Press Releases

Cox Automotive February Forecast: Tight Inventory Keeps U.S. Auto Sales From Gaining Traction

Wednesday February 23, 2022

Article Highlights

- February new-vehicle sales volume is expected to improve compared to January but remains significantly constrained by low inventory.

- Annual new-vehicle sales pace in February is forecast to finish near 14.4 million, down from last month’s 15.0 million pace, and down from last year’s 15.9 million level.

- February sales volume is expected to finish near 1.08 million units, a decline of nearly 11% year over year.

UPDATED, March 2, 2022 – February sales finished near 1.052 million, slightly below the Cox Automotive forecast, as tight new-vehicle inventory held back sales even more than expected. Since August, monthly sales volume has averaged near 1.05 million, and February was no exception. Until available supply at dealerships makes a significant improvement, the Cox Automotive Industry Insights team is forecasting new-vehicle sales will remain stuck at this million-unit level.

As the market enters the important spring selling season, when higher sales volumes are expected, the market pace will begin to look significantly worse. This month could be particularly tough for market numbers, as March is historically one of the best months of the year for sales volume. More than 1.6 million units were sold in March last year, making it the best single sales month of 2021. There is no indication that inventories will notably improve this month, so we expect new-vehicle sales volume will be similar to January and February. With seasonal factors included, the March seasonally adjusted annual rate (SAAR) will drop well below January and February. Cox Automotive expected new-vehicle sales to start the year in low gear and pick up in the second half. So far, our expectations have been met.

ATLANTA, Feb. 23, 2022 – New-vehicle sales in February are expected to reach 1.08 million units, a drop of 11% compared to February 2021, according to a forecast released today by Cox Automotive. The February pace of U.S. auto sales, or seasonally adjusted annual rate (SAAR), is forecast to show a market still significantly constrained by lack of new-vehicle supply and finish near 14.4 million, down from January’s 15.0 pace, and down from last February’s 15.9 million level. There are 24 selling days in February, the same as last year, so the decline in pace is not due to seasonal adjustments, but rather a tight supply situation that continues to hold back the market.

New-vehicle sales volume has been averaging just over 1.05 million each month since last August, and this February is not expected to buck the trend. Inventory levels are not showing significant improvement. New-vehicle inventory is now 62% below last year, and vAuto Available Inventory data show that available supply declined last week after rising for many weeks.

“The market is heading into a very interesting period,” said Charlie Chesbrough, senior economist at Cox Automotive. “With low supply and low sales volume, and no tangible market change expected, a big decrease in the sales pace — a sizable drop in the SAAR — is likely in the offing for next month. In the winter, when low sales volumes are expected, seasonal adjustments can result in a relatively strong SAAR, as we have in January and February. But come spring, when sales are expected to be much higher, the SAAR will look particularly weak. Without a big jump in inventory, March’s SAAR is going to show a significant decline.”

February 2022 Sales Forecast Highlights

- New-vehicle sales are expected to fall nearly 11% from last February but should increase nearly 8% from January 2022.

- The SAAR in February 2022 is estimated to be 14.4 million, below last year’s 15.9 million level, and down from January’s 15.0 million pace.

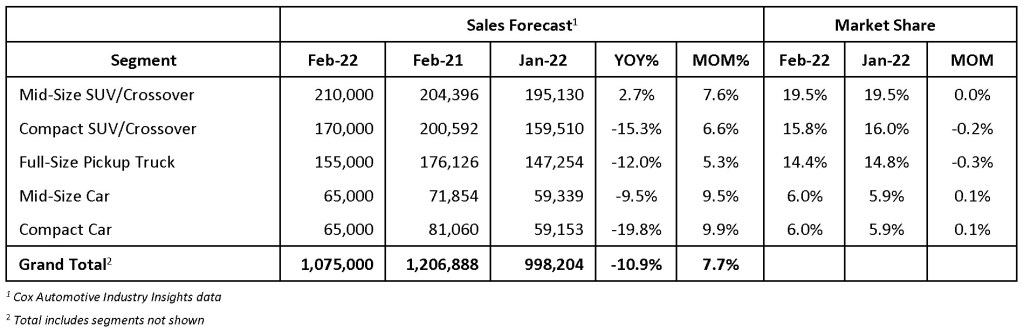

- The Mid-Size SUV/Crossover segment saw a 2.7% year-over-year increase while all other segments saw decreases with compact cars seeing the largest drop at -19.8%.

February 2022 Sales Forecast

All percentages are based on raw volume, not daily selling rate.

About Cox Automotive

Cox Automotive Inc. makes buying, selling, owning and using vehicles easier for everyone. The global company’s more than 27,000 team members and family of brands, including Autotrader®, Dealer.com®, Dealertrack®, Kelley Blue Book®, Manheim®, NextGear Capital®, VinSolutions®, vAuto® and Xtime®, are passionate about helping millions of car shoppers, 40,000 auto dealer clients across five continents and many others throughout the automotive industry thrive for generations to come. Cox Automotive is a subsidiary of Cox Enterprises Inc., a privately-owned, Atlanta-based company with annual revenues of nearly $20 billion. www.coxautoinc.com

Media Contacts:

Mark Schirmer

734 883 6346

mark.schirmer@coxautoinc.com

Dara Hailes

470 658 0656

dara.hailes@coxautoinc.com

Media Contacts:

Mark Schirmer

734 883 6346

mark.schirmer@coxautoinc.com

Dara Hailes

470 658 0656

dara.hailes@coxautoinc.com