Press Releases

Cox Automotive Forecast: August U.S. Auto Sales Languish at Slow Pace With Persistent Headwinds

Thursday August 25, 2022

Article Highlights

- The August U.S. auto sales pace is expected to show an improvement due to an additional selling day, but sales volume remains constrained by inventory and affordability challenges.

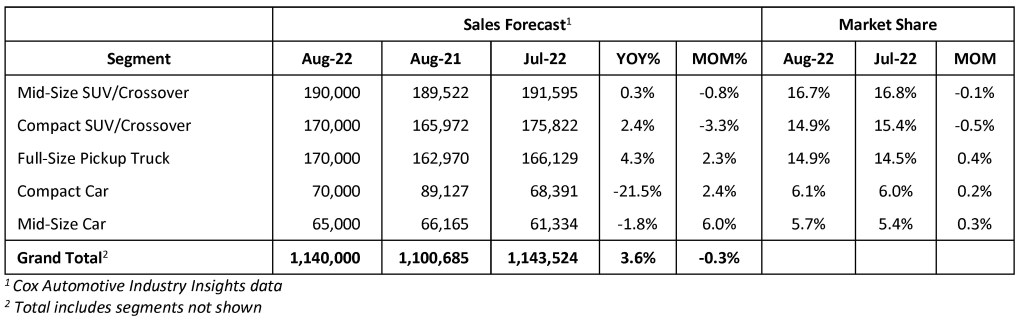

- New-vehicle sales volume in August is expected to rise to 1.14 million units, up 3.6% year over year but down 0.3% from last month.

- Annual new-vehicle sales pace in August is forecast to finish near 13.3 million, unchanged from last month’s 13.3 million seasonally adjusted pace but higher than last year’s 13.1 million level.

UPDATED, Sept. 2, 2022 – Calendar year 2022 has provided plenty of great examples of, “I’ve never seen that before.” And that is certainly the case with August 2022 new-vehicle sales. The Cox Automotive Industry Insights team is tallying the August totals and will have more to share next week, but early indications are that overall sales were consistent with July and June before that. Our August forecast called for a sales pace of 13.3 million and total sales volume to finish near 1.14 million units, up 3.6% from last year and roughly equal to last month.

August 2022 numbers illustrate just how difficult forecasting new-vehicle sales has become. On the one hand, the national daily sales rate has been remarkably consistent at 43,400 units per selling day for three straight months – June, July and August – with little variation. At the same time, there are sizable differences in brand-level sales volumes each month. Indeed, in the same month that Kia posts record-setting sales of 66,089, an increase of 22% over August 2021, the Honda brand delivers another abysmal sales month, with sales of just 63,924, a drop of more than 36% year over year and the worst August result in a decade. For comparison, in August 2019, Honda brand delivered more than 158,000 new vehicles in the U.S. and Kia delivered roughly 60,000. We will say it again, new-vehicle sales this year are not like anything we’ve witnessed before.

The Labor Day weekend is upon us, and in years past, the Industry Insights team would be reporting on sale incentives, overstock situations, and opportunities for great deals. Not this year, with days’ supply hovering near 39, massive Labor Day, metal-moving sales won’t be a thing. New-vehicle sales incentives remain at record lows.

As Cox Automotive Senior Economist Charlie Chesbrough has noted many times recently, until something significantly changes with new-vehicle inventory, we can’t expect much change in the overall new-vehicle sales pace. There are small signs that new-vehicle inventory levels are stabilizing, but they are also not getting significantly better. Some automakers have far more inventory than others, and some are managing their operations more efficiently – Hyundai and Kia are great examples from August.

Still, until days’ supply numbers markedly improve for the industry, we can’t expect much to change in the new-vehicle sales reports. Each month will deliver a few highlights – a record for Kia! – and lowlights. But in total, sales volumes will remain at about 1.1 million units a month, our 12-month average. And until nationwide supply improves, we also won’t know if high prices and rising interest rates are impacting new-vehicle buyers. No, until things change, inventory, not demand, continues to be the #1 issue for the new-vehicle market.

ATLANTA, Aug. 25, 2022 – U.S. new-vehicle sales in August are expected to show that the substantially slower pace of new-vehicle sales that started a year ago continues as new-vehicle supply remains virtually unchanged. According to the Cox Automotive forecast released today, the August U.S. auto sales pace, or seasonally adjusted annual rate (SAAR), is expected to finish flat month over month at 13.3 million, up from last year’s 13.1 million level.

The sales volume in August is forecast to finish near 1.14 million units, up 3.6% from last year but down 0.3% from July. With 26 selling days in August, the same as last month and one more than last year, the year-over-year gain in volume is expected to be lifted by the extra day.

“New-vehicle inventory remains essentially unchanged since tight inventory started severely limiting sales in July 2021,” said Cox Automotive Senior Economist Charlie Chesbrough. “The headwinds to a sales recovery this year are growing as buying conditions worsen. Rising interest rates and historically low consumer sentiment are keeping many potential buyers out of the new-vehicle market. And high prices for both gasoline and vehicles are making affordability an even greater challenge. However, the lack of supply is the biggest obstacle over the near term, and there is little evidence of new-vehicle supply returning to a healthier level.”

Most industry forecasters, including Cox Automotive, expect the chip shortage and other supply chain problems to improve slightly by year-end. Still, the pace of that recovery will be varied and volatile.

August 2022 Sales Forecast Highlights

- In August, light new-vehicle sales are expected to rise 3.6% from August 2021 but decline 0.3% from last month, with 26 selling days, one more than last year but the same as July 2022.

- The SAAR in August 2022 is estimated to be 13.3 million, above last year’s 13.1 million level but flat with last month’s pace.

- Sales for the Full-Size Pickup Truck, Compact Car and Mid-Size Car segments increased from July.

AUGUST 2022 NEW-VEHICLE SALES FORECAST

All percentages are based on raw volume, not daily selling rate.

About Cox Automotive

Cox Automotive Inc. makes buying, selling, owning and using vehicles easier for everyone. The global company’s more than 27,000 team members and family of brands, including Autotrader®, Dealer.com®, Dealertrack®, Kelley Blue Book®, Manheim®, NextGear Capital®, VinSolutions®, vAuto® and Xtime®, are passionate about helping millions of car shoppers, 40,000 auto dealer clients across five continents and many others throughout the automotive industry thrive for generations to come. Cox Automotive is a subsidiary of Cox Enterprises Inc., a privately-owned, Atlanta-based company with annual revenues of nearly $20 billion. www.coxautoinc.com

Media Contact:

Dara Hailes

470 658 0656

dara.hailes@coxautoinc.com