Data Point

CPO Sales Remain Hot in June, Outpacing the Used Market

Tuesday July 18, 2023

Article Highlights

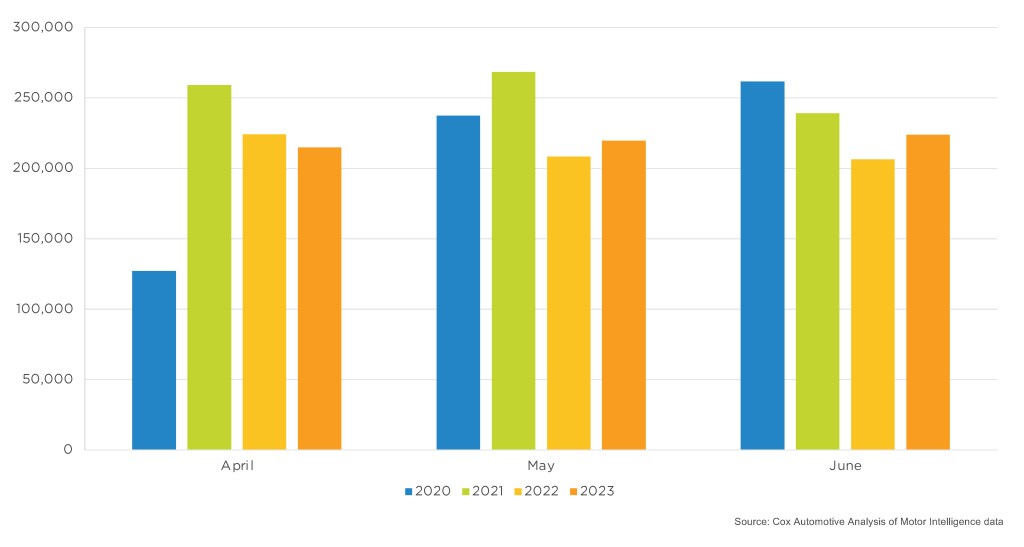

- Certified pre-owned (CPO) sales in June rose 8.4%, over 17,000 units, over last June to finish at 223,718.

- CPO sales year to date remain up 6.4%, or over 78,000 units, compared to the first six months of 2022, which was a down year for the CPO market.

- Among large manufacturers, Toyota had the largest CPO sales volume gain in May. Meanwhile, Hyundai has the largest year-over-year percentage gain in CPO sales, while Chevrolet had the largest percentage decline.

Certified pre-owned (CPO) sales in June rose 8.4%, over 17,000 units, over last June to finish at 223,718. This total is up over 4,000 units, a nearly 2% increase from May’s number. CPO sales year to date remain up 6.4%, or over 78,000 units, compared to the first six months of 2022, which was a down year for the CPO market.

“One area of strength in the used-vehicle market is certified pre-owned,” said Chris Frey, senior manager of Economic and Industry Insights at Cox Automotive. “Interestingly, certified pre-owned loans saw the most loosening of all loan types in June on a month-over-month basis, according to the Dealertrack Credit Availability Index. For consumers with good credit that are struggling to afford a new vehicle, CPO is an excellent alternative. Buyers can get a nearly new vehicle at a much better interest rate than they can get in the used market.”

June CPO Sales

Among large manufacturers, Hyundai had the largest CPO sales volume gain in June. Meanwhile, Hyundai also has the largest year-over-year percentage gain in CPO sales, while Lincoln had the largest percentage decline.

For comparison, total used-vehicle sales in June are estimated to be near 3.0 million units, up 2.8% from June 2022. The seasonally adjusted annual rate, or SAAR, is estimated to have finished near 36.7 million, up from last June’s 35.7 million pace and up from May’s downwardly revised 34.1 million level. Used retail sales were also estimated to be up month over month in June.

“For the most part, we are expecting CPO sales to track somewhat closely to 2022, with an increase in sales starting in October to finish the year at 2.6 million overall,” Frey noted.