Data Point

COVID-19 Hits April Fleet Sales Hard, Rental Units Drop 76.6%

Wednesday May 6, 2020

Article Highlights

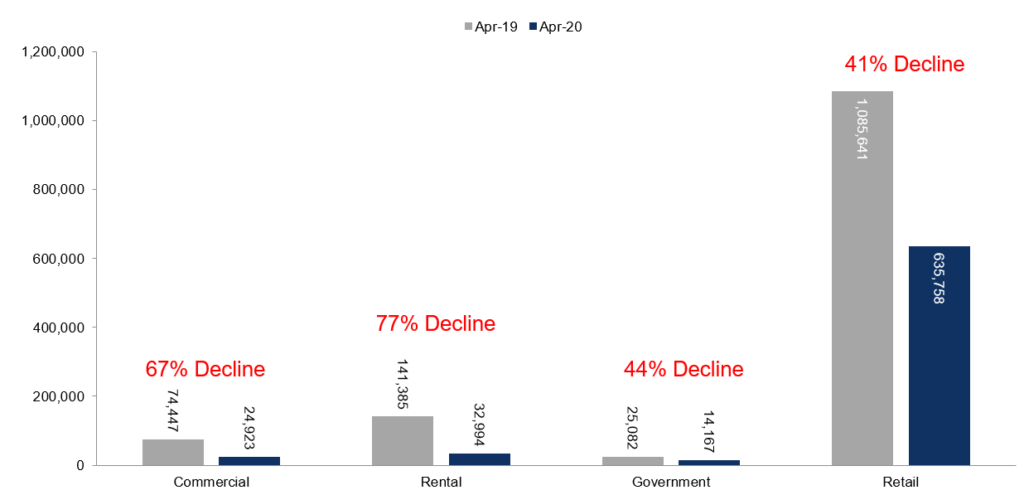

- Year-over-year growth in fleet sales began a strong decline compared to the prior year as combined rental, commercial and government purchases of new vehicles were down 70.1% in April.

- Total fleet volume in April was 72,084, down significantly from 240,914 in April 2019.

- Rental units led the drop with a 76.6% decrease year over year in April.

Year-over-year growth in fleet sales began a strong decline compared to the prior year as combined rental, commercial and government purchases of new vehicles were down 70.1% in April. Total fleet volume in April was 72,084, down significantly from 240,914 in April 2019. Rental units led the drop with a 76.6% decrease year over year in April.

Retail sales of new vehicles were down 41% year over year in April, leading to a retail seasonally adjusted annual rate (SAAR) of 7.7 million, down from 13.5 million last April and down from March’s 8.7 million rate.

April total new-vehicle sales were down 47% year over year, with one more selling day compared to April 2019. The April SAAR came in at 8.6 million, a decrease from last year’s 16.5 million and down from March’s 11.4 million rate.

The key impact of COVID-19 is that business uncertainty and expectations of recession have led to rental car companies and small businesses slowing (or stopping in some cases) vehicle purchases. And the hit taken due to the COVID-19 pandemic in April was far more severe in the fleet business than in retail.

Looking at automakers, all manufacturers saw large year-over-year declines in fleet sales ranging from -53.2% to -92.6%. FCA saw the largest fleet sales drop this month, according to our data analysis, compared to April 2019.