Press Releases

Cox Automotive Forecast: U.S. Auto Sales Expected to Finish 2022 Down 8% Year Over Year, as General Motors Reclaims Top Spot, Honda and Nissan Fall Significantly

Wednesday December 28, 2022

Article Highlights

- Full-year 2022 U.S. auto sales are forecast by Cox Automotive to finish near 13.9 million units, a decrease of nearly 8.0% from 15.1 million in 2021 and down 20% from the market peak in 2016.

- The annual vehicle sales pace in December is expected to finish near 13.2 million, down 0.9 million from last month’s 14.1 million pace but an increase from last year’s 12.7 million level.

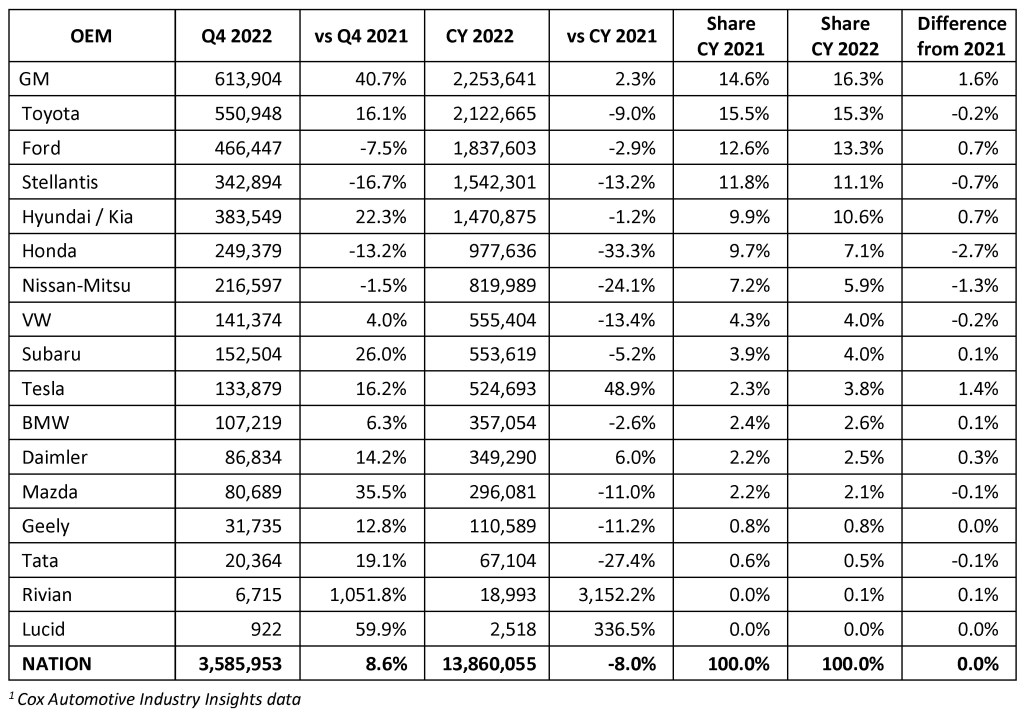

- General Motors is forecast to reclaim its title from Toyota Motor Company as the top seller in the U.S. market. Tesla grabs more share in 2022, Honda, Nissan fall.

Updated, Jan. 4, 2023 – While sales in December likely came in slightly higher than the initial Cox Automotive forecast, and above year-ago levels, the bottom-line result will hardly be cheered as a success. In fact, December sales continue to demonstrate a softening of retail demand, although demand has not collapsed. Sales in December, and in the months prior, were aided by improving new-vehicle inventory levels – up from record lows a year ago – and increasing fleet activity. Retail activity is not strong.

Overall, 2022 will close with the lowest sales volume in a decade and will be recorded as a year that began with inventory challenges and ended with demand issues. In a down market, Ford and General Motors, the big players in Detroit, delivered relatively strong numbers, as their inventory levels improved, and they gained back share lost in 2021. GM reclaimed its long-held status as #1 in U.S. sales. The Big Three from Japan – Honda, Nissan and Toyota – struggled with inventory and demand challenges and lost notable share in 2022; for Honda and Nissan, 2022 was a year to forget.

In the U.S. market, Hyundai and Kia continue to be the big advancers, furthering gains made in 2021. Even with tight inventory, the Korean brands delivered notable sales and grabbed more market share in 2022. Tesla, too, continued to gain share in the U.S. and now dominates the luxury market, well ahead of traditional luxury leaders BMW, Mercedes and Lexus.

Cox Automotive Senior Economist Charlie Chesbrough notes: “As the market closes out 2022 and we look to the year ahead, there is little reason to believe retail vehicle sales will increase in any meaningful way. With high auto loan rates in place and inflationary pressures on American consumers, vehicle affordability will continue to put downward pressure on the U.S. auto market.”

Monthly sales volumes of 1.1-to-1.3 million have been normal for the past year, and Cox Automotive expects more of the same in the coming months.

ATLANTA, Dec. 28, 2022 – New-vehicle sales in December are expected to reach 1.27 million units, an increase of nearly 4% compared to December 2021, according to a forecast released today by Cox Automotive. Sales volume in December is expected to rise by nearly 11% compared to last month, mostly due to two additional selling days in December. The December 2022 auto sales pace, or seasonally adjusted annual rate (SAAR), however, is expected to finish near 13.2 million, a large decline from November’s 14.1 million pace.

Full-year sales in 2022, based on vehicle counts by Kelley Blue Book, are forecast to finish near 13.9 million units, a decrease of 8% from 2021 and the lowest level since 2011 when total new-vehicle sales were recovering from the Great Recession and reached only 12.7 million. Sales in 2022 are forecast to finish below 2020’s total when the COVID-19 pandemic shut down much of the U.S. economy. Sales in 2020, according to Kelley Blue Book counts, were 14.6 million.

In what started as a year with a supply problem, 2022 is ending with a demand problem. Inventory levels have been increasing since late summer, and those gains have helped support increasing sales. The supply gains, however, have been uneven, with many Asian bestsellers nearly unavailable, while many of the Detroit Three’s top products have ample supply. In October, the SAAR reached 15.1 million, the best level since January and likely a result of improving inventory. As inventory improved, the Fed’s aggressive interest rate increases have driven auto loan costs to levels not seen in more than 20 years, pushing some shoppers out of the market due to vehicle affordability concerns. Since October, the sales pace has declined significantly – by nearly 2 million units.

“This December, there were fewer giant red bows than dealers would have liked,” said Charles Chesbrough, senior economist at Cox Automotive. “Given the large improvement in supply levels, it seems likely that rising interest rates are now constraining demand in the retail auto market. With record-high prices and elevated loan rates, the pool of potential new-vehicle buyers is shrinking.”

As we head into 2023, Cox Automotive is expecting the economy to see weak growth as the Federal Reserve tightens monetary conditions and consumers wrestle with high interest rates. New-vehicle sales are forecast to increase modestly versus 2022, supported in part by growing fleet volume. Affordability will continue to be a challenge for vehicle buyers in the year ahead. Cox Automotive’s 10 Predictions for 2023 were posted last week in the Cox Automotive Newsroom.

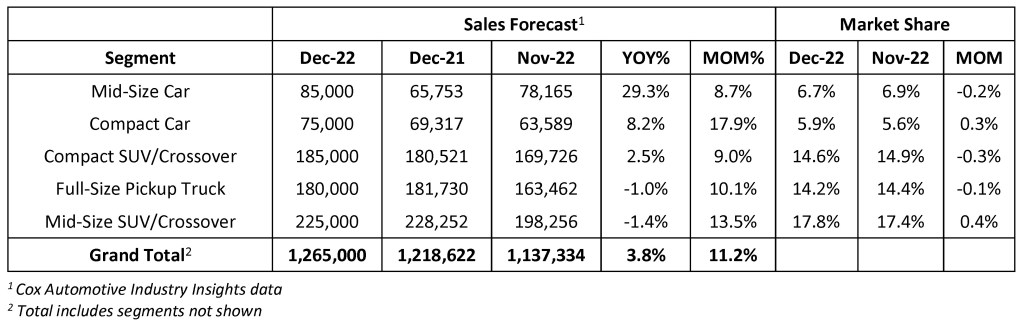

December 2022 U.S. New-Vehicle Sales Forecast Highlights

- Light new-vehicle sales are expected to rise 3.8% from December 2021 and 11.2% from last month.

- The SAAR in December 2022 is estimated to be 13.2 million, above last December’s 12.7 million level but down from last month’s 14.1 pace.

- December 2022 has 27 selling days, equal to 2021 but two more than November.

December 2022 U.S. New-Vehicle Sales Forecast

Full-Year 2022 U.S. New-Vehicle Sales Forecast Highlights

- New-vehicle sales are forecast to decrease 8.0% from 2021 and reach approximately 13.9 million units, based on a Cox Automotive analysis of Kelley Blue Book sales estimates. New-vehicle sales in 2022 will be the lowest since 2011.

- New auto sales in Q4 will be up 8.6% compared to Q4 2021, but not enough to push full-year sales above 14 million.

- GM regains the sales title from Toyota in 2022 while Honda sees the largest year-over-year sales decline.

Full-Year 2022 U.S. New-Vehicle Sales Forecast

All percentages are based on raw volume, not daily selling rate. There were 27 selling days in both December 2022 and December 2021, while there were 25 selling days in November 2022.

About Cox Automotive

Cox Automotive Inc. makes buying, selling, owning and using vehicles easier for everyone. The global company’s more than 27,000 team members and family of brands, including Autotrader®, Dealer.com®, Dealertrack®, Kelley Blue Book®, Manheim®, NextGear Capital®, VinSolutions®, vAuto® and Xtime®,are passionate about helping millions of car shoppers, 40,000 auto dealer clients across five continents and many others throughout the automotive industry thrive for generations to come. Cox Automotive is a subsidiary of Cox Enterprises Inc., a privately-owned, Atlanta-based company with annual revenues of nearly $20 billion. www.coxautoinc.com

Media Contacts:

Mark Schirmer

734 883 6346

mark.schirmer@coxautoinc.com

Dara Hailes

470 658 0656

dara.hailes@coxautoinc.com