Data Point

CPO Sales Continue Trending Higher in August

Wednesday September 20, 2023

Article Highlights

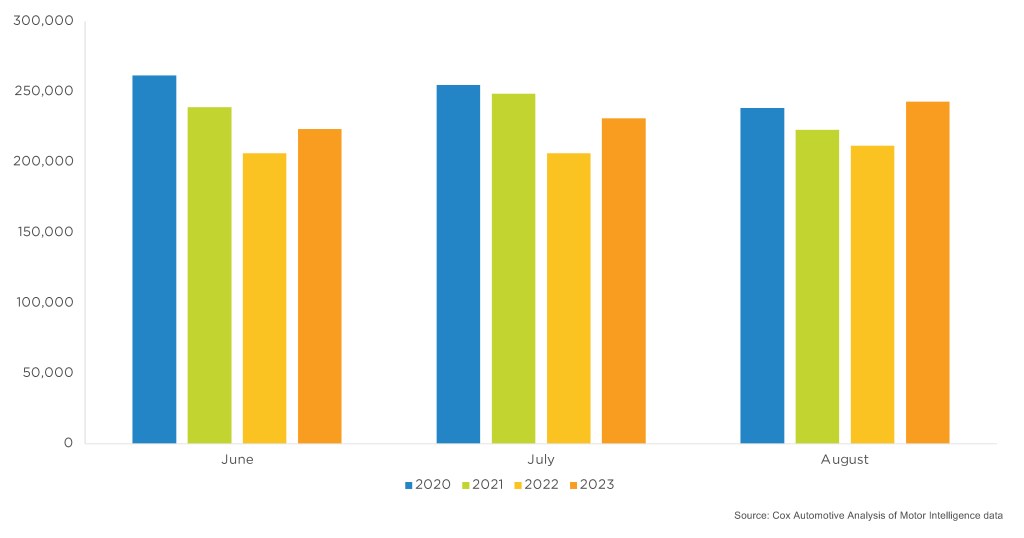

- Certified pre-owned (CPO) sales in August rose nearly 15%, over 12,000 units, over last August to finish at 243,132.

- Year-to-date CPO sales remain up 8%, or over 134,000 units, compared to the first eight months of 2022.

- Among large manufacturers, Honda had the largest CPO sales volume gain in August compared to July.

Certified pre-owned (CPO) sales in August rose nearly 15%, over 12,000 units, over last August to finish at 243,132. This total is up over 12,000 units, a 5% increase from July’s number. Year-to-date CPO sales remain up 8%, or over 134,000 units, compared to the first eight months of 2022.

“CPO sales continue at a steadily improving measured pace, outperforming the overall used-vehicle market,” said Chris Frey, senior manager of Economic and Industry Insights at Cox Automotive. “Monthly sales increases this year have been rising gradually, rather than the sporadic monthly levels of 2019, or even the trepid 2022 monthly sales rates after April.”

August CPO Sales

Among large manufacturers, Honda had the largest CPO sales volume gain in August compared to July. Meanwhile, Acura had the largest year-over-year percentage gain in CPO sales, while Ram had the largest percentage decline.

For comparison, according to Cox Automotive estimates based on vehicle registration data, total used-vehicle sales in August decreased nearly 8% from July to 3 million units. The relatively large month-over-month decline was impacted at least in part by July actuals coming in much higher than expected, due likely to some late June sales being reported in July. However, estimates indicate that the used-vehicle sales pace — both total and retail — in August improved compared to the market’s pace of one year ago. The seasonally adjusted annual rate, or SAAR, is estimated to have finished near 35.2 million, up from last August’s 34.3 million pace but down from July’s revised 38.8 million level.

“Our CPO forecast likely will be upgraded, but we will need to witness more improvements to substantiate that adjustment,” Frey noted. “Still, CPO sales have shown a lot of resilience given the price and interest rate environment, and that bodes well for the next few months’ sales figures.”