Data Point

CPO Sales Come in Surprisingly Weak in October

Friday November 17, 2023

Article Highlights

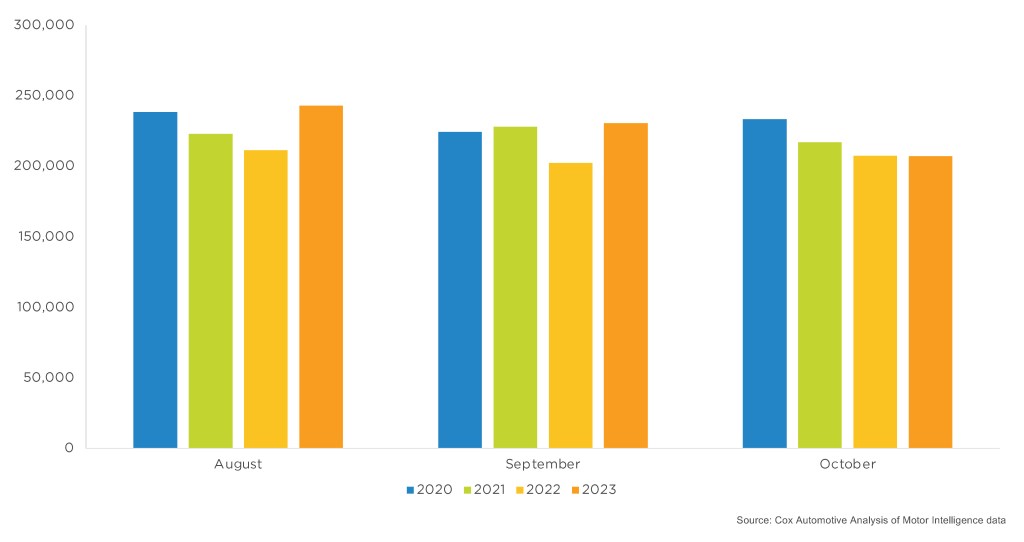

- In October, certified pre-owned (CPO) sales experienced a slight decline, falling by less than 400 units from October 2022 to reach 207,189, a year-over-year decrease of 0.2%.

- However, this decrease is more pronounced compared to September, as month-over-month CPO sales were down by over 23,000 units, or 10.1%.

- Year-to-date CPO sales have exceeded 2.2 million units, up nearly 8%.

In October, certified pre-owned (CPO) sales experienced a slight decline, falling by less than 400 units from October 2022 to reach 207,189, a year-over-year decrease of 0.2%. However, this decrease is more pronounced compared to September, as month-over-month CPO sales were down by over 23,000 units, or 10.1%. One less selling day contributed to both year-over-year and month-over-month declines.

“CPO sales came in surprisingly weak in October, down 10% from September,” said Chris Frey, senior manager of Economic and Industry Insights at Cox Automotive. “Consumers may have chosen new over nearly new in October. With growing inventory levels, we saw healthy new-vehicle sales in October.”

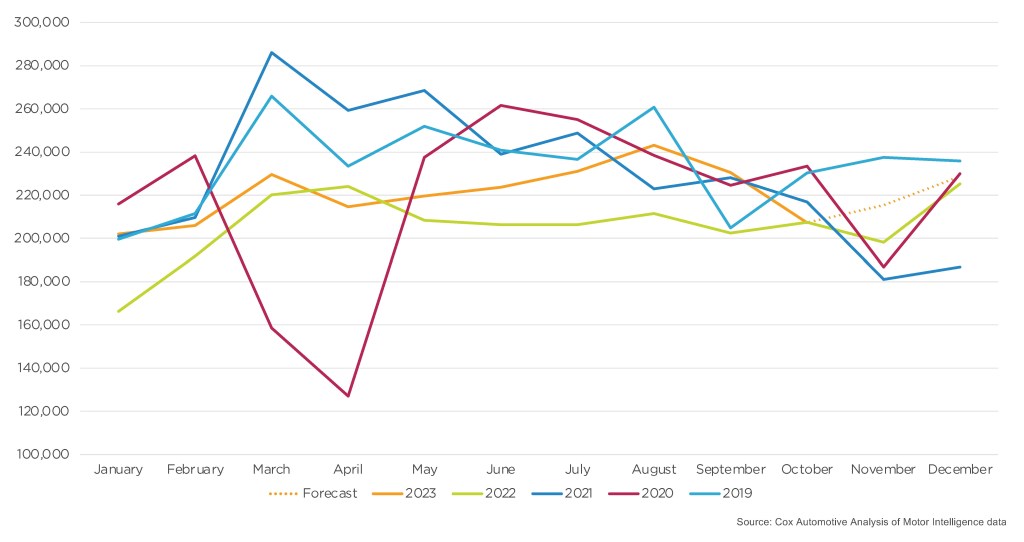

October CPO Sales

CPO Sales on Track to Hit 2023 Forecast, Luxury Leads the Way

Year-to-date CPO sales have exceeded 2.2 million units, up nearly 8%, or over 161,365 units compared to the same period last year. Luxury CPO sales have increased an impressive 11%, while non-luxury CPO sales are up 7%.

“Despite the month-over-month decline in October, year-to-date CPO sales remain on track to hit our 2.7 million full-year forecast,” noted Frey.

CPO MONTHLY SALES

When considering brands, Asian brand CPO sales are up more than 12% year to date, while European brands are up less than 6%. Meanwhile, the Detroit Three continue to lag, with only a 2% increase.

CPO is outperforming the used-vehicle market year to date. For comparison, according to Cox Automotive estimates based on vehicle registration data, total used-vehicle sales in October decreased 0.4% from September to 3.0 million units. Estimates based on registration data indicate that the used-vehicle sales pace — both total and retail — in October declined compared to the market’s pace of one year ago. The seasonally adjusted annual rate, or SAAR, is estimated to have finished at 36.5 million, down from last October’s 37.8 million pace but up from September’s upwardly revised 35.8 million level.