Press Release

Cox Automotive October Forecast: U.S. Auto Sales Achieve Sixth Straight Month of Growth

Wednesday October 28, 2020

Article Highlights

- Annual vehicle sales pace in October forecast to finish near 16.4 million, up slightly from last month’s surprising 16.3 million pace, continues recovery from April’s historic low.

- October sales volume expected to rise 1.7% from year-ago level and finish near 1.36 million units.

- An improving economy and better new-vehicle inventory levels are helping sales.

ATLANTA, Oct. 28, 2020 – U.S. auto sales for October are expected to show a still recovering market with the sales pace rising for the sixth straight month since April’s historic low. The seasonally adjusted annual rate (SAAR) of sales is expected to finish near 16.4 million, up slightly from September’s surprisingly strong 16.3 million rate but down from last year’s 16.8 million level, according to a forecast released today by Cox Automotive.

Another month of volume improvement illustrates the resilience of the auto industry. According to Charlie Chesbrough, senior economist at Cox Automotive: “Given the severity of the health and economic crisis in the country right now, the strong vehicle sales pace is a pleasant surprise, particularly when six months ago most market observers didn’t expect us to be here. Modest improvements in the U.S. economy from gains in consumer confidence and job creation, coupled with the roll-out of new MY2021 products, are keeping consumers interested in purchasing even during turbulent times.”

The tight inventory situation, which was most severe earlier in the summer when factories were still reopening, is now moderating and sales have followed. Production should be less of a hurdle now with factories operating close to pre-pandemic levels.

The economic recovery is also continuing to show modest improvements, so there is little reason to expect that the vehicle market will make a substantial change in its current recovery path in the coming months. However, there remain many risks that could hold back sales, including a second COVID-19 wave, a second dip in the economy, and next week’s election, with potential disruptions that could occur as a result.

Seasonal adjustments are impacting the SAAR this month. There are 28 selling days this October, one more selling day compared to last October, and three more selling days compared to September. The additional days should result in higher sales volume within the month, and the SAAR is adjusted accordingly. The adjusted change for the SAAR results in a market down about 2% from last year.

October 2020 Sales Highlights and New Full-Year 2020 Forecast

- New vehicle sales are forecast to rise to 1.36 million units, up 1.7% compared to October 2019. When compared to last month, sales are expected to increase around 25,000 units, or nearly 1.9%.

- The SAAR in October 2020 is estimated to be 16.4 million, below last year’s 16.8 million level, but a modest gain on last month, and continuing the recovery since April’s bottom to six months of continuous increases.

- The Cox Automotive full-year sales forecast has been updated to 14.3 million units, down 16% from 2019. New retail will perform better than fleet, down 9%, while fleet is forecast to come in near 1.9 million, down 42%.

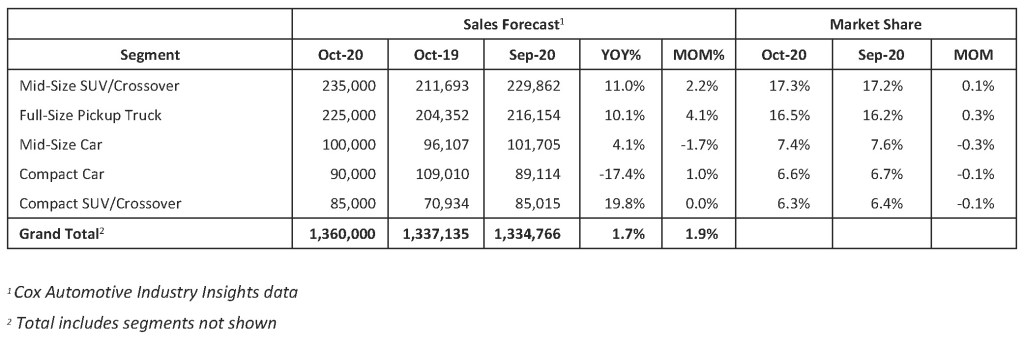

October 2020 Sales Forecast

All percentages are based on raw volume, not daily selling rate.

About Cox Automotive

Cox Automotive Inc. makes buying, selling, owning and using cars easier for everyone. The global company’s 34,000-plus team members and family of brands, including Autotrader®, Clutch Technologies, Dealer.com®, Dealertrack®, Kelley Blue Book®, Manheim®, NextGear Capital®, VinSolutions®, vAuto® and Xtime®,are passionate about helping millions of car shoppers, 40,000 auto dealer clients across five continents and many others throughout the automotive industry thrive for generations to come. Cox Automotive is a subsidiary of Cox Enterprises Inc., a privately-owned, Atlanta-based company with revenues exceeding annual revenues of $21 billion. www.coxautoinc.com

Media Contacts:

Mark Schirmer

734 883 6346

mark.schirmer@coxautoinc.com

Dara Hailes

470 658 0656

dara.hailes@coxautoinc.com