Press Releases

Cox Automotive Forecast: November New-Vehicle Sales Expected to Jump 10.8% Year Over Year, as Inventory Levels Continue to Improve

Monday November 28, 2022

Article Highlights

- New-vehicle sales volume in November is expected to rise 10.8% from one year ago and reach 1.13 million units. However, sales volume will decrease 4.2% from last month.

- November’s annual vehicle sales pace is expected to finish near 14.3 million, down 0.6 million from last month’s 14.9 million pace but up notably from last year’s 13.1 million level.

- New-vehicle inventory continues to improve, likely supporting sales in November.

Updated, Dec. 1, 2022 – When considering the new-vehicle market in the U.S., the Cox Automotive Economics and Industry Insights team has been trying to balance two distinct market realities: supply and demand. For much of 2022, tight inventory (supply) has been an anchor holding back the market. And indeed, with inventory historically low, new-vehicle sales have been depressed. Through the end of Q3, the new-vehicle market was down more than 12% year over year, and last year was hardly strong by historical measures.

Now, well into the final quarter of 2022, new-vehicle inventory is showing signs of improvement. At the end of October, available new-vehicle inventory was near 1.5 million units, up 78% from year-earlier measures; days’ supply was at 49 days, the highest level in more than a year, according to vAuto Available Inventory Data. New-vehicle inventory is still considered tight by historical measures, but the trend is clear: New-vehicle supply is improving.

Cox Automotive had forecasted 10% year-over-year new-vehicle sales growth in November. The final tally will be confirmed in the coming days, but early indications are sales came in slightly slower than our expectations, with a sales pace closer to 14.1 million, below the pace of 14.3 million in our forecast. Still, a 14.1 million pace is well ahead of the 13.1 million recorded last November, and there are clear examples of better inventory resulting in better sales. As Senior Economist Charlie Chesbrough noted in his forecast posted below: “The improving supply situation is something dealers and consumers alike are thankful for this year.”

This is notably true with popular Asian brands, which have had among the tightest supply in a constrained market. For example, while still tight, Hyundai’s inventory has vastly improved year over year, and November sales increased by 43%, according to reports. The same story is true at sister brand Kia: Sales in November increased by 25% year over year, and inventory is up significantly as well. The trend played out at Mazda, Subaru and Toyota as well.

The November new-vehicle sales story is anything but uniform, though. While some brands are benefiting from better product availability, others are not. Honda posted year-over-year sales declines, despite vast improvements in inventory. And our expectations are for slowdowns or declines at some of the major domestic brands, where supply is far better than it was a year ago, but demand is beginning to falter. Overall, we are expecting market growth versus November 2021, but there will be winners and losers.

As we’ve noted before, as the supply story improves, a stumbling economy, with low consumer confidence and rising interest rates, is beginning to sap demand. We still believe there is sufficient pent-up demand to reach our forecast of 13.7 million sales in 2022, down from 15 million in 2021, and the market should see new-vehicle sales improvement in 2023. Inventory woes are beginning to pass, replaced with the pain of high vehicle prices, stubborn inflation, and economic uncertainty. As we launch into December and the year ahead, the balance is shifting. Our attention turns to demand.

ATLANTA, Nov. 28, 2022 – November U.S. auto sales, when confirmed later this week, are expected to show no real surprises, with both sales volume and pace up from November 2021 but down modestly from last month. According to the Cox Automotive forecast released today, November U.S. new-vehicle sales volume is expected to reach 1.13 million an increase of 10.8%, or nearly 110,000 units, compared to last year’s extremely supply-constrained market. The sales pace, or seasonally adjusted annual rate (SAAR), is forecast to finish near 14.3 million, up from last year’s 13.1 million pace but a step backward from October’s 14.9 million level.

“Vehicle shoppers may not have been gobbling up new cars and trucks this Thanksgiving, but the improving supply situation is likely something dealers and consumers alike are thankful for this year,” said Charles Chesbrough, senior economist at Cox Automotive.

New-Vehicle Inventory Differs Greatly Based on Brand and Vehicle

In November 2021, the new-vehicle market was suffering from a significant lack of inventory on dealer lots across the country. This year, though, the supply situation has modestly improved, and inventory levels are much higher across the country. However, not all brands and vehicles are in the same position.

Chesbrough notes: “Some products, particularly the Asian best sellers, continue to have extremely tight supply. Order-and-wait is likely the only way to purchase one. Other products, such as domestic pickup trucks, have much greater availability. In general, incentives have been significantly lower during the past two years, but that situation is beginning to change for some brands as the post-COVID supply chain recovery continues.”

November 2022 U.S. New-Vehicle Sales Forecast Highlights

- New-vehicle sales are expected to increase 10.8% from November 2021 but decline 4.2% compared to last month.

- The SAAR in November 2022 is estimated to be 14.3 million, above last year’s 13.1 million level but down from last month’s 14.9 pace.

- November has 25 selling days, one less than October but one more than November 2021.

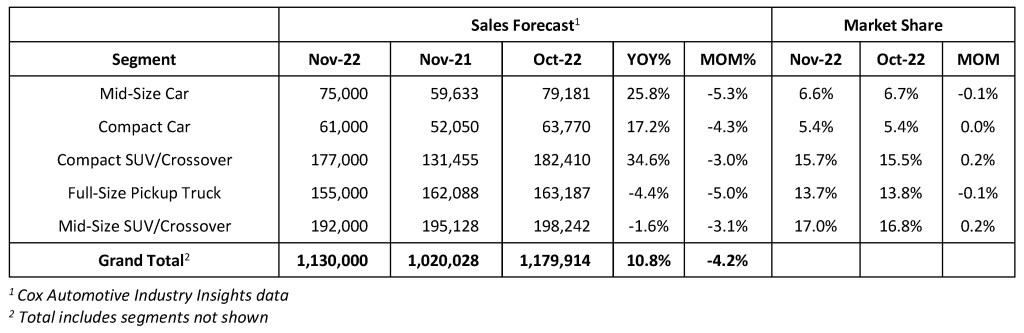

November 2022 U.S. New-Vehicle Sales Forecast

All percentages are based on raw volume, not daily selling rate.

About Cox Automotive

Cox Automotive Inc. makes buying, selling, owning and using vehicles easier for everyone. The global company’s more than 27,000 team members and family of brands, including Autotrader®, Dealer.com®, Dealertrack®, Kelley Blue Book®, Manheim®, NextGear Capital®, VinSolutions®, vAuto® and Xtime®,are passionate about helping millions of car shoppers, 40,000 auto dealer clients across five continents and many others throughout the automotive industry thrive for generations to come. Cox Automotive is a subsidiary of Cox Enterprises Inc., a privately-owned, Atlanta-based company with annual revenues of nearly $20 billion. www.coxautoinc.com

Media Contacts:

Mark Schirmer

734 883 6346

mark.schirmer@coxautoinc.com

Dara Hailes

470 658 0656

dara.hailes@coxautoinc.com