and up from May’s pace of 15.0 million.

- Sales volume is expected to rise 16.3% from one year ago and reach 1.33 million units.

- There are 26 selling days in June 2023, the same as June 2022.

June 2023 U.S. New-Vehicle Sales Forecast

Q2 2023 New-Vehicle Sales Forecast Highlights

- New-vehicle sales in Q2 2023 increase from Q1 and jump 15.3% from Q2 2022.

- While nearly all automakers increased sales year over year, Toyota and Daimler fall.

- Hyundai jumps past Stellantis through the first half; Tesla passes Subaru.

Q2 2023 New-Vehicle Sales Forecast1

All percentages are based on raw volume, not daily selling rate. There were 152 selling days in H1 2022 and H1 2023.

About Cox Automotive

Cox Automotive is the world’s largest automotive services and technology provider. Fueled by the largest breadth of first-party data fed by 2.3 billion online interactions a year, Cox Automotive tailors leading solutions for car shoppers, automakers, dealers, retailers, lenders and fleet owners. The company has 25,000+ employees on five continents and a family of trusted brands that includes Autotrader®, Dealertrack®, Kelley Blue Book®, Manheim®, NextGear Capital™ and vAuto®. Cox Automotive is a subsidiary of Cox Enterprises Inc., a privately-owned, Atlanta-based company with $22 billion in annual revenue. Visit coxautoinc.com or connect via @CoxAutomotive on Twitter, CoxAutoInc on Facebook or Cox-Automotive-Inc on LinkedIn.

Media Contacts:

Mark Schirmer

734 883 6346

mark.schirmer@coxautoinc.com

Dara Hailes

470 658 0656

dara.hailes@coxautoinc.com