Press Releases

Cox Automotive Forecast: Strong Incentives Expected to Prop Up November U.S. Auto Sales

Tuesday November 26, 2019

Article Highlights

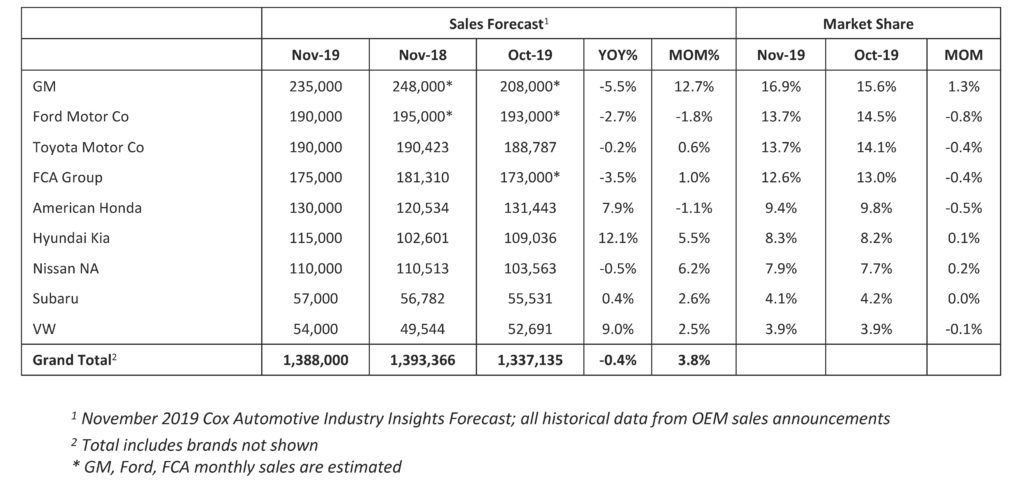

- Annual vehicle sales pace in November is forecast to finish near 16.9 million, up from October’s 16.5 million level, but down from last November’s 17.4 million.

- November sales volume is expected to fall slightly to 1.39 million, down 0.4% or about 5,000 units from November 2018.

- A new sales record for November is possible due to an additional selling day and upside potential of fleet sales.

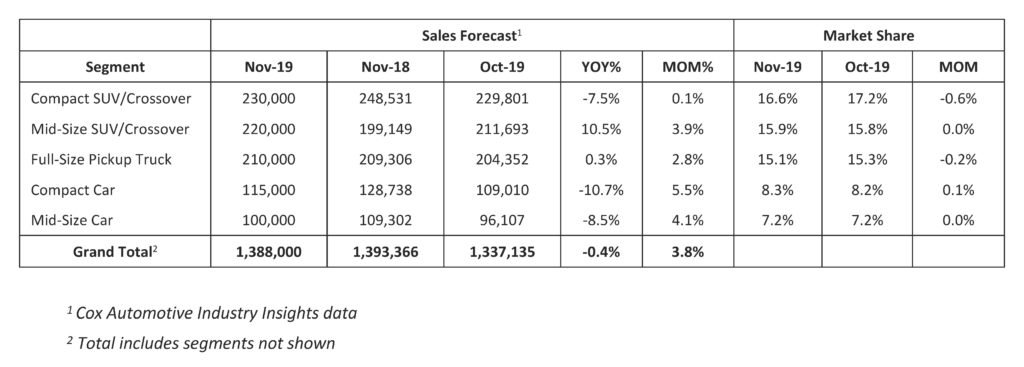

ATLANTA, Nov. 26, 2019 – The November light vehicle market is not expected to be a turkey, according to a Cox Automotive sales forecast released today, but it isn’t expected to fly either. The seasonally adjusted annual rate (SAAR) is forecast to finish near 16.9 million, up from last month’s strike-impacted 16.5 million level, but down slightly from the current 2019 year-to-date pace near 17.0 million. Total sales through October 2019 are down 1.4% compared to last year, and this negative trend is expected to continue. Sales volume, supported by an extra selling day, is expected to finish down 0.4% compared to November 2018. Sales, however, will be up nearly 4% from last month.

One key factor will be incentives, which generally rise at the end of the year as OEMs try to push old inventory to make way for new products. Black Friday and year-end sales promotions have become an important part of the sell-down strategy and are even more important in a downward moving retail market. (For more perspective on sales incentives, see this Data Point in the Cox Automotive Newsroom: Year-End Incentive Complexity Is A Real Grinch.)

Another key factor for November’s results will be the recovery of GM sales in the wake of the long strike. According to Cox Automotive Senior Economist Charlie Chesbrough: “We believe GM fleet activity, and likely some retail, was significantly lower in October by tens of thousands of units as factory closures disrupted deliveries. The question for the market this month is whether these sales were simply delayed, replaced or canceled.”

Fleet activity is not only an important question for November sales, but also for the industry outlook going into 2020. Fleet sales are up significantly in 2019, as they were in 2018, and these gains have been supporting an otherwise declining new-car market. With significantly higher fleet deliveries over the last two years, further growth in 2020 will be challenging. However, without it, the vehicle market could fall significantly. Retail sales – both leasing and purchasing – are down this year, as they were in 2018. Increasing retail sales at this late stage of the current sales cycle also seems unlikely, particularly with vehicle prices and discounts already elevated.

The all-time sales record for November occurred in 2017 when 1.425 million vehicles sold. A new sales record is possible this month given the upside potential of fleet activity, and the calendar is helping. There are 26 selling days in November 2019, one more than last year and 2017, and each day counts. Daily sales average close to 55,000, so an extra selling day is a major boost to annual gains.

November 2019 Sales Forecast Highlights

- In November, new light-vehicle sales, including fleet, are forecast to reach 1.39 million units, down about 5,000 units or 0.4% compared to November 2018. When compared to last month, sales are expected to rise nearly 50,000 units or 4%.

- The November 2019 SAAR is estimated to be 16.9 million, up from last month’s GM strike impacted 16.5 million level and down from last year’s 17.4 million. This November has 26 selling days, one more than last November and one less than last month. The increase in selling days is lifting the SAAR estimates over last year even though overall sales volume is expected to be nearly flat.

All percentages are based on raw volume, not daily selling rate.

About Cox Automotive

Cox Automotive Inc. makes buying, selling, owning and using cars easier for everyone. The global company’s 34,000-plus team members and family of brands, including Autotrader®, Clutch Technologies, Dealer.com®, Dealertrack®, Kelley Blue Book®, Manheim®, NextGear Capital®, VinSolutions®, vAuto® and Xtime®, are passionate about helping millions of car shoppers, 40,000 auto dealer clients across five countries and many others throughout the automotive industry thrive for generations to come. Cox Automotive is a subsidiary of Cox Enterprises Inc., a privately-owned, Atlanta-based company with revenues exceeding $20 billion. www.coxautoinc.com

Media Contacts:

Mark Schirmer

734 883 6346

mark.schirmer@coxautoinc.com

Dara Hailes

470 658 0656

dara.hailes@coxautoinc.com