Data Point

CPO Sales Beat Expectations in July

Wednesday August 16, 2023

Article Highlights

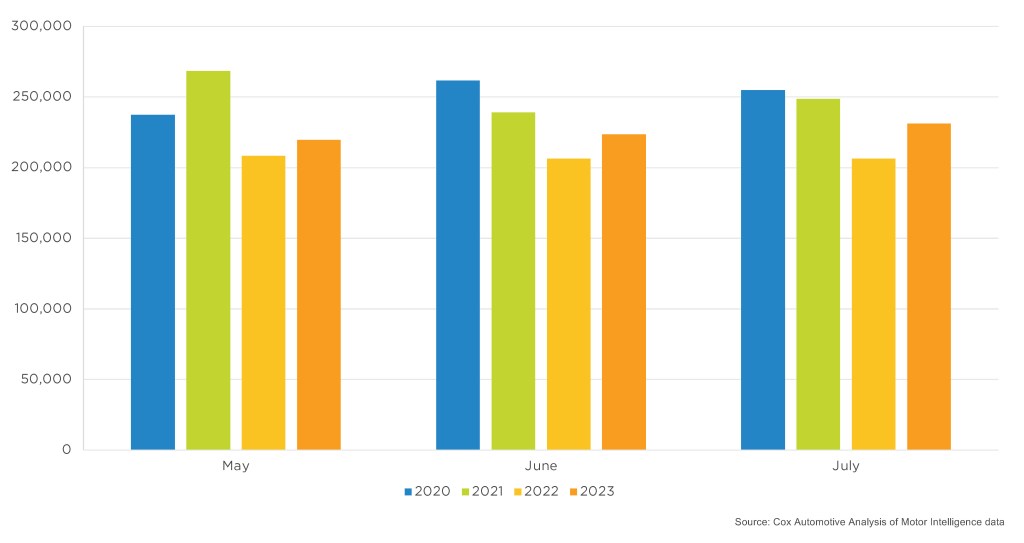

- Certified pre-owned (CPO) sales in July rose 12.0%, over 24,700 units, over last July to finish at 231,128. This total is up over 7,400 units, a nearly 3.3% increase from June’s number.

- CPO sales year to date remain up 7%, or over 103,000 units, compared to the first seven months of 2022, which was a down year for the CPO market.

- Among large manufacturers, Toyota had the largest CPO sales volume gain in July. Meanwhile, Honda had the largest year-over-year percentage gain in CPO sales, while Chevrolet had the largest percentage decline.

Certified pre-owned (CPO) sales rose by over 24,700 units year over year in July to finish at 231,128. This total is up more than 7,400 units from June’s number. Year-to-date CPO sales remain up 7%, or over 103,000 units, compared to the first seven months of 2022, which was a down year for the CPO market.

“Certified pre-owned sales have been hotter than expected,” said Chris Frey, senior manager of Economic and Industry Insights at Cox Automotive. “CPO is up 12% versus last year and up 3.3% from June alone. Last month’s sales were up 17% for domestics, 8% for European brands, and up 15% for Asian makes.”

July CPO Sales

Among large manufacturers, Toyota had the largest CPO sales volume gain in July. Meanwhile, Honda had the largest year-over-year percentage gain in CPO sales, while Chevrolet had the largest percentage decline.

For comparison, total used-vehicle sales in July are estimated to be near 3 million units, up 2.1% from July 2022. The seasonally adjusted annual rate, or SAAR, is estimated to have finished near 35.5 million, down from last July’s robust 38.4 million pace and down from June’s downwardly revised 35.8 million level. Used retail sales were also estimated to be up month over month in July.