Data Point

CPO Sales Outperform Overall Used-Vehicle Retail Market in May

Monday June 19, 2023

Article Highlights

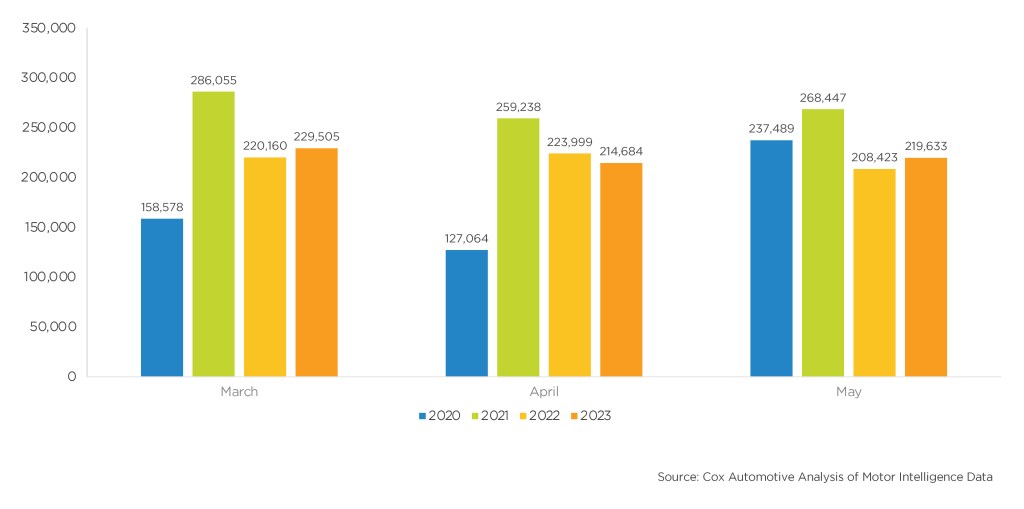

- Certified pre-owned (CPO) sales in May rose 5.4%, over 11,000 units, from last May to finish at 219,633.

- CPO sales year to date remain up 6.0%, or 61,000 units, compared to the first five months of 2022, which was a rough year for the CPO market.

- Among large manufacturers, Toyota had the largest CPO sales volume gain in May. Meanwhile, Hyundai has the largest year-over-year percentage gain in CPO sales, while Chevrolet had the largest percentage decline.

Certified pre-owned (CPO) sales in May rose 5.4%, over 11,000 units, from last May to finish at 219,633. This total is up nearly 5,000 units, a 2.3% increase from April’s number. CPO sales year to date remain up 6.0%, or 61,000 units, compared to the first five months of 2022, which was a rough year for the CPO market.

“CPO sales usually experience a significant surge from January to May, with a sharp increase in sales during the spring selling season,” said Chris Frey, senior manager of Economic and Industry Insights at Cox Automotive. “However, this year’s increase has been less dramatic than we usually see. The gain in sales has been modest so far, and the volume changes from month to month have been the least volatile since 2019.”

May CPO Sales

“While CPO outperformed total and retail used-vehicle sales in May, CPO sales are most likely muted due to continued high prices, declining credit availability and high interest rates,” Frey noted. “In fact, CPO loans saw the most tightening in May both month over month and year over year, according to the Dealertrack Credit Availability Index.”

Among large manufacturers, Toyota had the largest CPO sales volume gain in May. Meanwhile, Hyundai has the largest year-over-year percentage gain in CPO sales, while Chevrolet had the largest percentage decline.

For comparison, total used-vehicle sales are estimated to be near 3.1 million units in May, down 3.4% year over year. The seasonally adjusted annual rate, or SAAR, is estimated to have finished near 36.5 million, down from last May’s 37.8 million pace and down from April’s upwardly revised 36.9 million level. Used retail sales were also estimated to be lower in May, down 3.0% year over year.