Press Releases

Cox Automotive Forecast: October New-Vehicle Sales Expected To Slow For Sixth Straight Month

Wednesday October 27, 2021

Article Highlights

- U.S. auto sales in October are forecast to slow for a sixth consecutive month as low inventory and high prices continue to constrain the industry.

- Annual vehicle sales pace in October is expected to finish near 11.8 million, down from last month’s 12.2 million pace and well below last October’s early COVID recovery pace of 16.4 million.

- October sales volume is expected to fall nearly 30% from one year ago and finish near 950,000 units, the lowest October result since the Great Recession.

UPDATED, Nov. 3, 2021 – With new-vehicle inventory levels hovering around 1 million units in October, less than half the level of one year ago, the Cox Automotive Industry Insights team forecasted another month of relatively slow new-vehicle sales in October. And indeed, sales were down notably from one year ago, with some brands dropping more than 30% compared to October 2020. Final results will be secured in the coming day, but at this point, the seasonally adjusted annual rate of sales in October appears to be more robust than our forecast of 11.8 million, closer to 13.0 million. Sales volume in October was down 23%, less than our forecasted decline of 30%. In the second half of October, inventory stabilized more than anticipated and even improved for a few brands. The Hyundai and Kia brands saw year-over-year declines, but much smaller than anticipated. Ford delivered stronger than expected results. Toyota, Subaru and General Motors continue to struggle with low inventory and saw large drops.

The market is still experiencing very low inventory and correspondingly low incentives, but the worst is likely behind us. While still down year-over-year, sales in October will beat the Cox Automotive forecast and end a string of month-over-month declines. Our industry analysts expect pent-up demand to feed the industry with a steady stream of buyers for the foreseeable future. New-vehicle production, however, will remain constrained at least through the early part of 2021; elevated prices and limited choice will continue to be the norm in the coming months. Fleet sales will be lower year-over-year as automakers focus on filling dealer lots. As noted in our October forecast, new-vehicle sales in 2021 will finish closer to 15 million and recover to 16.3 million in 2022.

ATLANTA, Oct. 27, 2021 – October U.S. auto sales are forecast to be hit hard by supply limitations from the chip shortage, resulting in a fresh low point for the 2021 market. According to a forecast released today by Cox Automotive, the sales pace, or seasonally adjusted annual rate (SAAR), in October is expected to fall to 11.8 million units, down from September’s 12.2 million pace and down from the October 2020 pace of 16.4 million.

Sales volume in October is expected to take a significant hit as well and fall to just 950,000 units, down nearly 30% from October 2020 and down nearly 6% from September. There is one less selling day this October compared to last year, but two more days than September. However, with supply levels so low, the number of sales days will have minimal impact on the month’s results.

“October new-vehicle sales will be downright scary when announced next week,” said Charlie Chesbrough, senior economist, Cox Automotive. “We expect to see direct evidence that the chip shortage continues to impact all the automakers, even those that have been doing a remarkable job managing through this ongoing crisis.”

The expected decline in October would be the sixth month in a row of falling sales pace and the lowest October volume since 2010 when the market was in the early days of the Great Recession recovery. It would also be the lowest sales volume since April 2020 when the market was initially slammed by the first wave of COVID-19 and sales reached a historic low of 717,063.

The automotive market started the year with a tight supply, but the situation has gradually worsened. Inventory levels are half of what they were a year ago, and supply chain issues continue to disrupt production. It is expected that the next few months will be particularly challenging as sales will be choked off by the lack of product available on dealer lots. However, it is expected that many OEM supply issues will improve modestly in the coming months. The outlook for 2022 is that tight supplies will remain a strong headwind for the industry. Cox Automotive is forecasting total new-vehicle sales will finish closer to 15 million in 2021 and recover to 16.3 million in 2022.

October 2021 Sales Forecast Highlights

- New light-vehicle sales are forecast to fall to 950,000 on units, down 410,000 units, nearly 30% below last year. Compared to last month, sales are expected to fall 63,000, a nearly 6% decline.

- The SAAR in October 2021 is estimated to be 11.8 million, down from September’s chip constrained 12.2 million pace and down from last October’s 16.4 million level.

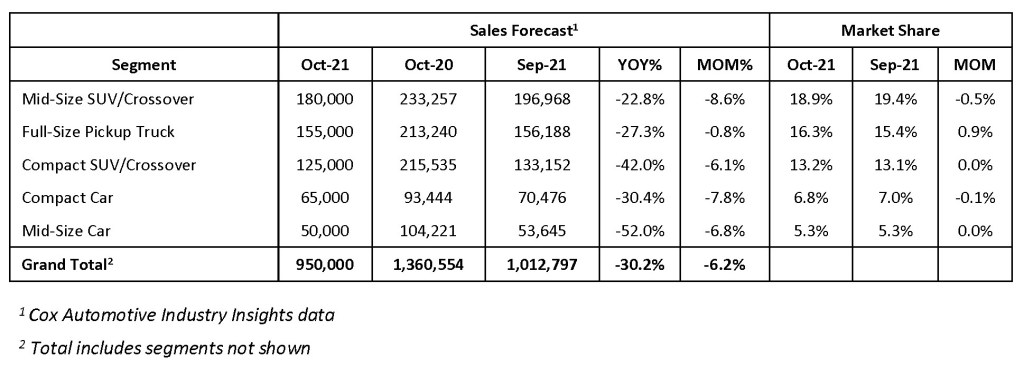

October 2021 New-Vehicle Sales Forecast

All percentages are based on raw volume, not daily selling rate.

About Cox Automotive

Cox Automotive Inc. makes buying, selling, owning and using vehicles easier for everyone. The global company’s more than 27,000 team members and family of brands, including Autotrader®, Dealer.com®, Dealertrack®, Kelley Blue Book®, Manheim®, NextGear Capital®, VinSolutions®, vAuto® and Xtime®, are passionate about helping millions of car shoppers, 40,000 auto dealer clients across five continents and many others throughout the automotive industry thrive for generations to come. Cox Automotive is a subsidiary of Cox Enterprises Inc., a privately-owned, Atlanta-based company with annual revenues of nearly $20 billion. www.coxautoinc.com

Media Contacts:

Mark Schirmer

734 883 6346

mark.schirmer@coxautoinc.com

Dara Hailes

470 658 0656

dara.hailes@coxautoinc.com

Media Contacts:

Mark Schirmer

734 883 6346

mark.schirmer@coxautoinc.com

Dara Hailes

470 658 0656

dara.hailes@coxautoinc.com