Press Releases

Cox Automotive Forecast: August New-Vehicle Sales Pace Slowest of 2021 Due to Low Supply

Wednesday August 25, 2021

Article Highlights

- Annual new-vehicle sales pace in August is forecast to finish near 14.3 million, the slowest pace in 2021. This pace reflects another downtick from last month’s supply-constrained 14.8 million and is the slowest since June 2020 when it was 13.0 million.

- August sales volume is expected to fall nearly 9% from one year ago and finish near 1.20 million units.

- The ongoing low supply situation is keeping the sales pace well below August 2020’s early post-COVID-19 recovery pace of 15.2 million.

UPDATED Sept. 1, 2021 – With new-inventory extremely tight for most brands across the country, a slowdown in sales compared to July was widely expected. Initial reports indicate that tight inventory is now negatively impacting sales at nearly all brands. A few will ultimately squeeze out small year-over-year gains – Acura, Mazda – but a vast majority will be down in August. Given the severity of the supply crunch in the market, some brands are down well below last year’s levels. Even Toyota, which has been able to successfully navigate tight supplies through the spring and summer suffered a sales decline in August.

August will be a fourth consecutive month of slowing sales and looks to be coming in even lower than our forecast of 1.2 million, a 9% decline from August 2020. Current data points to a drop closer to 17%, with sale volume near 1.1 million. At this point, indications are new-vehicle inventory issues will continue to stress dealers and consumers through the remainder of the year. The global auto supply chain has always been a fragile operation, and this year has demonstrated just how fragile indeed.

ATLANTA, Aug. 25, 2021 – U.S. auto sales are forecast to be squeezed even tighter in August by a worsening supply situation. The pace of auto sales, or seasonally adjusted annual rate (SAAR), is expected to finish near 14.3 million, the slowest sales pace this year, according to a Cox Automotive forecast released today. The August pace will be down from July’s 14.8 million pace and down from August 2020’s 15.2 million level, after averaging nearly 17.0 million a month through May.

Sales volume is expected to finish near 1.20 million, down 9% from last August, which had one additional selling day, and down nearly 7% from last month. August’s finish would be the fourth consecutive monthly decline of 500,000 units or more since April’s post-pandemic peak pace of 18.3 million.

The supply situation will likely worsen over the coming weeks. According to Cox Automotive Senior Economist Charlie Chesbrough: “Available inventory on dealer lots has been falling for months, and sales have been constrained further and further as a result. And soon the market will enter the Labor Day holiday weekend, usually one of the highest sales periods of the entire year, but with half the supply they had last year.”

The automotive market started the year with tight supply, and inventory levels have continued to deteriorate. New-vehicle inventory levels are over 50% lower than they were a year ago, when inventory was already below healthy levels, and supply chain issues continue to disrupt production. Most OEMs have been forced to cut production due to a lack of computer chips. The problem promises to persist this fall. Both Nissan and Toyota recently announced production shutdowns that will limit their available inventory within weeks. It is expected that the next few months will be particularly challenging as new-vehicle sales will be choked off from the lack of product available on dealer lots. Many OEM supply issues are expected to improve in Q4, but the outlook for 2022 is that tight supplies will continue to be a strong headwind for the industry.

August 2021 New-Vehicle Sales Forecast Highlights

- In August, new light-vehicle sales in the U.S. are forecast to fall to 1.20 million units, or down 118,000 units, nearly 9% below last year. Compared to last month, sales are expected to fall 88,000 units, or almost 7%.

- The SAAR in August 2021 is estimated to be 14.3 million, down from last August’s early COVID-19 recovery pace of 15.2 million, and down from July’s 14.8 million supply-constrained level.

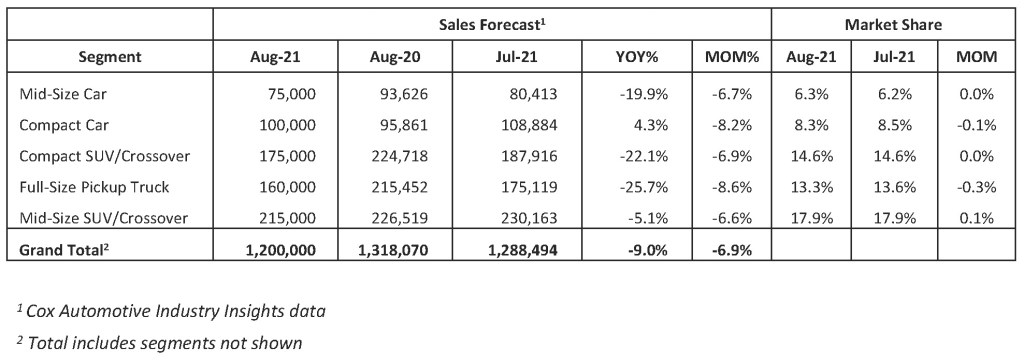

- The only segment that is expected to see a year-over-year increase in August is compact cars, but still lower than 2019. The increase is likely due to availability and affordability as well as being an alternative to used vehicles which are also in short supply.

August 2021 New-Vehicle Sales Forecast

All percentages are based on raw volume, not daily selling rate.

About Cox Automotive

Cox Automotive Inc. makes buying, selling, owning and using vehicles easier for everyone. The global company’s more than 27,000 team members and family of brands, including Autotrader®, Dealer.com®, Dealertrack®, Dickinson Fleet Services, Kelley Blue Book®, Manheim®, NextGear Capital®, VinSolutions®, vAuto® and Xtime®, are passionate about helping millions of car shoppers, 40,000 auto dealer clients across five continents and many others throughout the automotive industry thrive for generations to come. Cox Automotive is a subsidiary of Cox Enterprises Inc., a privately-owned, Atlanta-based company with annual revenues of nearly $20 billion. www.coxautoinc.com

Media Contacts:

Chintan Talati

949 267 4855

chintan.talati@coxautoinc.com

Dara Hailes

470 658 0656

dara.hailes@coxautoinc.com