Press Releases

Cox Automotive January Forecast: U.S. Auto Sales Volume Holds Steady, Inventory Levels Remain Tight

Wednesday January 26, 2022

Article Highlights

- Seasonality adjustments are expected to show an improved January sales pace, but sales volume remains constrained by low inventory.

- Annual new-vehicle sales pace in January is forecast to finish near 15.3 million, up from last month’s 12.4 million pace, but down from last year’s 16.8 million level.

- January sales volume is expected to finish near 1.01 million, below December 2021 and down nearly 9% from year-ago levels.

UPDATED, Feb. 3, 2022 – January new-vehicles sales came in at 998,000 according to our best estimates, just slightly below our forecast of 1.01 million, but well within our expectations for the industry. As noted in our forecast release, with inventory tight, sales volumes are stuck in the neighborhood of 1 million units a month. Sales in January were down approximately 10% from January 2021, which in fact may be a relatively good result considering new-vehicle inventory is down by more than 50%. The January SAAR came in at 15.0 million (against our 15.3 million forecast), a 10% decline from last year’s 16.8 million, a time before inventory fell to historic lows. And in January 2020, before the pandemic began, the SAAR was 16.9 million.

We still believe that inventory and product availability will be driving the market this year, as demand will remain robust. In 2022, if it can be built, it will be sold. New-vehicle inventory will likely improve in the second half of the year. One highlight from January: Sales of EVs commanded nearly 6% of new-vehicle sales, a level the industry posted in Q4 of 2021. As more EVs hit the market, EV share will increase further.

The team will have updates on average transaction prices, incentive levels and fleet sales in the coming days.

ATLANTA, Jan. 26, 2022 – New-vehicle sales in January are expected to reach 1.01 million units, a drop of 8.9% compared to January 2021, according to a forecast released today by Cox Automotive. The January pace of U.S. auto sales, or seasonally adjusted annual rate (SAAR), is forecast to show a sizable month-over-month improvement and finish near 15.3 million, up from 12.4 million in December, which was the slowest pace since May 2020.

Improvement in the January sales pace is a positive sign for the market, but it is mostly due to seasonality adjustments. In fact, there haven’t been any significant market changes to positively impact sales. New-vehicle sales remain stuck in the 1.0-to-1.2 million range. January is expected to continue this trend, as the market continues to be held back by tight inventory. New-vehicle inventory is starting 2022 down 61% from last year – that means 1.2 million fewer vehicles available at the start of 2022 compared to the start of 2021.

According to Charlie Chesbrough, senior economist at Cox Automotive: “A large decline in sales to start the year after a robust holiday shopping period is expected, and adjustments are made to sales data to reflect this. In January, the seasonal factors will reveal that, even though sales volumes are stuck in their current range, the market is moving in the right direction and, importantly, not getting worse.”

January 2022 Sales Forecast Highlights

- Light vehicle sales are expected to fall 8.9% from last January and drop 17.1% from December 2021.

- The SAAR is estimated to be 15.3 million, below last year’s 16.8 million level, but a notable increase from December’s 12.4 million pace.

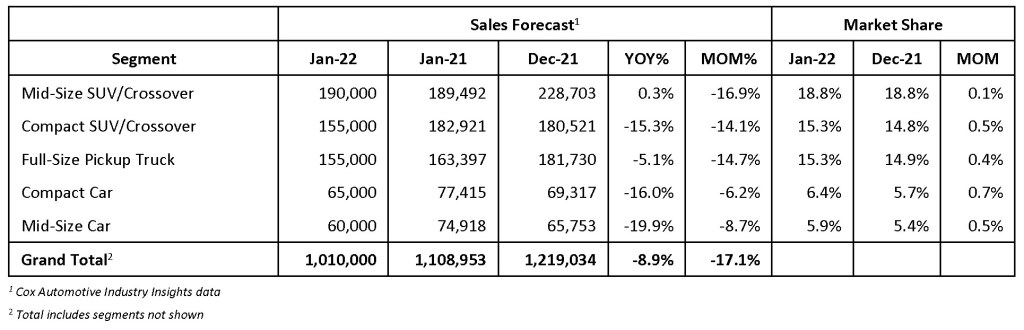

January 2022 Sales Forecast

All percentages are based on raw volume, not daily selling rate.

About Cox Automotive

Cox Automotive Inc. makes buying, selling, owning and using vehicles easier for everyone. The global company’s more than 27,000 team members and family of brands, including Autotrader®, Dealer.com®, Dealertrack®, Kelley Blue Book®, Manheim®, NextGear Capital®, VinSolutions®, vAuto® and Xtime®, are passionate about helping millions of car shoppers, 40,000 auto dealer clients across five continents and many others throughout the automotive industry thrive for generations to come. Cox Automotive is a subsidiary of Cox Enterprises Inc., a privately-owned, Atlanta-based company with annual revenues of nearly $20 billion. www.coxautoinc.com

Media Contacts:

Mark Schirmer

734 883 6346

mark.schirmer@coxautoinc.com

Dara Hailes

470 658 0656

dara.hailes@coxautoinc.com

Media Contacts:

Mark Schirmer

734 883 6346

mark.schirmer@coxautoinc.com

Dara Hailes

470 658 0656

dara.hailes@coxautoinc.com