Press Releases

Cox Automotive Forecast: May Auto Sales Expected to Fall to Slowest Pace in 2022

Wednesday May 25, 2022

Article Highlights

- New-vehicle sales volume in May is forecast to fall nearly 28% from one year ago, to 1.14 million units.

- The new-vehicle sales pace is expected to finish near 13.1 million in May, the lowest point in 2022 and down from last month’s 14.3 million pace.

- Tight inventory and high prices continue to push many would-be buyers to the sidelines.

UPDATED, June 2, 2022 – May new-vehicle sales came in lower than the Cox Automotive forecast issued last week. Our team was expecting a year-over-year volume decline of roughly 28%; results indicate a drop of more than 29%. Auto sales in May are traditionally quite strong, spurred in part by the long Memorial Day Weekend. But that was not the case this year. Overall new-vehicle buying conditions are a challenge right now for many would-be buyers. Not only are borrowing costs rising with higher interest rates, but higher gas prices are driving up vehicle operating costs as well. According to fresh research from Kelley Blue Book, more shoppers are looking for smaller, fuel-efficient and electrified vehicles, but finding them on vehicle lots is proving challenging. Inventory levels for hybrids and compact vehicles remain well below the industry average.

Higher costs, coupled with a lack of available products to buy, suggest that only two types of people are still in the market: Those with immediate transportation needs and those wealthier households less concerned with price points. Many consumers are choosing to wait, although the situation is unlikely to change quickly. And with interest rates increasing – the waiting game has downsides as well.

Cox Automotive continues to believe vehicle availability will begin to improve in the months ahead but remain historically tight throughout 2022 from ongoing supply constraints as well as months-old order fulfillment preventing significant inventory accumulation. With low unemployment and rising wages, there is sufficient demand for higher sales. But the story is unchanged: A lack of inventory is holding the automotive industry in check. The seasonally adjusted annual rate of sales in May was near 12.7 million, hitting a low point of the year.

ATLANTA, May 25, 2022 – With no relief from elevated prices and tight new-vehicle inventory, U.S. auto sales are expected to drop to their lowest level of the year in May. According to the Cox Automotive forecast released today, the seasonally adjusted annual rate (SAAR) of new-vehicle sales in May is expected to hit 13.1 million, a step backward from April’s 14.3 million level and far below the 16.9 million level posted in May 2021.

May sales volume is forecast to finish near 1.14 million units, down 9% from last month and nearly 28% from one year ago. Last year, in May 2021, new-vehicle sales reached 1.59 million, the second-best month of 2021 by volume, behind only March. While high prices and tight inventory are negatively impacting new-vehicle sales this month, the low sales volume can also be attributed to the calendar. There are 24 selling days this month, three fewer than last month and two fewer than May 2021.

Tight inventory isn’t the only headwind facing the market. Other issues may be having a growing impact. Rising interest rates and higher prices, and the resulting increase in monthly payments, are likely hurting demand as well. Vehicle affordability in the U.S. continues to worsen, according to the Cox Automotive/ Moody’s Analytics Vehicle Affordability Index. In addition, lower consumer optimism in the wake of high inflation, surging gas prices, and a volatile stock market may be keeping some potential buyers from entering the market.

“Historically, the daily sales pace is higher in May than in most other months, with spring optimism in the air, thoughts of summer road trips on the horizon, and the buzz of Memorial Day sales,” said Charlie Chesbrough, senior economist at Cox Automotive. “But many of the industry’s normal patterns have been overturned by tight inventory and the lingering effect of the global pandemic.”

May 2022 Sales Forecast Highlights

- Vehicle sales are expected to drop nearly 28% from May 2021 and fall 9% from last month.

- The SAAR in May 2022 is estimated to be 13.1 million, below last year’s 16.9 million level and down from April’s 14.3 million pace.

- May 2022 has 24 selling days, three fewer than last month and two fewer than May 2021.

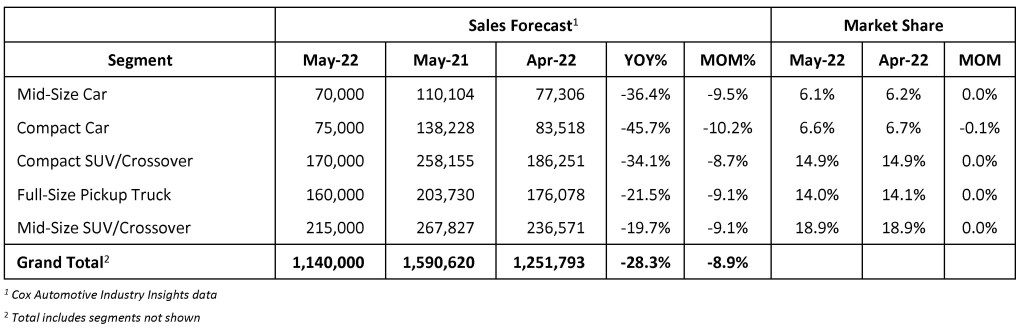

May 2022 Sales Forecast

All percentages are based on raw volume, not daily selling rate.

About Cox Automotive

Cox Automotive Inc. makes buying, selling, owning and using vehicles easier for everyone. The global company’s more than 27,000 team members and family of brands, including Autotrader®, Dealer.com®, Dealertrack®, Kelley Blue Book®, Manheim®, NextGear Capital®, VinSolutions®, vAuto® and Xtime®, are passionate about helping millions of car shoppers, 40,000 auto dealer clients across five continents and many others throughout the automotive industry thrive for generations to come. Cox Automotive is a subsidiary of Cox Enterprises Inc., a privately-owned, Atlanta-based company with annual revenues of nearly $20 billion. www.coxautoinc.com

Media Contacts:

Mark Schirmer

734 883 6346

mark.schirmer@coxautoinc.com

Dara Hailes

470 658 0656

dara.hailes@coxautoinc.com

Media Contacts:

Mark Schirmer

734 883 6346

mark.schirmer@coxautoinc.com

Dara Hailes

470 658 0656

dara.hailes@coxautoinc.com