Press Releases

Cox Automotive Forecast: New-Vehicle Sales Pace Remains Muted Despite Higher Inventory Levels

Friday November 24, 2023

Article Highlights

- Cox Automotive forecasts annual vehicle sales pace in November to finish near 15.3 million, up 1.0 million from last November’s 14.3 million pace, but down slightly from October’s 15.5 million level.

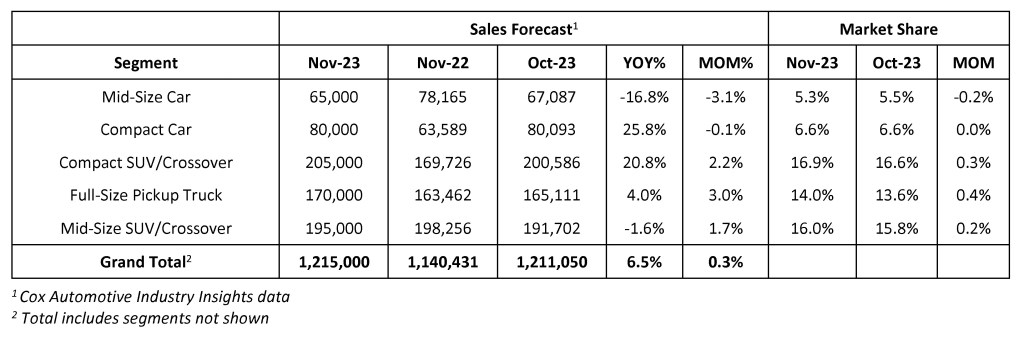

- November’s sales volume is expected to rise 6.5% from one year ago to 1.21 million units. This is a 0.3% increase from October which had 25 selling days, the same as this month.

- Improved inventory levels continue to boost new-vehicle sales volume despite challenging buying conditions.

Updated, Dec. 5, 2023 – Early indications suggest the new-vehicle sales pace in November came in at a seasonally adjusted annual rate of 15.3 million, aligned with the Cox Automotive forecast released late last month. Industry sales volumes were likely up more than 7% year over and year November and slightly higher than October. As noted in our forecast, new-vehicle sales typically gain momentum in the final two months of the year. While sales volume did increase from October, the November increase was muted at best, holding the sale pace below both September and October and suggesting new-vehicle sales growth slowed. New-vehicle inventory levels continue to improve, but prices remain stubbornly high and auto loan rates, while retreating from recent peaks, are still a challenge and keeping some buyers on the sidelines. The U.S. market is on course to finish 2023 with new-vehicle sales volumes up more than 10% from 2022 and at the highest level since 2019.

Retail sales in November were generally healthy, although slowing compared to October, and fleet activity likely slowed for the second month in a row. There’s a lot of talk in business circles right now about a “soft landing” for the U.S. economy, and that might well be what’s happening in the auto industry – slowing as the year winds down, but certainly not crashing in the face of inflation. At the same time, new-vehicle sales in the U.S. are not taking off either: 2023 will mark the best sales year since the pandemic, but will be down more than 11% from the average volume sold in the years 2015 to 2019. With inventories building with many automakers in this final month of 2023, total year-end volumes will be based largely on just how aggressive automakers and dealers are willing to be when it comes to discounts and incentives.

ATLANTA, Nov. 24, 2023 – November new-vehicle sales, when announced next week, are expected to show gains over last year’s product-constrained market. According to the Cox Automotive forecast released today, sales volume is expected to rise 6.5% over November 2022 when the market was in the early stages of recovery from severe product shortages. The seasonally adjusted annual rate (SAAR), or sales pace, is expected to finish near 15.3 million in November, up 1.0 million over last year’s pace but a slight decline from last month’s 15.5 million level.

According to Charlie Chesbrough, senior economist at Cox Automotive: “A slight rise in sales volume is expected in November, but the sales pace will decline for the second straight month. October is normally one of the slowest sales months of the year, and the buying pace generally increases in November and December. This year, however, despite more discounting and more promotion, we are expecting the sales pace to slow slightly in a weak buying climate.”

Sales Pace Continues to Reflect Improved New-Vehicle Inventory Levels

New-vehicle inventory volume was 2.40 million at the start of November, higher by more than 900,000 units from one year ago. Meanwhile, days’ supply had climbed to 67, up from 60 at the start of October and higher by 41% compared to November 2022.

Chesbrough notes: “New-inventory volume continues to improve and is at the highest level since March 2021. Additional inventory is providing more options for buyers still in the market, particularly for larger trucks and SUVs. New-vehicle days’ supply has been approaching 2020 levels this month, with the current days’ supply above both 2021 and 2022 levels.”

November 2023 New-Vehicle Sales Forecast

All percentages are based on raw volume, not daily selling rate. There were 25 selling days in November 2023, the same as October and November 2022.

About Cox Automotive

Cox Automotive is the world’s largest automotive services and technology provider. Fueled by the largest breadth of first-party data fed by 2.3 billion online interactions a year, Cox Automotive tailors leading solutions for car shoppers, automakers, dealers, retailers, lenders and fleet owners. The company has 25,000+ employees on five continents and a family of trusted brands that includes Autotrader®, Dealertrack®, Kelley Blue Book®, Manheim®, NextGear Capital™ and vAuto®. Cox Automotive is a subsidiary of Cox Enterprises Inc., a privately-owned, Atlanta-based company with $22 billion in annual revenue. Visit coxautoinc.com or connect via @CoxAutomotive on Twitter, CoxAutoInc on Facebook or Cox-Automotive-Inc on LinkedIn.

Media Contacts:

Mark Schirmer

734 883 6346

mark.schirmer@coxautoinc.com

Dara Hailes

470 658 0656

dara.hailes@coxautoinc.com