Press Releases

Cox Automotive Forecast: March New-Vehicle Sales to Jump 4.5% From Year-Ago Levels, as U.S. Market Continues to Normalize

Monday March 25, 2024

Article Highlights

- Annual new vehicle sales pace in March is forecast to finish near 15.5 million, up 0.6 million from last March’s 14.9 million pace but down from February’s 15.8 million level.

- March’s sales volume is expected to reach 1.45 million units, a 4.5% increase from one year ago and a 14.4% increase from February.

- New-vehicle sales volume is forecast to grow 5.6% year over year in Q1 to 3.8 million; the Q1 sales pace is forecast at an annual rate of 15.4 million, up from 15.0 in Q1 2023.

ATLANTA, March 25, 2024 – Cox Automotive forecasts U.S. new-vehicle sales in Q1 will increase 5.6% year over year and reach 3.8 million units. The year-over-year increase in Q1 sales suggests that the new-vehicle market in the U.S. continues to recover slowly from the 10-year low – 13.8 million total sales – recorded in 2022.

Sales volume in March, when announced early next month, is expected to show gains over March 2023 and 2022 as the market continues to expand. The forecast of 1.45 million sales in March would be an increase of 4.5% year over year and close to the 10-year average for the month, historically one of the strongest sales months in a given year.

Healthy sales are being supported by significantly improved new-vehicle inventory levels. At the beginning of March, the total supply of available new vehicles was up more than 50% compared to last March, according to the latest vAuto Live Market View data.

The March seasonally adjusted annual rate (SAAR), or selling pace, is expected to finish near 15.5 million, up 0.6 million over last year’s pace but down slightly from February’s surprisingly strong 15.8 million level. This March has 27 sales days, the same as last year but two more than last month. Through Q1, the SAAR is forecast at 15.4 million, up from 15.0 million, or a 2.7% increase, compared to Q1 2023.

Cox Automotive Senior Economist Charlie Chesbrough said: “Since April 2023, the SAAR has experienced some large swings with an average at the mid-15 million level. That sales pace is expected to continue this month as well. However, March weather was unseasonably warm this year, which could give sales an extra boost.”

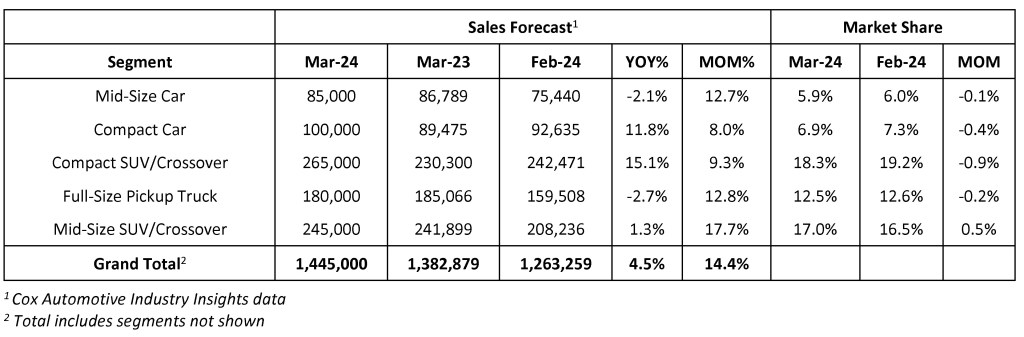

March 2024 New-Vehicle Sales Forecast

All percentages are based on raw volume, not daily selling rate.

Cox Automotive to Hold Q1 Industry Insights and Sales Forecast Call March 28

Cox Automotive Chief Economist Jonathan Smoke, Senior Economist Charlie Chesbrough, and members of the Industry Insights team will provide a comprehensive update on the U.S. automotive industry through the first quarter, covering the new, used, and wholesale markets, along with insights, data and forecasts from Cox Automotive. The Q1 Cox Automotive Industry Insights and Sales Forecast Call is for media, analysts and auto industry stakeholders. The 60-minute call will begin at 11 a.m. EDT on Thursday, March 28. Interested parties should RSVP through Cox Automotive Corporate Communications.

About Cox Automotive

Cox Automotive is the world’s largest automotive services and technology provider. Fueled by the largest breadth of first-party data fed by 2.3 billion online interactions a year, Cox Automotive tailors leading solutions for car shoppers, auto manufacturers, dealers, lenders and fleets. The company has 29,000+ employees on five continents and a portfolio of industry-leading brands that include Autotrader®, Kelley Blue Book®, Manheim®, vAuto®, Dealertrack®, NextGear Capital™, CentralDispatch® and FleetNet America®. Cox Automotive is a subsidiary of Cox Enterprises Inc., a privately owned, Atlanta-based company with $22 billion in annual revenue. Visit coxautoinc.com or connect via @CoxAutomotive on X, CoxAutoInc on Facebook or Cox-Automotive-Inc on LinkedIn.

Media Contacts:

Mark Schirmer

734 883 6346

mark.schirmer@coxautoinc.com

Dara Hailes

470 658 0656

dara.hailes@coxautoinc.com