Press Releases

Cox Automotive Forecast: An Upside Surprise Expected for U.S. Auto Sales in Q1 2023

Tuesday March 28, 2023

Article Highlights

- New-vehicle sales volume is forecast to grow 5.7% year over year in Q1; the sales pace is forecast at an unexpectedly strong annual rate of 15 million, up from 14.1 million in Q1 2022.

- New-vehicle inventory levels significantly improved from Q1 2022, helping stimulate sales despite elevated prices and high auto loan rates.

- General Motors is expected to finish Q1 as the top seller; Tesla leads the luxury market, with total market share forecast to surpass 5% for the first time.

Updated, April 3, 2023 – As the Cox Automotive Industry Insights team expected, new-vehicle sales in Q1 delivered solid year-over-year gains. Higher inventory levels and improved fleet sales combined to lift overall industry results. Honda and Nissan delivered stronger-than-expected vehicle sales in Q1; both GM and Ford had good results fueled by strong truck and SUV performance; and Tesla, buoyed by price cuts, saw big gains. Overall industry volume increased even more than the 6% forecast last week by Cox Automotive. With 1.366 million units sold, March sales volume was up 8.6% year over year, with fleet up 28% year over year. The seasonally adjusted annual rate (SAAR) of sales finished at 14.8 million in March down from 16.0 million in January and 15.0 million in February. Still, the 15.3 million sales pace in Q1 2023 ended well ahead of the 14.1 million SAAR recorded in Q1 last year and was the best quarterly SAAR since Q2 2021.

The average loan rate for a new vehicle is now edging toward 9% and listing prices are above $47,000, but the U.S. car shopper continues to be a buyer. Anyone looking for signs of a recession won’t find it in the new-vehicle market, as several makers delivered record sales in Q1, and most all booked sales above year-ago levels. New-vehicle inventory is up approximately 70% year over year and at the highest level since the summer of 2021. Increased inventory is providing shoppers with better choices and, in some cases, actual discounts and deals. Leasing in Q1 was up year over year as well, after hitting surprising lows in 2022.

Overall, the U.S. new-vehicle market is showing signs of strength and is also being reshaped by higher prices and fewer subprime buyers. Luxury share of the U.S. market reached all-time highs in Q1 2023, as automakers chose to cater to buyers less impacted by high auto loan rates and high prices. Many automakers that traditionally served buyers with lower credit scores struggled with sales in Q1, as rates and credit availability remain an obstacle for many buyers.

Overall, the U.S. auto market in Q1 performed better than initially foreseen, and Cox Automotive has increased its full-year, new-vehicle sales forecast to 14.2 million. High prices and slowing economic momentum will continue to be headwinds for the industry, holding back further growth, and the market is expected to stay well below the glory days of 17 million. Of course, as the team noted during the Q1 Industry Insights and Sales Forecast call, forecasting this year: It’s Tricky.

ATLANTA, March 28, 2023 – Cox Automotive, the world’s largest automotive services and technology provider, forecasts new-vehicle sales volume in Q1 will increase by nearly 6% year over year, reaching 3.5 million units. Sales volume in March, the final month of Q1, is expected to be near 1.30 million, an increase of 2.6% from March 2022. Through Q1, the seasonally adjusted annual rate (SAAR) is forecast at 15.0 million, an increase of more than 6% compared to the 14.1 million SAAR in the first quarter of 2022.

A key driver of the increased sales is the vastly improved new-vehicle inventory level, which is up roughly 70% from the volume recorded in the early months of 2022. Sales in Q1 were also helped by a notable increase in fleet activity. Fleet sales in January were up 58% year-over-year. In February, fleet sales increased by 48%. A similar increase is expected in March.

“The stronger start to 2023 has led us to make positive revisions to our vehicle sales forecasts, but we continue to believe supply constraints and affordability issues will put a ceiling on what’s possible in the year ahead,” noted Cox Automotive Chief Economist Jonathan Smoke. “With the job market still strong, the largest demand problem for automotive in 2023 will be rising interest rates that push many would-be buyers out of the market.”

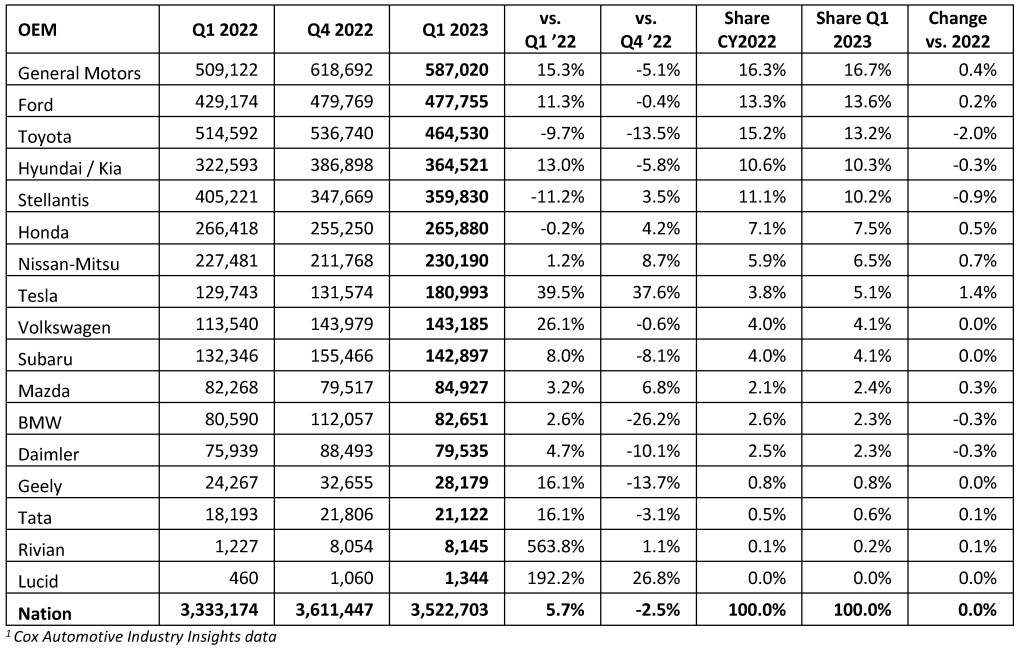

Tesla Grabs More Share; GM Remains On Top

General Motors will finish Q1 as the No. 1 seller of new vehicles in the U.S. A year ago, Toyota was on top. Thanks mostly to improved inventory levels, Cox Automotive is forecasting GM sales to increase more than 15% year over year and reach 587,000 units. Sales, however, will be down from Q4 2022, when GM’s volume hit 618,692.

Tesla, which lowered prices in the first quarter to spark demand, is forecast to post solid sales gains and surpass market share of 5% for the first time. Tesla sales in Q1 are expected to reach 180,000, a record quarter for the company in the U.S. and a gain of nearly 40% from Q1 2022. Tesla will be the top luxury-vehicle seller in the U.S. in Q1, by far, with sales more than double that of BMW or Mercedes.

Cox Automotive Increases Full-Year Outlook After Strong Start in 2023

After a stronger-than-expected start to 2023, Cox Automotive is adjusting its full-year new-vehicle sales forecast to 14.2 million, an increase of nearly 3% from 2022. While new-vehicle inventory is expected to improve through the year, elevated prices and average auto loan rates above 8% are expected to hold back new-vehicle sales. In Q1, the typical new-vehicle loan payment was more than $750 a month, an amount out of reach for many households.

“The Q1 result is surprisingly strong given all the bad economic news,” said Charlie Chesbough, senior economist at Cox Automotive. “But we expect the upside market experienced in Q1 won’t last throughout the year. In fact, sales volume in Q1 will be down 3% from last quarter, suggesting that market headwinds are growing. Inventory levels at some automakers are moving back up above pre-pandemic normal, suggesting that overall demand has slowed in some corners of the market.”

Fleet sales for the full year of 2023 are forecast at 2.2 million, up 23% from 2022, when 1.8 million units were sold to commercial buyers.

March 2023 Sales Forecast Highlights

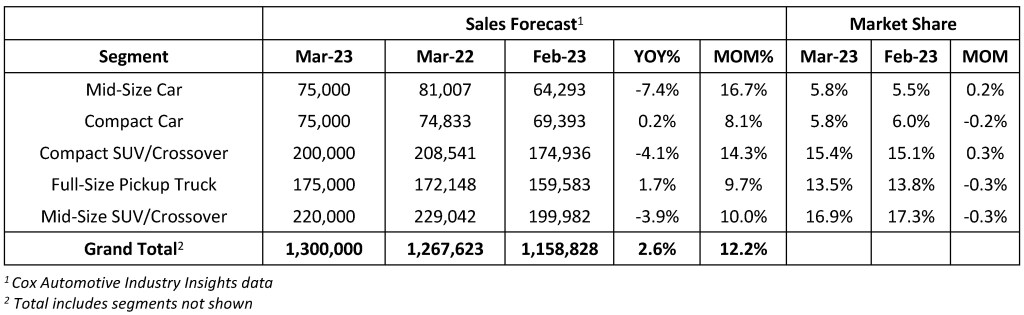

- The annual sales pace in March is expected to finish near 14.1 million, up 0.5 million from last March’s 13.6 million pace but down from February’s 14.9 million level.

- Sales volume is expected to rise 2.6% from one year ago and reach 1.3 million units.

- There are 27 selling days in March 2023, equal to March 2022.

March 2023 Sales Forecast

Q1 2023 Sales Forecast Highlights

- While new-vehicle sales will be lower than last quarter, sales in Q1 exceeded expectations and are forecast to increase by 5.7% year over year.

- Better inventory levels and higher fleet sales were key drivers of the Q1 sales growth.

- After a strong start to the year, Cox Automotive has increased its full-year new-vehicle sales forecast to 14.2 million, up more than 3% from 2022.

Q1 2023 Sales Forecast

All percentages are based on raw volume, not daily selling rate. There were 75 selling days in both Q1 2022 and Q1 2023.

About Cox Automotive

Cox Automotive is the world’s largest automotive services and technology provider. Fueled by the largest breadth of first-party data fed by 2.3 billion online interactions a year, Cox Automotive tailors leading solutions for car shoppers, automakers, dealers, retailers, lenders and fleet owners. The company has 25,000+ employees on five continents and a family of trusted brands that includes Autotrader®, Dealertrack®, Kelley Blue Book®, Manheim®, NextGear Capital™ and vAuto®. Cox Automotive is a subsidiary of Cox Enterprises Inc., a privately-owned, Atlanta-based company with $22 billion in annual revenue. Visit coxautoinc.com or connect via @CoxAutomotive on Twitter, CoxAutoInc on Facebook or Cox-Automotive-Inc on LinkedIn.

Media Contacts:

Mark Schirmer

734 883 6346

mark.schirmer@coxautoinc.com

Dara Hailes

470 658 0656

dara.hailes@coxautoinc.com